Bitcoin - Please, Please, Please, Don’t Let Fear Of Missing Out Lead Your Investment Decisions

InvestorEducation / Learning to Invest Dec 07, 2017 - 09:20 AM GMTBy: John_Mauldin

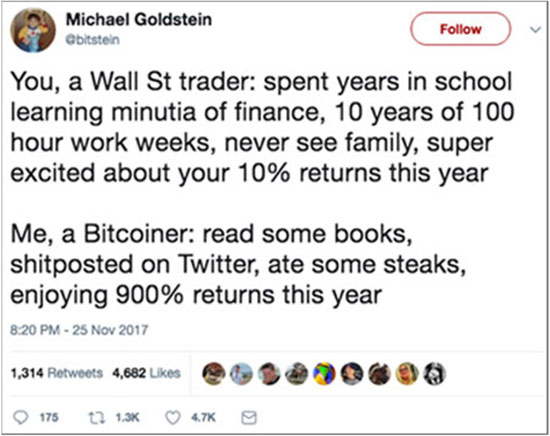

BY JARED DILLIAN : This tweet was getting retweeted all over the place last weekend. Apologies for the bad language.

BY JARED DILLIAN : This tweet was getting retweeted all over the place last weekend. Apologies for the bad language.

For starters, the guy’s Twitter handle is “bitstein.” But anyway. This is the fable of the grasshopper and the ant.

At the top of the cycle, there are always people who look down on the working stiffs. (I wrote about that in more detail in my free special report, Investing in the Age of the Everything Bubble, which you can download here.)

Actually, it seems like the loudest voices in finance these days are people who tell you to be long SPY, Amazon, or even bitcoin—unhedged.

I don’t think we should be denigrating people who think it’s prudent to wear a seat belt.

Getting Rich Slow (with an Option)

I’m a big fan of getting rich slow. But I should add a caveat. I’m a big fan of getting rich slow with an option to make more.

A wonderful portfolio strategy is to put 90% of your money into safe assets with a stable return. Then set aside the remaining 10% for long shots. Stuff that can give you 10x or 100x or 1000x returns.

Bitcoin falls into that category, but its ship has likely sailed. We’re in full tulipmania now. 2014 would have been a nice time to have that idea. Now, it is too late.

It is too late for a lot of longshots—venture capital, cryptocurrencies, Internet stocks… the 100x returns have already been made.

Yes, there is always a bull market somewhere, but the trouble with investing in 2017 is that there are bull markets everywhere.

This is why I am a big proponent of wearing a seatbelt. It’s stupid to be short or flat, but it’s prudent to be careful. Will you miss out on some upside? Possibly. Will you miss out on the downside? Yes, that is the point.

Slow and steady wins the race.

Captain Moonshot

So why are moonshots so popular? You wouldn’t buy Amazon at a $580 billion market cap unless you thought there was a reasonable probability of it reaching a $1 trillion market cap. Or even a $2 trillion market cap! Who knows—anything is possible.

But that sentiment—anything is possible—is not always present. There are some points in history where it seems like nothing is possible. That was the case not long ago—in 2009.

If you know a little bit about finance, you know that valuing equities without dividends can be tricky, and a lot of it depends on your assumption of what a “terminal value” might be. This also depends heavily on interest rates, which happen to be low.

So, lots of ebullience + easy monetary policy means these moonshots have very high valuations. With a little foresight, we might have been able to predict that these conditions would develop—but I think no reasonable person thought it would go this far.

No Shame

If you’re not invested in the likes of Bitcoin or Amazon, you have nothing to be ashamed of. Please, please, please, do not have fear of missing out.

Fear of missing out is currently manifesting itself in the number of Coinbase accounts exceeding the number of Schwab accounts.

You may think watching other people get rich is bad. But there is nothing quite like the smug satisfaction of sitting on a pile of cash in the crisis.

Sure, some people just have a higher tolerance for risk. Their life isn’t complete unless they are watching their net worth rip around at a rate of 15% a day.

There has always been a fine line in this business between investing and speculating. Reflect a little on which one you have been doing.

Grab Jared Dillian’s Exclusive Special Report, Investing in the Age of the Everything Bubble

As a Wall Street veteran and former Lehman Brothers head of ETF trading, Jared Dillian has traded through two bear markets.

Now, he’s staking his reputation on a call that a downturn is coming. And soon.

In this special report, you will learn how to properly position your portfolio for the coming bloodbath. Claim your FREE copy now.

John Mauldin Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.