Fragile Stock Market Bull in a China Shop

Stock-Markets / Stock Market 2017 Oct 31, 2017 - 11:41 AM GMTBy: James_Quinn

“So the modern world may be increasing in technological knowledge, but, paradoxically, it is making things a lot more unpredictable.” – Nassim Nicholas Taleb, Antifragile: Things That Gain From Disorder

“So the modern world may be increasing in technological knowledge, but, paradoxically, it is making things a lot more unpredictable.” – Nassim Nicholas Taleb, Antifragile: Things That Gain From Disorder

“Success brings an asymmetry: you now have a lot more to lose than to gain. You are hence fragile.” – Nassim Nicholas Taleb, Antifragile: Things That Gain From Disorder

I had read Nassim Taleb’s other best-selling tomes about risk, randomness and black swans – Fooled by Randomness & The Black Swan. They were not easy reads, but they were must reads. He is clearly a brilliant thinker, but I like him more because he is a prickly skeptic who scorns and ridicules academics, politicians, and Wall Street scumbags with gusto. There were many passages which baffled me, but so many nuggets of wisdom throughout each book, you couldn’t put them down.

When his Antifragile book was published in 2012, the name intimidated me. I figured it was too intellectual for my tastes. When I saw it on the shelf in my favorite used book store at the beach, I figured it was worth a read for $9. I’m plowing through it and I haven’t been disappointed.

His main themes are more pertinent today than they were in 2012. He published The Black Swan in 2007, just prior to one of the biggest black swans in world history – the 2008 Federal Reserve/Wall Street created financial collapse. His disdain for “experts” like Bernanke, Paulson, and Wall Street CEOs, and their inability to comprehend the consequences of their actions and in-actions as the financial system was blown sky high, was a bulls-eye.

As usual, all of Taleb’s warnings and rational analysis of how the world really works have been forgotten or ignored, as the actions of the captured Fed, corrupt DC politicians, and greedy Wall Street shysters propel the nation and the world toward another historic financial collapse. The “experts” will be proven to be knaves and fools once again.

“The problem with experts is that they do not know what they do not know” – Nassim Nicholas Taleb, Antifragile: Things That Gain From Disorder

As I was reading passages of his Antifragile analysis of the real world, I was struck by how his concepts of fragility and antifragility become more relevant as this relentless bull market in stocks, bonds, real estate and government debt reaches nose bleed heights only seen twice before in financial history. When something is fragile it breaks easily.

Interventionist monetary actions by the Federal Reserve, non-enforcement of financial regulations by the Federal Reserve, introduction of unregulated indecipherable derivatives, repeal of the Glass-Steagall Act, mass Wall Street collusion in the largest control fraud in history, and delusional expectations of ignorant investors created extremely fragile housing and stock markets which were certain to break.

“Complications lead to multiplicative chains of unanticipated effects.” – Nassim Nicholas Taleb, Antifragile: Things That Gain From Disorder

And break they did. There was no specifically particular catalyst which caused national housing prices to fall 30% or the stock market to fall 50%. Their extreme fragility made it certain they would break. The “experts” who declared the housing market strong and the stock market not overvalued provided a myriad of retrospective causes after the financial system collapsed.

They never provide prospective warnings before things break. Their job is to mislead, while the Wall Street pillaging machine does its work. Were lessons learned from this horrific man-made debacle? Based on the actions taken by those in power, no lessons have been absorbed. The authorities have done the exact opposite of what needed to be done to make the financial system less fragile. Their reckless self-serving debt spawning scheme has guaranteed another far worse collapse.

“If something is fragile, its risk of breaking makes anything you do to improve it or make it “efficient” inconsequential unless you first reduce that risk of breaking.” – Nassim Nicholas Taleb, Antifragile: Things That Gain From Disorder

As the ill-gotten profits of criminal Wall Street banks evaporated during late 2008 and early 2009 the very survival of these Too Big To Prosecute behemoth owners of the Federal Reserve was in question. They were effectively bankrupt, as the toxic mortgage debt and busted derivatives blew gaping holes in their balance sheets. With 30 to 1 leverage, they were dead shysters walking.

It was at this point the captured central bankers, crooked politicians, and feckless government apparatchiks across the globe colluded to prop up the existing elite establishment at the expense of the people they had just got done screwing out of $700 billion, after they had absconded with trillions in middle class wealth.

The plan has been to introduce massive doses of central bank and government debt into an already debt saturated fragile global economic system and artificially suppress interest rates in order to prop up stock markets and high end real estate markets, while impoverishing senior citizens, savers and the working middle class. A few million middle class eggs must be broken to make a gold plated oligarch omelet.

