Credit Crisis Set to Intensify as Economies Begin to Crumble

Stock-Markets / Credit Crisis 2008 Aug 31, 2008 - 01:08 PM GMT The gyrations of financial markets ahead of the Labor Day weekend tested the patience of bulls and bears alike. As big swings took place in thinly-traded markets, I was reminded of Albert Schweitzer's words: “As we acquire more knowledge, things do not become more comprehensible but more mysterious.”

The gyrations of financial markets ahead of the Labor Day weekend tested the patience of bulls and bears alike. As big swings took place in thinly-traded markets, I was reminded of Albert Schweitzer's words: “As we acquire more knowledge, things do not become more comprehensible but more mysterious.”

None the wiser, I also did not succeed in capturing a leprechaun and finding the gold during my visit last week to the Emerald Isle. However, the beautiful Irish scenery, hospitality and “open for business” attitude resulted in a very successful trip and will keep me going back in search of the “buried treasure”.

Nervousness about the financial system was still paramount as investors realized that none of the problems were likely to be fixed anytime soon. The upshot of the week's trading was a further weakening in credit markets, judging by the elevated credit spreads. Global stock and bond markets ended another volatile week on a mixed note, whereas crude prices gained surprisingly little on the impending arrival of Hurricane Gustav and a festering geopolitical situation with Russia.

Nervousness about the financial system was still paramount as investors realized that none of the problems were likely to be fixed anytime soon. The upshot of the week's trading was a further weakening in credit markets, judging by the elevated credit spreads. Global stock and bond markets ended another volatile week on a mixed note, whereas crude prices gained surprisingly little on the impending arrival of Hurricane Gustav and a festering geopolitical situation with Russia.

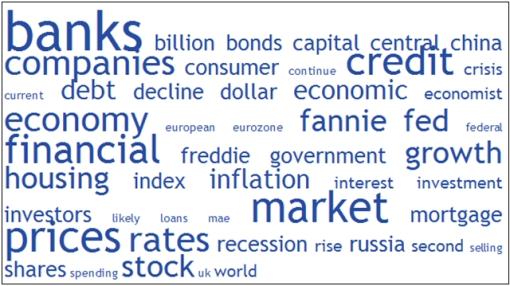

Next, a tag cloud of the text of all the articles I have read during the past week. This is a way of visualizing word frequencies at a glance. As expected, words such as “banks”, “prices”, “credit” and “financial” featured prominently in my reading matter.

I do believe we are still in a primary bear market where stock markets are, at best, faced with a prolonged convalescence period characterized by sub-optimal returns. Whether significant further declines will take place from these levels and valuations overshoot to bargain levels is anybody's guess.

However, in the short term I give the nascent stock market rallies the benefit of the doubt provided the mid-July lows are sustained. For any rally to become more enduring will require further base building and an eventual shift in central bank policy to targeting GDP growth rather than inflation.

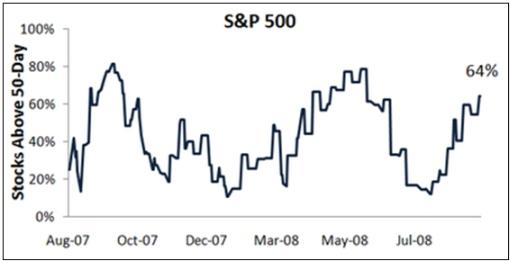

The rally's lack of breadth, however, is worrying, causing Richard Russell ( Dow Theory Letters ) to warn: “If July 15 was a true bottom, the market should be roaring up today, and that's not what's been happening. Caution is warranted!”

But we should also take note of the fact that 64% of stocks in the S&P 500 are currently trading above their 50-day moving averages, as pointed out by Bespoke . “As shown in the chart below, the reading has been creeping higher and higher since mid-July, and looks to be on its way to the 80% to 85% levels seen twice over the last year. Readings above 50% are signs of a healthy market, and it hasn't been above 50% for much of 2008.”

Seasonality indicates that “September has firmly secured the rank as the worst month of the year” ( Stock Trader's Almanac ), but that a year-end rally typically starts in late September / early October.

Before highlighting some thought-provoking news items and quotes from market commentators, let's briefly review the financial markets' movements on the basis of economic statistics and a performance round-up.

