Deepening Crisis In Hyper-inflationary Venezuela and Zimbabwe

Currencies / HyperInflation Nov 16, 2017 - 05:49 PM GMTBy: GoldCore

– Deepening Crisis In Hyper-inflationary Venezuela and Zimbabwe

– Deepening Crisis In Hyper-inflationary Venezuela and Zimbabwe

– Real inflation in Zimbabwe is 313 percent annually and 112 percent on a monthly basis

– Venezuela’s new 100,000-bolivar note is worth less oday thehan USD 2.50

– Maduro announces plans to eliminate all physical cash

– Gold rises in response to ongoing crises

A military coup-de-grace in Zimbabwe and a bankrupt Venezuela. Both countries have extreme hyperinflation, citizens are starving and basic medical treatment is near impossible to find. These are the real world problems 47.5 million people are currently facing.

Presidents Robert Mugabe and Nicolas Maduro both deny the crises in their respective countries. For Maduro it is the media propagating false truths. In Zimbabwe the response to hyperinflation has been to declare it illegal.

Both countries are in the media spotlight after a significant week that has left one man powerless and another scrambling to restore faith in his bankrupt country.

Each country’s mess is thanks to mismanagement of resources and the central banking system. Citizens have had their rights almost decimated as the cash in the bank is worth increasingly less and fewer people are receiving income. Basic goods and services are near impossible to come by, with little sign of let-up.

The hyperinflation and economic situations in both the Latin American and south African country are a reminder of the damage caused by governments. Both Maduro and Mugabe have acted under the premise of serving the electorate. Citizens as a result have only suffered and seen their wealth diminish on a daily basis.

Both countries may seem a million miles away from the West in terms of political situation and cultures. However there is a strong lesson to be learnt. Savers should learn the need to protect their earnings and wealth from the manipulative decisions of governments and destructive monetary policies.

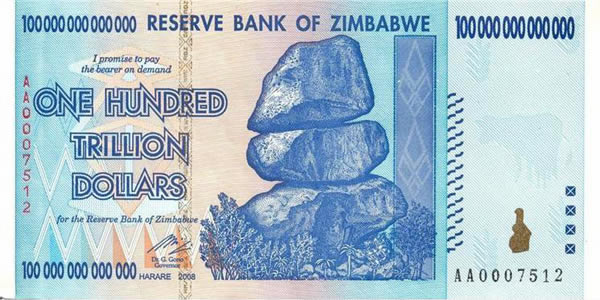

Zimbabwe: The tyranny of a despot and his central bank

“Zimbabwe, welcome back to the record books! You have once again entered the inglorious world of hyperinflation. It is a world of economic chaos, wrenching poverty and death,”

– Steve Hanke, economics professor at Johns Hopkins University

Venezuela reminds me of a quote that is often misattributed to Milton Friedman:

“If you put the federal government in charge of the Sahara Desert, in 5 years there’d be a shortage of sand.”

Today you could say the same about oil and the Venezuelan government. The country was once the richest in Latin America but can no longer cover its own debts.

On Monday it missed interest payments on two government bonds. Even after a 30-day grace period it is unable to muster up $280 million owed in payments.

Meanwhile the value of the bolivar continues to plunge, causing major financial problems for Venezuelans. As explained by Business Insider:

After the country’s economic collapse in 2016, high inflation caused the bolivar’s value to plummet. By December, the then-largest note of 100 bolivares, which was worth about $US0.02, was pulled from circulation. To counter this, new denominations of 500, 1,000, 2,000, 5,000, 10,000, and 20,000 bolivares were introduced.

Maduro’s unveiling of the 100,000 bolivar note means it’s possible that some of these smaller notes may soon be phased out. This would cause serious problems for Venezuelans who, on average, are only allowedto withdraw about 10,000 to 20,000 bolivares a day. In October, the daily withdrawal allowance equalled roughly $3 to $6 at black market exchange rates. On the current market, 20,000 bolivares are worth around 50 cents.

To ‘combat’ the problem of cash shortages Maduro recently announced in a public broadcast that he planned to phase out physical cash, saying “the use of the physical currency is being replaced.”

This is something that was also seen in Zimbabwe. During their first notable hyperinflation era of 2005-2009, the government ran out of money to pay for money. The local currency cost US Dollars, which they could not afford to buy.

Should this happen this will be even more damming for those with cash in the bank. Currently they are able to withdraw physical cash in order to keep on top of the daily increase in inflation. Now they will have little choice but to sit and watch its value disappear.

The enforced holding of cash in the bank will no doubt bring with it capital controls as citizens are prevented from exchanging the bolivar for stronger currencies such as the US dollar. The first step has already been taken as Maduro has tried to contain the financial rout by banning the publication of black market rates. Something Mugabe also tried.

Venezuela’s default should also be of concern to citizens elsewhere, especially in the US. It has come to light that a number of Americans with 401(k) own a hefty amount of Venezuela’s $60 billion debt. How will this work out if the country is unable to pay or has its debt restructured?

Avoid exposure to hyperinflation

Here in the West we are currently extremely fortunate as we are not facing political leaders such as Maduro or hyper inflationary scenarios as those seen in both Zimbabwe and Venezuela.

However, as evidenced just above we may still be exposed in the immediate sense to the failings of these countries, whether through our pension plans or investments elsewhere.

Even if you can be certain that you hold no Venezuelan debt or exposure to the Zimbabwean economy this is still a lesson in how one must diversify their assets outside of cash and the banking system. This is thanks to ultimate control institutions and governments have over these entities, should they so choose.

By holding assets outside of the system you can work to protect your wealth from such measures as those seen in Zimbabwe and Venezuela. Gold is one of the best examples. When held in a physical, allocated and segregated manner the owner cannot be prevented from accessing it whenever they so wish. Nor can it be devalued at will or suddenly illegal to trade. It is a borderless currency that acts without the control of governments looking to further their own wealth or political beliefs.

Gold Prices (LBMA AM)

16 Nov: USD 1,277.70, GBP 969.01 & EUR 1,085.53 per ounce

15 Nov: USD 1,285.70, GBP 976.62 & EUR 1,086.29 per ounce

14 Nov: USD 1,273.70, GBP 972.47 & EUR 1,086.59 per ounce

13 Nov: USD 1,278.40, GBP 977.59 & EUR 1,097.89 per ounce

10 Nov: USD 1,284.45, GBP 976.44 & EUR 1,102.19 per ounce

09 Nov: USD 1,284.00, GBP 980.98 & EUR 1,106.29 per ounce

08 Nov: USD 1,282.25, GBP 976.82 & EUR 1,105.43 per ounce

Silver Prices (LBMA)

16 Nov: USD 17.04, GBP 12.92 & EUR 14.48 per ounce

15 Nov: USD 17.12, GBP 13.00 & EUR 14.45 per ounce

14 Nov: USD 16.94, GBP 12.92 & EUR 14.45 per ounce

13 Nov: USD 16.93, GBP 12.93 & EUR 14.53 per ounce

10 Nov: USD 17.00, GBP 12.92 & EUR 14.60 per ounce

09 Nov: USD 17.10, GBP 13.03 & EUR 14.69 per ounce

08 Nov: USD 17.00, GBP 12.96 & EUR 14.65 per ounce

Mark O'Byrne

This update can be found on the GoldCore blog here.

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information containd in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.