“The world as a whole has never been richer, and it has never been more heavily in debt, living off borrowed money. The record shows that, for society, the richer we become, the harder it gets to live within our means. Abundance is harder for us to handle than scarcity.” – Nassim Nicholas Taleb, Antifragile: Things That Gain From Disorder

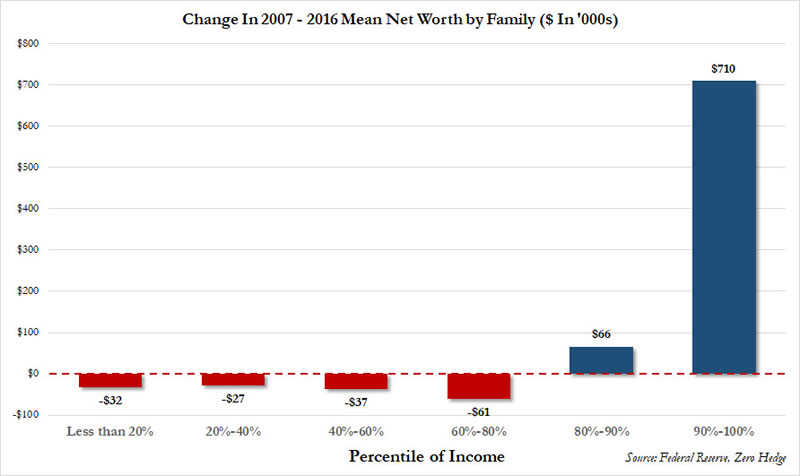

It was reported with great fanfare by the mouthpieces for the establishment in the corporate mainstream media the net worth of U.S. households has reached an all-time high. The Fed has successfully elevated the net worth of the top 10%, with the majority of the benefits accruing to the top .1%. This debt engineered faux recovery has benefited only Wall Street sycophants and the parasites feeding off their wealth, while throwing 80% of the population under the bus. There has been no recovery for the average working class American. Wall Street has gorged on debt and rigged markets, while Main Street has seen their savings eviscerated and depleted by soaring healthcare costs, skyrocketing rents, mounting tax burden, and everyday living expenses.

The fraud of GDP growth since 2009, as pitiful as it has been, is completely dependent upon trillions of dollars of deficit spending by the government, Federal Reserve money printing, and massive forced spending created by Obamacare. The powers that be decided their own well-being, power, control and wealth superseded any civic obligation to future generations.

“As to growth in GDP, it can be obtained very easily by loading future generations with debt – and the future economy may collapse upon the need to repay such debt.” – Nassim Nicholas Taleb, Antifragile: Things That Gain From Disorder

Their actions have guaranteed economic collapse, but as long as the stock market remains elevated all is well in Elitist-ville USA. As long as we pretend the $20 trillion national debt and $200 trillion of unfunded welfare liabilities don’t matter, the party can continue. As long as a dumbed down populace chooses to willfully ignore basic mathematical facts, the propaganda spewing corporate media’s narrative of economic expansion and strong jobs market will be believed.

As long as the American people allow themselves to be distracted by a tweeting reality president, bloated hog Hollywood sexual predators, mysterious video poker playing mass shooters, kneeling overpaid low IQ athletes, and the usual Washington bullshit about budgets, tax cuts, and healthcare plans, the oligarchs will keep their raping and pillaging of the national wealth machine running at hyper-speed.

“More data means more information, but it also means more false information.” – Nassim Nicholas Taleb, Antifragile: Things That Gain From Disorder

Never has there been more false information disguised as data in world history. Technology instantaneously disseminates data, as governments, central banks and corporations issue economic narratives and financial reports designed to mislead, confuse, obfuscate and hide the truth from the public.

The government reports “strong” GDP of 3% while somehow ignoring the impact of two devastating hurricanes. The number is a pure guess based upon models designed to show it in the best light possible. It will be revised dramatically lower in the future with little fanfare, but its PR effect has already done the job of elevating stock markets higher. Mission accomplished.

The brainless bimbos and talking head twits peddled as financial experts on the corporate fake news channels gushed about the strong economic results without even questioning the basis of the number. Consumer spending accounts for 69% of GDP. Some critical thinking might make you question the validity of that 3% GDP number. The massive increase in healthcare spending forced upon the public by the Obamacare cataclysm is counted as a great big positive for GDP. So is the jump in gasoline expenditures and food costs.

