A Stock Market Reset May be Coming

Stock-Markets / Stock Market 2017 Dec 02, 2017 - 05:30 PM GMTI had a chance to compare my long-term charts with a couple other analysts’ charts of the DJIA and SPX over the past 8 years. While there are some differences in interpretation, we all seem to agree that the rally may be over.

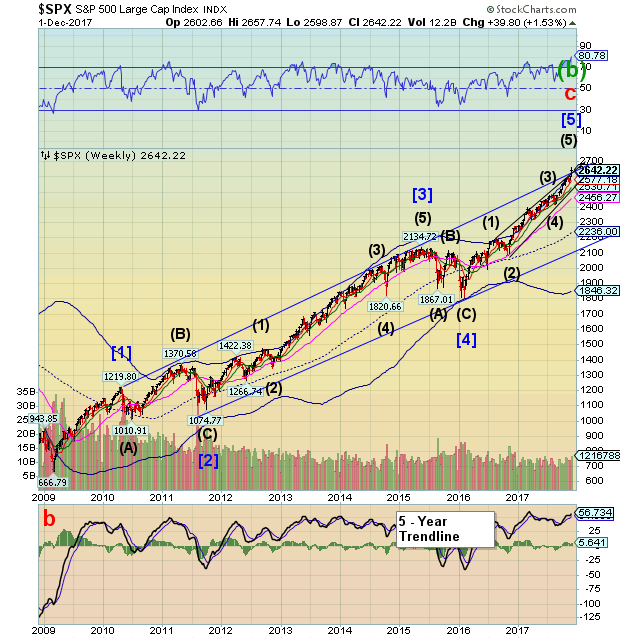

The big curve ball was the errant Wave (B) in 2011 that threw off the analysis for a long while. The second curve ball was this year’s Wave structure. It turned out that Wave (4) bottomed in August instead of March, as I had been suggesting. The corrected pattern makes much more sense and appears complete.

There are two primary reasons:

The first is that the SPX has challenged (throw-over) the upper trendline originating in 2010. Waves [1], [3] and [5] have now touched the upper trendline, suggesting completion.

The second is that Two important Fib relationships were met. Wave [3] measured from the lowest part of Wave [2] at 1010.91 is twice the size of Wave [1]. Wave [5] is 1.5 times the size of Wave [1] at 2639.50 which happens to be where the two upper trendlines intersect.

If the giant Orthodox Broadening Top is still active, we may now calculate the probable target for the January 2020 low. It appears to be near 169.05. Talk about a reset! This will be a Wave (c) like no other in history.

Regards,

Tony

Our Investment Advisor Registration is on the Web.

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinve4stor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals.

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.