Tesla, Electric Metals Hot- Gold Cold

Companies / Electric Cars Nov 07, 2017 - 06:11 AM GMTBy: Plunger

While gold has has been down and out the electric metals have been all the rage, especially the cobalt plays. Seems every month a new battery factory is announced and a new EV manufacturer announces its plans to enter the market. With additional automotive capacity entering the market the collateral damage this week was the darling of the sector- Tesla.

While gold has has been down and out the electric metals have been all the rage, especially the cobalt plays. Seems every month a new battery factory is announced and a new EV manufacturer announces its plans to enter the market. With additional automotive capacity entering the market the collateral damage this week was the darling of the sector- Tesla.

Tesla– is it finally time for the shorts to be taken off the intensive care list?

Things changed this week for Tesla, as reality came calling when the tax debate in Washington put Tesla’s tax credits in the cross hairs. With the $7,500 tax credit/ vehicle under threat the economics of the EV are not quite as good. If shorting is best done as a shoot em in the back strategy maybe it’s time to start taking aim…just sayin.

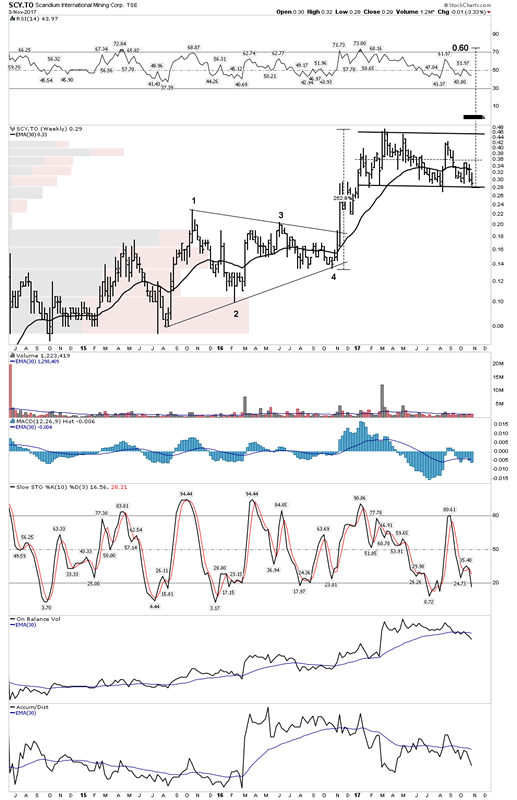

Weekly:

30 W EMA now rolling over with broken momentum indicators

Daily- This may be the ugliest chart of the day, as it sports not one but two violated H&S patterns. The gap jumping the 200 EMA delivers the message -it’s done.

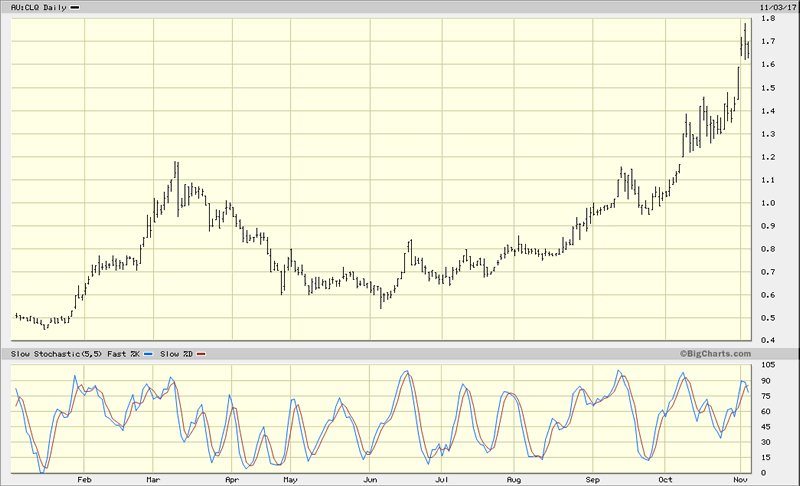

Electric Metals still hot.

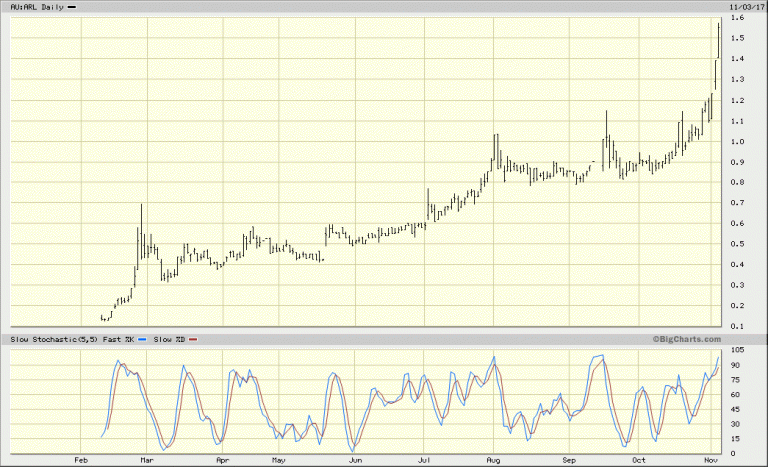

But Tesla is just one of many EV producers, and the demand for the metals will be insatiable. The lithium stocks have been on fire for some time and recently the cobalts have been catching up. My personal cobalt play is Ardea Resources in Australia:

Plunger

Copyright © 2017 Plunger - All Rights Reserved

All ideas, opinions, and/or forecasts, expressed or implied herein, are for informational purposes only and should not be construed as a recommendation to invest, trade, and/or speculate in the markets. Any investments, trades, and/or speculations made in light of the ideas, opinions, and/or forecasts, expressed or implied herein, are committed at your own risk, financial or otherwise. The information on this site has been prepared without regard to any particular investor’s investment objectives, financial situation, and needs. Accordingly, investors should not act on any information on this site without obtaining specific advice from their financial advisor. Past performance is no guarantee of future results.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.