Economy

“Global business sentiment remains weak and fragile and consistent with recession in the US, Europe and Japan,” according to the Survey of Business Confidence of the World conducted by Moody's Economy.com . The survey results suggest that the Asian economy (ex Japan) continues to post growth that is near its potential. “Across the globe, sentiment is consistent with an economy that is near recession. Pricing pressures remain very elevated, but fell notably last week.”

The minutes from the FOMC meeting of August 5, released on Tuesday, indicate that committee members were concerned about the near-term risks to growth. Most participants expected inflation to fall, although they remained wary about upside risks to inflation. Given the problems in financial markets, members did not view current monetary policy as overly stimulative.

Other economic reports released in the US during the past week included the following:

• The GDP growth rate in the second quarter was revised upward to 3.3% from 1.9%, exceeding expectations. In the first quarter, real GDP increased by 0.9%. The better-than-expected outcome did not change most economists' view that the economy was weakening, with the beneficial effects of rebate checks and foreign demand fading fast. Corporate profits edged down for the fourth straight quarter, falling twice as fast as in the first three months of the year.

• New orders for durable goods rose by 1.3% in July, surpassing expectations for only a slight increase. Core capital goods orders also surprised on the upside, increasing by 2.6% over the month.

• Existing home sales increased by 3.1% over the month in July, according to the National Association of Realtors. This increase put the annualized pace of sales up to 5 million units. However, substantial slack persisted, with inventories hitting a record high of 11.2 months. Furthermore, the median price of an existing house declined by 7.1% in year-ago terms, slightly worse than in June.

• Personal income tumbled by 0.7% in July after rising by 0.1% in June. Excluding the tax rebate effect, disposable personal income rose by 0.5% in July, up from 0.3% in June. Spending growth slipped to 0.2% from 0.6% the previous month. Real spending fell by 0.4% as price growth remained high. The core PCE deflator rose by 0.3%, matching the fastest rate since September, while the top-line deflator rose by 0.6%. The saving rate fell back to 1.2% from 2.5% in June but remained inflated by rebates.

Source: Slate

Summarizing the US economic situation, John Mauldin ( Thoughts from the Frontline ) said: “Even many mainstream economists are now suggesting we will be in a recession by the fourth quarter, if we are not in one now. The recovery, when it comes, will be tepid until credit spreads signal an end to the credit crisis. It is going to be Muddle Through for 2009. This is NOT going to be good for the stock market. When will it be safe to get back into the water? Pay attention to credit spreads.”

Data releases from Europe and Japan underlined rapidly deteriorating economies flirting with recession. The Japanese government announced a $107 billion set of fiscal measures, including tax cuts and larger government-guaranteed loans, in response to the weakening economy.

Week's economic reports

| Date | Time (ET) | Statistic | For | Actual | Briefing Forecast | Market Expects | Prior |

| Aug 25 | 10:00 AM | Existing Home Sales | Jul | 5.00M | 4.95M | 4.90M | 4.85M |

| Aug 26 | 10:00 AM | Consumer Confidence | Aug | 56.9 | 53.0 | 53.0 | 51.9 |

| Aug 26 | 10:00 AM | New Home Sales | Jul | 515K | 535K | 525K | 503K |

| Aug 26 | 2:00 PM | FOMC Minutes | Aug 5 | - | - | - | - |

| Aug 27 | 8:30 AM | Durable Orders | Jul | 1.3% | 0.2% | 0.0% | 1.3% |

| Aug 27 | 10:35 AM | Crude Inventories | 08/23 | -177K | NA | NA | 9390K |

| Aug 28 | 8:30 AM | Chain Deflator-Prel. | Q2 | 1.2% | 1.1% | 1.1% | 1.1% |

| Aug 28 | 8:30 AM | GDP -Prel. | Q2 | 3.3% | 2.8% | 2.7% | 1.9% |

| Aug 28 | 8:30 AM | Initial Claims | 08/23 | 425K | 425K | 425K | 435K |

| Aug 29 | 8:30 AM | Personal Income | Jul | -0.7% | -0.5% | -0.2% | 0.1% |

| Aug 29 | 8:30 AM | Personal Spending | Jul | 0.2% | 0.3% | 0.2% | 0.6% |

| Aug 29 | 9:45 AM | Chicago PMI | Aug | 57.9 | 50.5 | 50.0 | 50.8 |

| Aug 29 | 10:00 AM | Mich Sentiment-Rev. | Aug | 63.0 | 63.0 | 62.0 | 61.7 |

Source: Yahoo Finance , August 29, 2008.

