Few Investors Understand The Difference Between A Good And A Bad ETF

Companies / Exchange Traded Funds Oct 05, 2017 - 08:07 AM GMTBy: John_Mauldin

BY JARED DILLIAN : There are now about 2,000 ETFs on the market. Many of them are useless.

BY JARED DILLIAN : There are now about 2,000 ETFs on the market. Many of them are useless.

Some people think we are in an ETF bubble, because of all the stupid ETFs that are coming out. When a fund like WSKY (Spirited Funds/ETFMG Whiskey and Spirits ETF) appears on the scene, it’s safe to assume that the top is probably in.

Actually, that is not the case.

ETFs That Take Off Big Time

The thing about ETFs is that they are much cheaper to launch than a traditional open-end mutual fund. It still costs money—in the six figures—but I know rather ordinary people who have done it.

It’s a lot of work navigating the regulations, working with an index provider, getting people to make markets—but it’s just sweat equity. There simply is not a lot of overhead.

That incentivizes people to come up with all kinds of crazy ideas for what might make a good ETF. The payoff is a bit like a call option. Spend a few hundred grand dreaming this thing up, building an index, and launching it, and if it fails, no harm done. If it succeeds, it will generate many millions in revenue.

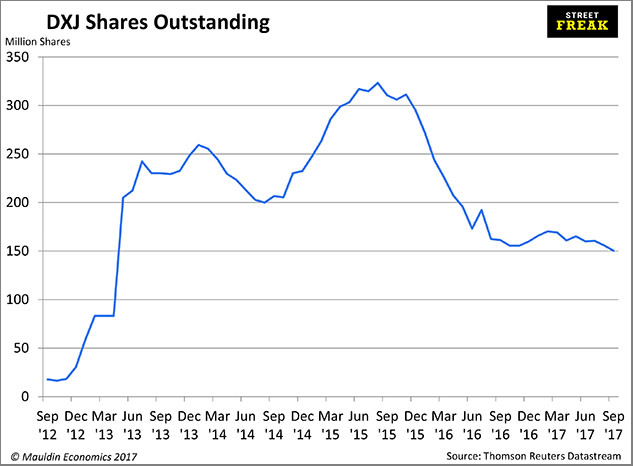

Probably the best example of an ETF launch that went right was DXJ, the WisdomTree Japan Hedged Equity ETF (disclosure: I own it). It’s a currency-hedged equity index ETF—you can hold Japanese stocks in dollar terms.

DXJ was a genius idea—it was launched before the start of Abenomics, on the idea that if Japan engaged in quantitative easing on a grand scale, the stock market would rise, but the yen would depreciate significantly. You would only want to hold DXJ on a hedged basis.

Source: Mauldin Economics

The fund currently has $8 billion under management, but at one point, it was almost twice as large.

Everyone wants to launch the next DXJ. Problem is, most of these ideas are awful—and dead on arrival.

ETFs That Are Doomed to Fail

If you want, you can invest in the Nashville ETF, which is allegedly somehow correlated to economic growth in Nashville. Nashville is booming, so why not offer people exposure to Nashville?

Bzzzt, wrong answer.

Even if the basket in NASH gave you direct exposure to economic growth in Nashville, you have to ask yourself some questions. How is this thing going to gather assets? Will a hedge fund, pension fund, or RIA really load up on five million shares or more? Do you think the story is compelling enough to attract a lot of retail order flow?

With ETFs like these, you have to count on them getting written up favorably in Barron’s or somewhere like that. But with so many ETFs, there is just not enough bandwidth for ETF issuers to get their story out.

As I write, just 54 shares of NASH have traded on the day. It has $8 million in assets.

I have seen a lot of other bad ideas for ETFs—hundreds of them. But there are also good ideas for ETFs that still manage not to gather any assets.

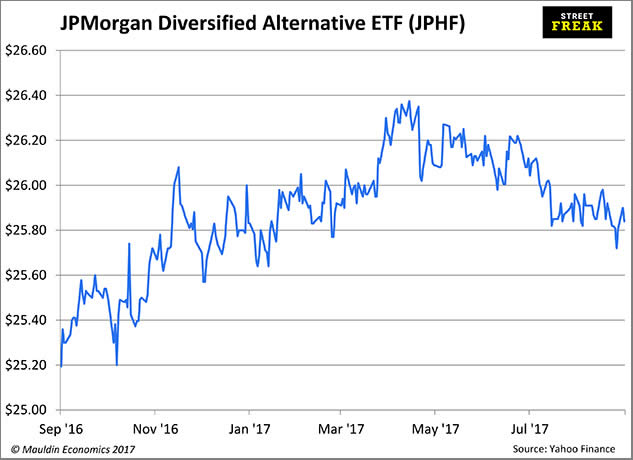

One of my favorites: JPHF—the J.P. Morgan Diversified Alternatives ETF. It mimics certain hedge fund strategies in a quantitative, smart beta fashion. For many people, it is as close as they will get to ever investing in a hedge fund. It costs 85 basis points, which is expensive, but cheaper than a hedge fund!

Some big asset managers actually have R&D departments to dream up what might be a good idea for an ETF. One unpleasant possibility: all the good ideas might already be taken.

How to Pick ETFs

Picking an ETF is hard (after all, there are 2,000 of them). How do you evaluate which ones are good?

For many people, it means going to some website, searching through hundreds of tickers, and picking something that “sounds good.” But there is much more to it than that when it comes to research.

And then, you have to think about how one fund might interact with the rest of your portfolio.

There are a lot of bad ETFs out there. Most of them are harmless, but some are not. The investors who only spend 20 minutes in front of their computer at night with a glass of wine… are the ones who’ll get into trouble.

Grab Jared Dillian’s Exclusive Special Report, Investing in the Age of the Everything Bubble

As a Wall Street veteran and former Lehman Brothers head of ETF trading, Jared Dillian has traded through two bear markets.

Now, he’s staking his reputation on a call that a downturn is coming. And soon.

In this special report, you will learn how to properly position your portfolio for the coming bloodbath. Claim your FREE copy now.

John Mauldin Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.