A supposed large increase in auto purchases gave a boost to GDP. If automakers are reporting lower sales and reducing production, how could this be? Plus virtually all auto “sales” are nothing but easy money debt based rentals through 7 year $0 down, 0% interest loans or low payment 3 year leases.

A full 17% of GDP ($3.4 trillion) is generated by the Federal, state and local government spending money they have absconded from you at gunpoint. Only a deeply dishonest disgraceful captured bureaucracy could count money taken from its citizens and then miss-allocated in epic proportions as an increase in GDP. The GDP calculation is fake data used to mislead the masses.

If consumer spending was really robust it would be based upon strong wage growth from a vibrant jobs market. That’s the other outrageous fake data narrative being spun by the masters of propaganda within the Deep State. The government and politicians need to keep the sheeple calm and sedated during their never ending sheering, so they falsely report a 4.2% unemployment rate and the bloviator in chief takes credit for all the new jobs.

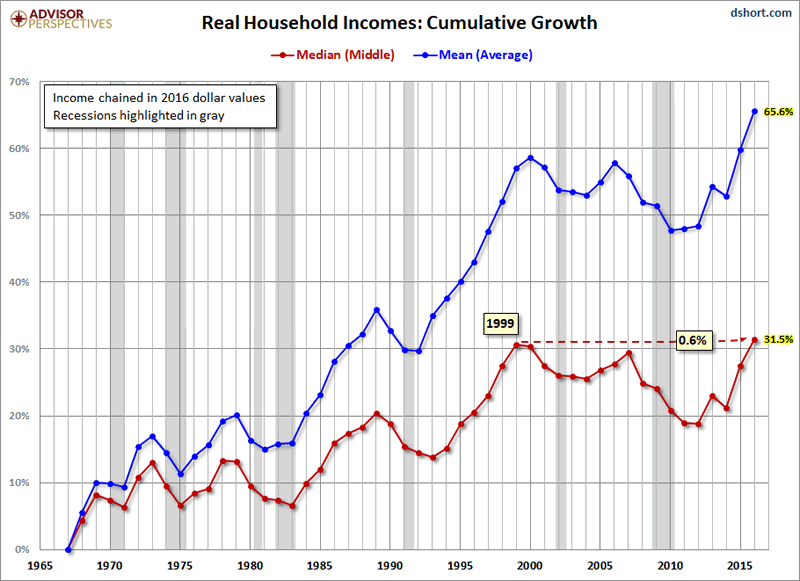

In reality, there were 2.6 million new jobs added last year and the trend over Trump’s first eight months is 2.7 million new jobs – and most of them continue to be low paying service jobs. If the unemployment rate was really 4.2%, wages would be soaring as demand exceeded supply. But we all know real wages are stagnant and consumer debt has reached new all-time highs, as average middle class Americans are clinging to their credit cards to survive.

A few basic facts obliterate this strong jobs market false narrative. Since 2007 (before the Fed created financial crisis) the working age population has grown by 24 million, while the number of employed Americans has increased by 8 million (only 3.6 million men), but somehow the unemployment rate is the same. Of those 8 million new jobs, 2.5 million are part-time.

There are currently 2 million less men between the ages of 35 and 54 employed than there were in 2007. Those are considered prime working years for men. According to your lying government, 16 million working age Americans voluntarily left the workforce because they don’t need a job. Only an Ivy League professor or a 75 IQ moron could actually believe the drivel fed to the American public by these government apparatchiks.

Ask yourself whether the real situation on Main Street America matches a 4.2% unemployment rate or a 20% unemployment rate. Ask yourself whether your real world inflation rate is 2% or in excess of 5%. If rising consumer expenditures reflect the health of the consumer, why are JC Penny, Sears and Macys dead retailers walking? Why are there more store closings and retail bankruptcies in 2017 than the depression year of 2009?

Why has restaurant traffic been declining for over a year? Why do putrefying ghost malls haunt the suburban landscape like a scary apparition? We are living in zombieland, with the only an extraordinary amount of debt being pumped into the diseased veins of the global economy by central banker mad scientists giving this cadaver the appearance of life.

With real median household income still at 1999 levels, the middle class (aka the deplorables) in flyover country is lifeless and barely surviving on their credit cards. This supposed recovery has passed the deplorables by, as it has been specifically engineered for the wealthy oligarchs. The pliant academic puppets running the Federal Reserve, ECB and the Bank of Japan on behalf of billionaire oligarchs, Wall Street bankers, government bureaucrats, mega-corporation CEOs, and corrupt politicians had a moral obligation to take actions which would have made the global financial system more resilient and less fragile. After the near death experience in 2008/2009 for the financial elite, central bankers and their co-conspirator government lackeys decided they would do whatever it took to elevate stock, bond and real estate markets.