In addition to the Fed releasing its beige book on September 3 and interest rate announcements by the Bank of England and the European Central Bank on September 4, next week's US economic highlights, courtesy of Northern Trust , include the following:

1. ISM Manufacturing Survey (September 1): The consensus for the manufacturing ISM composite index is 49.5 vs. 50.0 in July. If the consensus forecast is accurate, it would be consistent with weakness in other parts of the economy. Consensus : 49.5 versus 50.0 in July.

2. Employment Situation (September 5): Payroll employment in August is expected to have dropped by 85,000, taking the tally of consecutive monthly declines to eight. The jobless rate is predicted to have held steady at 5.7%. Consensus : Payrolls: -75,000 versus -51,000 in July, unemployment rate: 5.8% vs. 5.7% in July.

3. Other reports : Construction spending, auto sales (September 2), factory orders (September 3), ISM non-manufacturing (September 4).

Click here for a summary of Wachovia's weekly economic and financial commentary.

A summary of the release dates of economic reports in the UK, Eurozone, Japan and China is provided here . It is important to keep an eye on growth trends in these economies for clues on, among others, the trend of the US dollar.

Markets

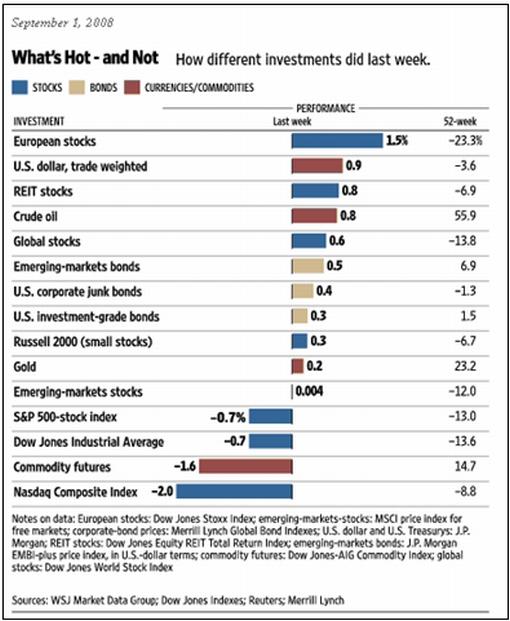

The performance chart obtained from the Wall Street Journal Online shows how different global markets performed during the past week.

Source: Wall Street Journal Online , August 31, 2008.

Equities

Global stock markets, in general, were mixed during the past week. The MSCI World Index rose by 0.6%, with the MSCI Emerging Markets Index closing unchanged.

Among mature markets, the US stock indices were mostly lower, but European stocks turned in good performances, for example Italian Comit 30 Index (+2.6%), French CAC 40 Index (+1.9%) and German XETRA Dax Index (+1.3%). Australia (+4.1%), Japan (+3.2%) and Canada (+2.4%) also shrugged off the gloomy economic outlook and moved higher.

The emerging markets category saw solid gains in Hong Kong (+4.3%) and Taiwan (+2.0%), whereas large declines were registered by Pakistan (-7.9%), Russia (-3.3%) and Turkey (-2.6%). The Russian Trading System Index ( 16.3%) and the Chinese Shanghai Composite Index (-13.6%) were the worst performers for the month of August.

With the exception of the Russell 2000 Index (+0.3%; YTD -3.5%), the US stock markets closed lower as shown by the major index movements: Dow Jones -0.7% (YTD -13.0%), S&P 500 Index +0.7% (YTD -12.6%) and Nasdaq Composite Index -2.0% (YTD 10.7%).

Particularly noteworthy, the MSCI World Index has outperformed the MSCI Emerging Markets Index over the past month (-1.6% vs -8.2%), past three months (-11.9% vs -21.0%), YTD (-15.4% vs -23.2%), and also since the stock market peaks of October 2007 (-20.7% versus -28.6%).

The Russell 2000 Index is trading above both its 50- and 200-day moving averages, whereas the Dow Jones Industrial Index, S&P 500 Index and Nasdaq Composite Index are above their 50-day averages but still below the important 200-day line – often used as an indicator of the primary trend.

