Stock Market Crash Opportunities, Broken Printing Presses, Cattle and Hogs

Stock-Markets / Financial Markets Sep 03, 2008 - 05:46 PM GMTBy: Paul_Lamont

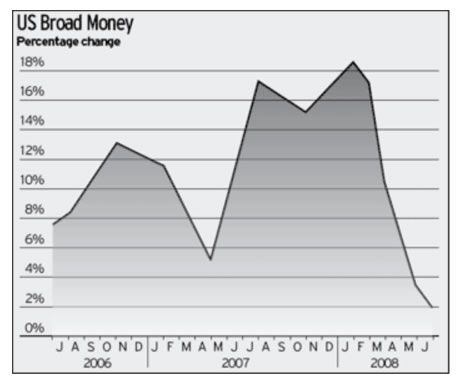

As we mentioned two months ago , a speculative commodity bust would fit with the onset of a deflationary collapse. During the month of July, commodities began this correction with the largest monthly decline in 28 years . They are still falling. Similarly, Lombard Street Research 's measure of M3 fell in July the most on record (since 1959). The chart of the percentage change in money growth is below.

As we mentioned two months ago , a speculative commodity bust would fit with the onset of a deflationary collapse. During the month of July, commodities began this correction with the largest monthly decline in 28 years . They are still falling. Similarly, Lombard Street Research 's measure of M3 fell in July the most on record (since 1959). The chart of the percentage change in money growth is below.

The banking system is currently broken. Without credit, asset prices fall and money is hoarded. The risk is of a Great Deleveraging of the economy. We still recommend U.S. Treasury Bills for the preservation of one's portfolio . That being said, in the first part of this series, we would like to mention other investments (even some commodities) that could appreciate during this deflationary period. In the second report, we reveal what investments could present a better buy at the bottom in 2010-2011.

***More For Clients and Subscribers***

Cattle and Hogs

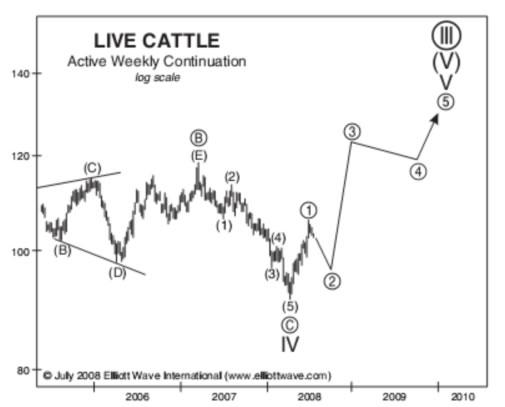

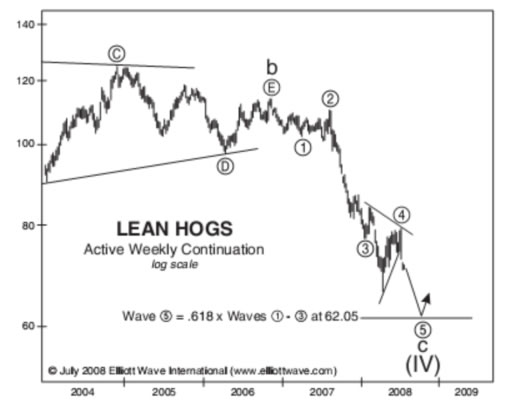

We also believe livestock could rise during the next few years.

The main costs in raising hogs and cattle; gasoline, corn feed, and labor are all falling. Due to recent financial innovation, there are ways to invest in these price trends without owning a farm or purchasing commodity futures. However the option available to U.S. investors, exchange traded notes (ETNs) offered by Barclays and UBS, have a major flaw. They are subject to credit risk, as they are little more than bets with the bank. So while you may be correct in the price rise, if the bank goes down or defaults, you will not receive your winnings.

In 2005, Jim Rogers' commodity funds at Refco (“wrongful” handling or not) were also similarly unavailable for redemption. In the current environment, these atypical risks become more probable. In our view, investing in companies that sell pork or beef is also unadvisable. The inability to pass a higher price along to the consumer could become an important problem. A companies' debt woes could also be fatal. Instead, we prefer to take possession.

Inverse Stock Index Funds

Speculative investors may also want to consider inverse stock index funds. These funds rise in value as the market goes down. We offer a Bear Market Strategies Account in which the bulk of your funds are protected with U.S. Treasury Bills, the remainder positioned in speculative inverse index funds. This can possibly hedge business owners from a recession or attempt to provide a little better return for investors who are still saving for retirement. The suitability of this account depends on your risk tolerance. It is not for everyone. In an environment where institutions are failing, counterparty risk is also a major concern. Please contact us to further discuss the risks of these funds.

***For disclosure purposes: At the time of publication, Paul Lamont holds positions in UVPIX and RYUCX.***

Sixty Years Ago…Another Dark Hero

With The Dark Knight breaking box office records this summer, we were reminded of another movie .

By Paul Lamont

www.LTAdvisors.net

At Lamont Trading Advisors, we provide wealth preservation strategies for our clients. For more information, contact us . Our monthly Investment Analysis Report requires a subscription fee of $40 a month. Current subscribers are allowed to freely distribute this report with proper attribution.

***No graph, chart, formula or other device offered can in and of itself be used to make trading decisions.

Copyright © 2008Lamont Trading Advisors, Inc. Paul J. Lamont is President of Lamont Trading Advisors, Inc., a registered investment advisor in the State of Alabama . Persons in states outside of Alabama should be aware that we are relying on de minimis contact rules within their respective home state. For more information about our firm, or to receive a copy of our disclosure form ADV, please email us at advrequest@ltadvisors.net, or call (256) 850-4161.

Paul Lamont Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.