These traitors to their citizens have printed tens of trillions of currency out of thin air to elevate stock markets, buy bad debt to artificially suppress interest rates, and colluded with Wall Street hedge funds to drive real estate prices higher by purposefully reducing supply. Their actions have benefitted the haves at the expense of the have nots, while providing the deceitful appearance of stability when they are steadily introducing instability and vulnerability into the system.

“But the larger point is that we can now see that depriving systems of stressors, vital stressors, is not necessarily a good thing, and can be downright harmful.” – Nassim Nicholas Taleb, Antifragile: Things That Gain From Disorder

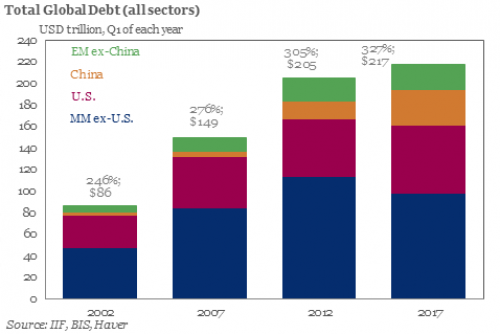

They have created an eight year bull market in everything, while increasing global debt by a mere $70 trillion. This long period of faux prosperity has encouraged rampant risk taking and speculation utilizing leverage to supercharge returns. The lack of volatility and unquestioned belief central bankers will bail them out, has led arrogant swashbuckling MBA hotshots to program their supercomputer high frequency trading machines to buy every dip.

Many of these 30 somethings have never experienced a terrifying plunge or a real bear market. By eliminating fear of losses and suppressing volatility, central bankers have created a landscape where a buildup in risk and fragility guarantees a Minsky Moment.

The speculative juices have now reached epic levels. The appropriate cautiousness of respected financial minds like Shiller, Hussman, Mauldin, Stockman, and Taleb is scorned and ridiculed by the egotistical big swinging dicks on the trading desks of the criminal Wall Street banks. Their belief in their statistical models is only outdone by their faith markets will never crash again. They believe central bankers have figured out how to levitate financial markets for all eternity. With the markets overvalued on par with 1929 and 2000, bullishness and margin debt have never been higher.

The FANG stocks are the new Dotcom bubble stocks. Last week’s Amazon earnings release tells you everything you need to know about the outrageous hype and false narratives spun by Wall Street and their media mouthpiece pawns. The hyperbolic headlines screamed “HUGE EARNINGS BEAT”. At the start of the year earnings projections for the 3rd quarter were $2.00 per share. The company and their Wall Street analyst minions guided that down to 2 cents per share and then “beat” that by announcing 52 cents per share. Wow!!

Meanwhile, their gross margins fell for the 4th quarter in a row, chiming in at NEGATIVE 18% or a $5.2 billion loss. That’s right. They lose 18% on every sale. That was enough to propel the stock over $1,000 per share, with a PE ratio of 250. This certainly isn’t irrationally exuberant. Right?

No one on Wall Street dares to question the narrative about Amazon, Netflix, Facebook, or Google. The corporate propaganda media dutifully reports what they are told to report. Financial metrics, valuations, GAAP earnings, and common sense have left the building. The “professionals” on Wall Street are fully invested because they want those year-end bonuses.

The little guys are entering the market. ETFs dominate on the way up and will lead the way down. Everything is being bought by the machines and everything will be sold when the machines revolt. The confidence level for future gains is off the charts. The herd of lemmings is stampeding towards the cliff. Skeptics and contrarians are getting flattened.

“There is something like a switch in us that kills the individual in favor of the collective when people engage in communal dances, mass riots, or war. Your mood is now that of the herd. You are part of what Elias Canetti calls the rhythmic and throbbing crowd” – Nassim Nicholas Taleb, Antifragile: Things That Gain From Disorder

Central bankers have succeeded in convincing virtually everyone they have everything under control, when in reality they have introduced far more risk and fragility into the financial system than existed in 2007. Curing a debt problem with far more debt is like treating a gunshot wound to the leg with a gunshot to the head. This cycle of greed and fear will end just as every previous cycle has ended.

The debt financed speculative frenzy will cease when cash flow becomes insufficient to service the debt taken on to make the speculative investments. Even relatively small losses on the speculative assets will cause lenders to call their loans, which will begin a multiplicative chain of ferocious selling and unanticipated consequences. The sell-off will lead to a sudden and precipitous collapse in market-clearing asset prices, a sharp drop in market liquidity, and a severe demand for cash. Minsky will be smirking.