Click here or on the thumbnail below for a market map, courtesy of Finviz.com , providing a quick overview of the performance of the various segments of the S&P 500 Index over the week.

The thrifts and mortgage finance group (+16%) was the best-performing group for the week, led by Freddie Mac (FRE) and Fannie Mae (FNM), up 61% and 37% respectively. This is a strong reversal from being the worst-performing group during the previous week with a decline of 23%. The stocks were driven down recently by speculation on whether a government bailout was imminent, a prospect that would probably wipe out the equity holders. Those concerns seemed to diminish last week after some analysts estimated that the firms had enough capital to last at least until next year.

The homebuilding group was the second-best performing group, gaining 9% on housing reports being interpreted as showing signs of a stabilizing market.

The trucking group (-7%) was the worst performer, led by its single member, Ryder System (R). A brokerage analyst downgraded the trucking sector, predicting that freight volumes in the peak shipping season through November might be weaker than expected because of the soft US economy.

The Internet retail group (-6%) was the second-worst performer, led by its largest member, Amazon (AMZN). A blog posting by a newspaper reporter raised the topic again of how well Amazon's Kindle electronic book reader was actually selling.

Fixed-interest instruments

Global government bond yields were mostly lower during the past week, as investors dismissed the threat of inflation and priced in concerns about a global recession.

The ten-year US Treasury Note declined by 4 basis points to 3.83%, the UK ten-year Gilt yield by 13 basis points to 4.48%, the German ten-year Bund yield by 5 basis points to 4.17% and the Japanese ten-year bond yield by 5 basis points to 1.42%.

Currencies

The US dollar maintained its recent rally as the currency benefited from the view that foreign central banks will be quicker to cut rates than the Fed will be to tighten rates.

The past week saw the greenback rising against the euro (+0.7% – a six-month high), the British pound (+1.6%), the Swiss franc (+0.2%), the Australian dollar (+1.2%) and the Canadian dollar (+1.6%).

Sterling has come under further selling pressure as pessimism about the UK economic outlook intensified, dropping to a 12-year low on a trade-weighted basis ahead of the Bank of England's interest rate announcement next week.

The Japanese yen was the only currency to gain against the US dollar during the past week, closing 1.1% higher on the back of better-than-expected economic data and the announcement of a $107 billion fiscal stimulus package.

Commodities

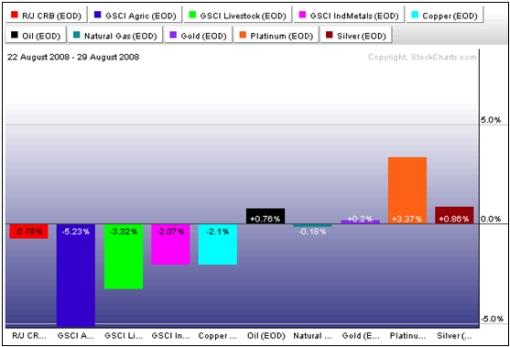

The dollar's strength and growing concerns of slowing demand knocked dollar-denominated commodity prices as seen in the Reuters/Jeffries CRB Index, which declined by 0.8%.

West Texas Intermediate crude traded between $115.0 and $118.76 a barrel last week before closing 0.8% up at $115.46 on Friday. The gain was relatively small given the impending arrival of Hurricane Gustav and concerns about the geopolitical situation with Russia, but word from the Department of Energy that it would release strategic oil stocks to combat any disruption kept oil prices in check. (The Gulf of Mexico is responsible for 25% of US crude oil production and 15% of US natural gas production.)

The chart below shows the past week's movements for the various commodities:

Now for a few news items and some words and charts from the investment wise that should be of help with keeping our investment portfolios on a winning path. As the Irish say: “Go n-eírí an bóthar leat. May the road rise with you.” And also wishing you a fabulous Labor Day weekend.

Hat tip: Barry Ritholtz's Big Picture

YouTube: Take a load off Fannie

The story of Fannie Mae, as narrated by The Band.

Source: YouTube , August 24, 2008. (Hat tip: Barry Ritholtz's The Big Picture .)

Financial Times: Fannie and Freddie doubts grow

“Shares in Fannie Mae and Freddie Mac fell on Friday amid concerns foreign investors were reassessing their exposure to the troubled US mortgage financiers' bonds and guaranteed securities.

