Have Stocks Reached A Permanently Rigged Plateau?

Stock-Markets / Stock Market 2017 Dec 11, 2017 - 03:49 PM GMTBy: Brady_Willett

A painting recently sold for a record $450 million, a blanket recently sold for $1.5 million, Bitcoin has gone ballistic, and Cramer thinks there are ‘bubbles’ everywhere except stocks. Are these the types of signals that bears have been waiting for? In a word, maybe.

A painting recently sold for a record $450 million, a blanket recently sold for $1.5 million, Bitcoin has gone ballistic, and Cramer thinks there are ‘bubbles’ everywhere except stocks. Are these the types of signals that bears have been waiting for? In a word, maybe.

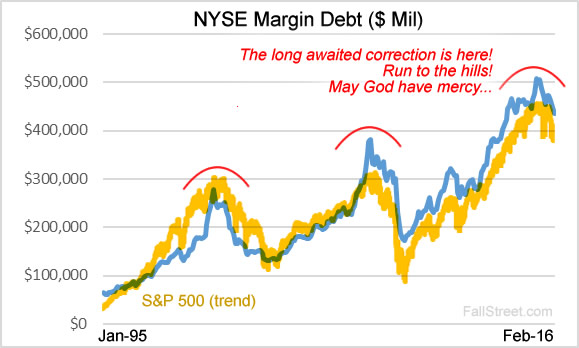

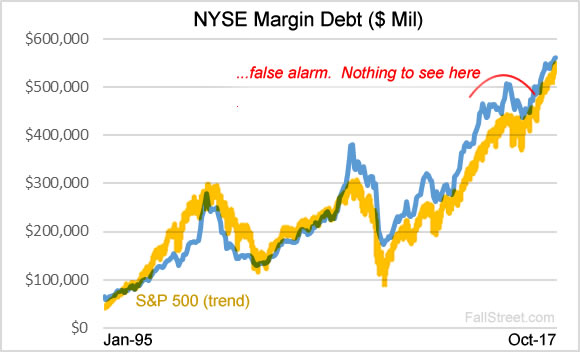

The problem with calling for an end to the good times is that there has been so many false contrarian signals in recent years it is as if the very idea of “risk/reward” has been temporarily laid to waste. To use a quick example, in early 2016 alarm bells were ringing as junk bonds were imploding, confidence was sliding, and technical market levels were being struck. At the time it looked like the big bad bull was done.

As it would turn out, it did not take long for the good times to start rolling again.

Suffice to say, while maniacal movements in things like equities, art, and digital currencies are suggestive of a “top”, there are forces underpinning liquidity and speculative psychology in the marketplace today that make it impossible to know exactly when the bear/bull pendulum will swing in reverse. These ‘forces’ are not only pushing asset prices to extremes, but they have rendered the art of contrarianism useless, at least for the moment…

Taming of the Shrewd

Recent history has shown us is instances of market rigging are beyond what anyone previously thought possible. To be sure, since the ratings/subprime fiasco there has been scandals/price fixing schemes unearthed in the FX market, LIBOR, oil, silver, SSA bonds, copper, wheat, and crypto, to name a few. Then there is the granddaddy of them all – the price fixing measures instigated by central bankers. On this subject consider a recent paper from the St. Louis Fed:

“The Fed’s immediate goal was to reduce long-term interest rates and term premia to stimulate investment and consumption. A series of event studies persuasively showed that these programs successfully reduced long yields and term premia and moved other asset prices, such as stock prices and foreign exchange rates, in desired directions.”

While a blasé idea today, central bankers conspiring to move FX and equity markets in “desired directions” was an outrageous thought pre-2008. The paper continues:

“The failure of [bond] shorts to reinstitute their positions after the last purchase announcement confirms that the Fed convinced sophisticated investors that interest rates would remain low.”

Notice the neat word choice here – “convince”. It is not like the ‘sophisticated’ bond shorts were peacefully walked down the path to enlightenment so much as they were poisoned, hung, shot, and stabbed, repeatedly, by the Fed.

In other words, thanks to the Fed’s mob-boss like tactics, it is obvious that the global bond market is a rigged game. What is considerably less obvious is how a prolonged period of fictitious prices turns astute minds to mush. Consider Bloomberg’s Noah Smith’s recent article entitled “Sizing Up QE Now That It’s Ended”:

“So although we’ll never know how much QE helps the real economy, we do know that it’s not the risk that many once believed…other anticipated dangers of QE, like asset bubbles and financial instability, also have quite conspicuously failed to materialize.”

The logic here seems to be that if you successfully rig a market for long enough the scheme must of worked and everyone that thought the rigging would end in tears must be wrong (and please do ignore the fact that the markets are still being rigged while this ‘Rigged Market + Time Without Crash = The Fed Rules!’ formula is being flouted).

So, Here We Are

With increasingly bold ‘all-in’ efforts to combat every market crumple since Alan Greenspan took charge in 1987, the Fed has, once again, helped produce the largest ever increase in asset and debt prices. And while the boom that began in 2009 will, undoubtedly, end very badly, we are currently stuck in the days of contrarian woe. Quite frankly, so long as the Fed’s pixie dust (the U.S. dollar) remains tinged with magic, stocks have, to play on Fisher’s famous 1929 quote, reached a permanently rigged plateau. This doesn’t mean bear markets and recessions have been eradicated, but it does mean that until a currency and/or sovereign debt crisis arrives there is no scenario where central banks suddenly awaken and change their manipulative ways.

For the ‘sophisticated’ unsexy contrarians still too afraid to follow the herd to Magicville, the lessons are quite simple: be a selective equity owner, own some precious metals, beware of following the crazies down new currency allies, and don’t trust the price of any bond market anywhere (and yet don’t bet against bonds either). As for a guiding hand to further understand today’s rigged-games, the fictional character Gordon Gekko does just as well as any other:

“ This painting here? I bought it ten years ago for sixty thousand dollars. I could sell it today for six hundred. The illusion has become real, and the more real it becomes, the more desperately they want it…The richest one percent of this country owns half our country’s wealth…It’s bullshit. You got ninety percent of the American public out there with little or no net worth. I create nothing. I own. We make the rules, pal. The news, war, peace, famine, upheaval, the price per paper clip. We pick that rabbit out of the hat while everybody sits out there wondering how the hell we did it. Now you’re not naive enough to think we’re living in a democracy, are you buddy?”

By Brady Willett

FallStreet.com

FallStreet.com was launched in January of 2000 with the mandate of providing an alternative opinion on the U.S. equity markets. In the context of an uncritical herd euphoria that characterizes the mainstream media, Fallstreet strives to provide investors with the information they need to make informed investment decisions. To that end, we provide a clearinghouse for bearish and value-oriented investment information, independent research, and an investment newsletter containing specific company selections.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.