The suppression of volatility by central bankers has lulled the masses into a false sense of security as the everything bubble grows ever larger and less stable beneath the surface. If they had allowed corrections over the last few years to periodically release the buildup of speculative pressures, the financial system would not be nearly as fragile.

The all-knowing “experts” see nothing on the horizon which could derail this bull market. Trump has taken ownership of this bubble by taking credit for the surge since Election Day, after previously calling it a huge bubble during the campaign. He will rue his decision to own this over-priced market.

This market bubble is so overblown, a specific trigger is not necessary to start the disintegration of this bubble. In retrospect, as in the case of Bear Stearns and Lehman Brothers in 2008, the financial press will need to blame the inevitable collapse on something tangible such as a military conflict, political indictment, financial institution failure, natural catastrophe, or surge in interest rates. This house of cards built on a foundation of dodgy debt and mass delusions of grandeur will come toppling down, with societal implications which will propel this Fourth Turning towards its bloody climax.

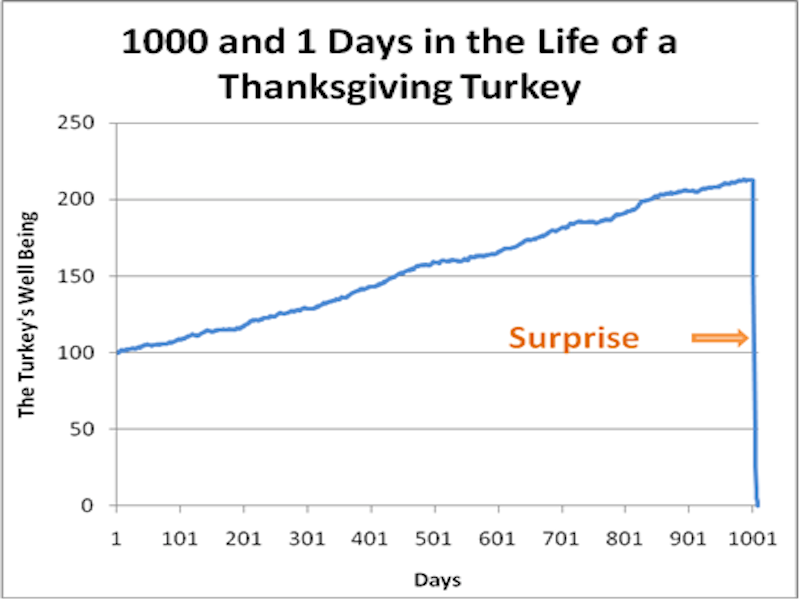

The overconfidence and hubris being exhibited by the ruling class and the parasites feeding off their leftover scraps is palpable. There is no fear. They’ve got this thing. The suckers not getting rich in this market are to be disparaged and derided as losers. They remind me of the turkey who has been fed like a king for a thousand days by the butcher and every day turkey “experts” report with unequivocal statistical confidence that butchers love turkeys and will treat them like kings forever. Then on the 1,001st day the turkey experiences a fatal surprise. The Wall Street turkeys should note Thanksgiving is approaching rapidly.

No one knows when or how this collapse will appear, but we do know Bernanke, Yellen, Draghi, Kuroda, Wall Street, Washington DC, and the fake news corporate media are culpable in weakening our economic and financial systems through their reckless, arrogant, corrupt solutions to the last collapse caused by their irresponsible, greedy, fraudulent schemes designed to enrich their wealthy oligarch constituents. They’ve created a supremely fragile financial system. When the losses begin to mount, we (the deplorables) will need to get in touch with our inner butcher. These turkeys will need to pay for their evil miss-deeds.

“Not seeing a tsunami or an economic event coming is excusable; building something fragile to them is not.” – Nassim Nicholas Taleb, Antifragile: Things That Gain From Disorder

Join me at www.TheBurningPlatform.com to discuss truth and the future of our country.

By James Quinn

James Quinn is a senior director of strategic planning for a major university. James has held financial positions with a retailer, homebuilder and university in his 22-year career. Those positions included treasurer, controller, and head of strategic planning. He is married with three boys and is writing these articles because he cares about their future. He earned a BS in accounting from Drexel University and an MBA from Villanova University. He is a certified public accountant and a certified cash manager.

These articles reflect the personal views of James Quinn. They do not necessarily represent the views of his employer, and are not sponsored or endorsed by his employer.

© 2017 Copyright James Quinn - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

James Quinn Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.