“Bank of China this week revealed it had cut its portfolio of securities issued or guaranteed by the two government-sponsored enterprises by a quarter, or $4.6 billion, since the end of June. The sale underscored signs of nervousness among foreign buyers of Fannie and Freddie's debt.

“Federal Reserve custody data on Thursday showed foreign official and private investors reduced their holdings of agency debt for the sixth consecutive week.

“Bill O'Donnell, analyst at UBS said: ‘If this recent theme of cooling passions for GSE's debt becomes a longer-term trend, then it could be problematic for the GSEs given that the central banks have taken … roughly 30% to 60% of new GSE issuance in recent months and years.'

“The US Treasury was granted powers last month to extend its credit lines to Fannie and Freddie and to invest in their debt and equity.”

Source: Saskia Scholtes, Financial Times , August 29, 2008.

Times Online: Buffett predicts game over for Fannie and Freddie

“For Fannie May and Freddie Mac the game is over. The Sage of Omaha has spoken.

“Warren Buffett, the world's richest man, said it was no longer feasible for America's two biggest mortgage finance companies to exist independently. He went on to forecast that the US economy would remain in the doldrums for at least five months.

“Fannie and Freddie, which underpin America's mortgage market by buying home loans and packaging them into bonds, did not have any net worth, Mr Buffett told CNBC. Both face losses of tens of billions of dollars on the bonds. Analysts said they look increasingly likely to need a cash injection from the Government and Mr Buffett said they were too big to fail, predicting: ‘You will see some action fairly soon.'

“Mr Buffett was also downbeat about the housing market and, in turn, the broader economy. ‘What we're seeing in business, in our retail business, or anything having to do with housing, is a further slowing down in June and July, both in terms of credit experience where people first got into trouble with house payments, and now credit card payments,' he said. ‘In my judgment, it [the economy] won't be any better five months from now.'

“Mr Buffett, who runs the Berkshire Hathaway investment group from its headquarters in Omaha, Nebraska, added: ‘You always find out who's been swimming naked when the tide goes out. We found out that Wall Street has been kind of a nudist beach.'

“Mr Buffett said he expected more banks to fail, especially in areas where there was a housing bubble. ‘We will see failures where the bankers were dumb in what they did,' he said.”

Source: Tom Bawden, Times Online , August 23, 2008.

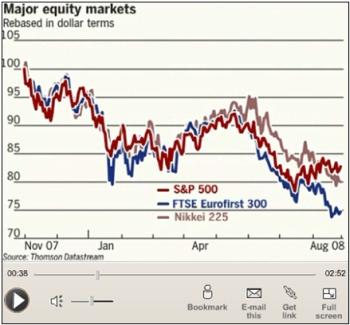

John Authers (Financial Times): Credit crunch winners and losers

John Authers discusses how the big loser in the credit crunch has not been the United States but Europe due to the effects of a weaker dollar.

Click here for the full article.

Source: John Authers, Financial Times , August 29, 2008.

Financial Times: Bankers caught between hope and despair

“More than a year into the credit crisis, the world's top central bankers admit they are still in the dark as to what its ultimate impact on the global economy will be.

“By the same token they are unsure to what extent weakening growth will help to ease high inflation.

“‘There is enormous uncertainty about where we stand at the moment,' Stanley Fischer, governor of the Bank of Israel, said at the close of the Federal Reserve's annual retreat in Jackson Hole, Wyoming.

“His comments came as US Treasury officials worked through the weekend on options for Fannie Mae and Freddie Mac, the troubled mortgage groups, amid expectations an announcement could come this week.

“Mr Fischer told central bankers from 43 nations ‘we are in the midst of the worst financial crisis since World War II'. But it was still not clear how big an event it would turn out to be.

“So far, he said, ‘in real economy terms we are not looking at anything exceptional'. But the crisis was entering a ‘second round' in which economic and financial weakness could feed on each other.

“Other current and former central bankers shared this view. Alan Blinder, a former Fed vice-chairman, said: ‘It is amazing a year later how much is still unresolved.'

“Monetary policymakers appear torn between hope that the global economy is turning out to be resilient – in part thanks to policy interventions – and fear that the worst could lie ahead.

“They think the economy will muddle through and recover next year. But they cannot rule out the possibility that the financial crisis – in conjunction with the oil shock – could deliver a bad economic outcome.”

Source: Krishna Guha, Financial Times , August 24, 2008.

Barron's: Is the global liquidity tide turning?

“My invitation to hob-nob with the world's monetary muckety-mucks in Jackson Hole this weekend got lost in the mail, yet again. Amidst the Grand Tetons of Wyoming, the Federal Reserve hosts its end-of-summer junket for the movers and shakers and hangers-on to discuss the key monetary matters of the day.M

“Too bad they are little more than corks tossed on violent seas of global forces totally beyond their control.

“The inflationary tide in global liquidity could be turning … The sharp break in gold suggests that could be happening, and that's being transmitted through the commodities markets. The dollar has stopped going down, and even has flattened out against the renminbi. The bear market in risk assets, such as stocks and particularly the Chinese market, also is symptomatic of a liquidity squeeze. As for the US housing market, it is at the nexus, resulting in wealth losses for borrowers and a reduction in lenders' ability and willingness to extend credit.

“That's something that the crowd in Jackson Hole can scarcely control. So they might as well enjoy themselves on their junket.”

Source: Randall W. Forsyth, Barron's , August 21, 2008.

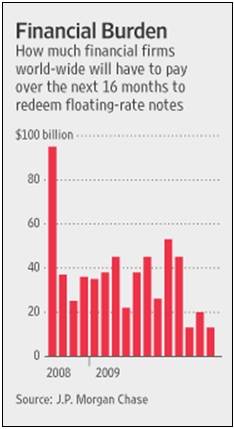

The Wall Street Journal: New credit hurdle looms for banks

“US and European banks, already burdened by losses and concerns about their financial health, face a new challenge: paying off hundreds of billions of dollars of debt coming due.

“At issue are so-called floating-rate notes – securities used heavily by banks in 2006 to borrow money. A big chunk of those notes, which typically mature in two years, will come due over the next year or so, at a time when banks are struggling to raise fresh funds. That's forcing banks to sell assets, compete heavily for deposits and issue expensive new debt.

“The crunch will begin next month, when some $95 billion in floating-rate notes mature. JPMorgan analyst Alex Roever estimates that financial institutions will have to pay off at least $787 billion in floating-rate notes and other medium-term obligations before the end of 2009. That's about 43% more than they had to redeem in the previous 16 months.

“The problem highlights how the pain of the credit crunch, now entering its second year, won't end soon for banks or the broader economy. The Federal Deposit Insurance Corp. said on Tuesday that its list of ‘problem' banks at risk of failure had grown to 117 at the end of June, up from 90 at the end of March. FDIC Chairman Sheila Bair said her agency might have to borrow money from the Treasury Department to see it through an expected wave of bank failures. She said the borrowing could be needed to handle short-term cash-flow pressure brought on by reimbursements to depositors after bank failures.

“As banks scramble to pay the floating-rate notes, they could see profit margins shrink as wary investors demand higher interest rates for new borrowings. They're also likely to become less willing to make new loans to consumers and companies, aggravating economic downturns in both the US and Europe.”

Source: Carrick Mollenkamp, The Wall Street Journal , August 27, 2008.

Scott Bugie (Standard & Poor's): Second phase of credit crunch could be severe

“The credit crunch is entering a second, ‘post-subprime' phase where banks' loan books deteriorate more rapidly and capital-raising efforts might become harder, says Scott Bugie, credit analyst at Standard & Poor's.

“‘Loan book deterioration is starting to hit a wider array of financial institutions, as credit losses migrate from subprime into other sectors of household finance, such as credit cards, Alt-A and prime mortgages, and auto loans well into 2009,' he says.

“Mr Bugie believes losses on the loan books of US banks could reach $265 billion a year for the next two to three years. In Europe, he says, the focus of concern is shifting to commercial loans as European economies enter a downturn.

“While capital-raising has largely offset losses that financial institutions have incurred from writedowns, much of the capital raised has been in the form of hybrid securities with both debt and equity characteristics, he says.

“‘Consequently, the quality of the banks' capital has eroded somewhat.'

“And he warns that in the US and Europe, a major concern is regional banks' ability to raise capital.”

Source: Scott Bugie, Standard & Poor's (via Financial Times ), August 26, 2008.M

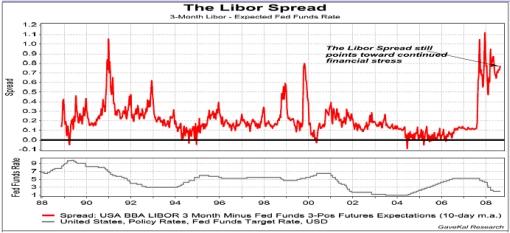

GaveKal: The Libor spread points to financial stress

Source: GaveKal – Checking the Boxes , August 26, 2008.

Asha Bangalore (Northern Trust): Fed on hold, arguments in favor of supporting growth outweigh inflation concerns

“The main message from the minutes of the August 5 FOMC meeting is that the Fed is on hold for several meetings, barring unexpected developments. That said, the minutes lean toward favoring policy supportive of economic growth in the inflation-growth debate. Inflation did feature extensively, but growth and financial market stability are at the top of the list of concerns. The concern about inflation expectations appears overdone because, for now, the market is less concerned about inflation than a few weeks ago.

It is also interesting to note the following quote:

“‘Most members did not see the current stance of policy as particularly accommodative, given that many households and businesses were facing elevated borrowing costs and reduced credit availability due to the effects of financial market strains as well as macroeconomic risks. Although members generally anticipated that the next policy move would likely be a tightening, the timing and extent of any change in policy stance would depend on evolving economic and financial developments and the implications for the outlook for economic growth and inflation.'”

Source: Asha Bangalore, Northern Trust – Daily Global Commentary , August 26, 2008.

Richard Russell (Dow Theory Letters): We're heading for de-leveraging and deflation

“Brilliant Bloomberg columnist Caroline Baum probably knows the bond market better than anyone else I know. Caroline starts her current column as follows. ‘Inflation expectations are so weighted down that investors are buying 10-year Treasuries yielding 3.8% with inflation running at 5.6%. Federal Reserve policy makers couldn't ask for a stronger mooring in the face of disappointing inflation news. A pair of reports on consumer and producer prices for July showing year-over-year increases of 5.6% and 9.8%, respectively, the fastest pace in 17 and 27 years, failed to rattle the US Treasury market.'

“What's going on? ‘One school holds that bonds are mispriced. Buyers are either complacent or smoking something stronger than tobacco. Even if they are in full command of their faculties, they are choosing liquidity over yield.'

“Russell Comment – Bond people tend to be very sophisticated. I think they are thinking in terms of the great international de-leveraging that may be coming up. Or why would the 10-year T-notes be selling at a lousy 3.8% yield which is actually below the rate of inflation? Obviously, the bond crowd sees deflation ahead. And nobody else does. Maybe the stock market is just getting wind of it now!

“Remember, years ago I said that the big problem coming up would be INCOME. Everybody's going to need income, and income will be hard to come by. I'm still of that same opinion. My dear subscribers – hunker down – there's a hard rain a'comin'. We're heading into de-leveraging and deflation, and nobody's positioned for it.”

Source: Richard Russell, Dow Theory Letters , August 25, 2008.

Did you enjoy this post? If so, click here to subscribe to updates to Investment Postcards from Cape Town by e-mail.

By Dr Prieur du Plessis

Dr Prieur du Plessis is an investment professional with 25 years' experience in investment research and portfolio management.

More than 1200 of his articles on investment-related topics have been published in various regular newspaper, journal and Internet columns (including his blog, Investment Postcards from Cape Town : www.investmentpostcards.com ). He has also published a book, Financial Basics: Investment.

Prieur is chairman and principal shareholder of South African-based Plexus Asset Management , which he founded in 1995. The group conducts investment management, investment consulting, private equity and real estate activities in South Africa and other African countries.

Plexus is the South African partner of John Mauldin , Dallas-based author of the popular Thoughts from the Frontline newsletter, and also has an exclusive licensing agreement with California-based Research Affiliates for managing and distributing its enhanced Fundamental Index™ methodology in the Pan-African area.

Prieur is 53 years old and live with his wife, television producer and presenter Isabel Verwey, and two children in Cape Town , South Africa . His leisure activities include long-distance running, traveling, reading and motor-cycling.

Copyright © 2008 by Prieur du Plessis - All rights reserved.

Disclaimer: The above is a matter of opinion and is not intended as investment advice. Information and analysis above are derived from sources and utilizing methods believed reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Do your own due diligence.

Prieur du Plessis Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.