Which Central Bank Will Go Under First When the Everything Bubble Bursts?

Interest-Rates / Central Banks Dec 12, 2017 - 05:23 PM GMTBy: Graham_Summers

In the aftermath of the Great Financial Crisis, Central Banks began cornering the sovereign bond market via Zero or even Negative interest rates and Quantitative Easing (QE) programs.

In the aftermath of the Great Financial Crisis, Central Banks began cornering the sovereign bond market via Zero or even Negative interest rates and Quantitative Easing (QE) programs.

The goal here was to reflate the financial system by pushing the “risk free rate” to extraordinary lows. By doing this, Central Bankers were hoping to:

1) Backstop the financial system (sovereign bonds are the bedrock for all risk).

2) Induce capital to flee cash (ZIRP and NIRP punish those sitting on cash) and move into risk assets, thereby reflating asset bubbles.

In this regard, these policies worked: the crisis was halted and the financial markets began reflating.

However, Central Banks have now set the stage for a crisis many times worse than 2008.

Let me explain…

The 2008 crisis was triggered by large financial firms going bust as the assets they owned (bonds based on mortgages) turned out to be worth much less (if not worthless), than the financial firms had been asserting.

This induced a panic, as a crisis of confidence rippled throughout the global private banking system.

During the next crisis, this same development will unfold (a crisis in confidence induced by the underlying assets being worth much less than anyone believes), only this time it will be CENTRAL banks (not private banks) facing this issue.

The consensus view is that a Central Bank can never go bust because it can always print money to remain solvent.

However, this is misguided.

Central Banks are currently sitting atop over $10 TRILLION in bonds, courtesy of nine years of QE programs.

These bonds trade based on inflation.

If inflation rises, these bonds will drop in value as their yields rise to accommodate the move in inflation.

When a Central Bank is sitting atop trillion of dollars in bonds, an inflationary spike inducing those bonds to drop could very quickly wipe out $100 billion or more in capital.

Now, you might argue that the same Central Bank could simply print more money to prop up the bond markets… but doing so would only increase inflation … which in turn would force bonds prices lower… inducing greater losses.

You get the point.

Policies like QE and ZIRP only work as long as the financial system maintains confidence in the currency a Central Bank is printing. The minute that currency begins to devalue rapidly due to inflation, the whole game is over.

This process has already started. The explosion of Bitcoin and other cryptocurrencies is just one way in which the system is losing confidence in primary currencies.

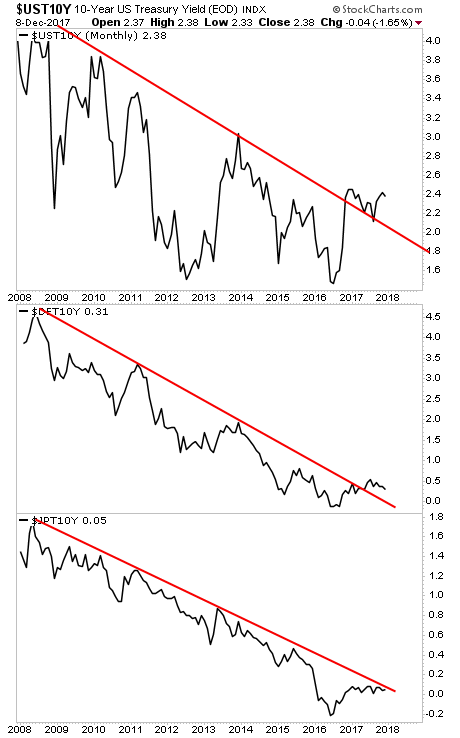

The recent spike in bond yields is another. Across the globe, the $100+ trillion bond market is begin to lurch towards an inflationary future. Below you can see these moves in Germany’s 10-Year Government bonds, Japan’s 10-Year Government bonds, and the US’s 10-Year Treasuries.

The time to prepare for this is NOW before the carnage hits.

On that note, we are putting together an Executive Summary outlining all of these issues as well as what’s to come when The Everything Bubble bursts.

It will be available exclusively to our clients. If you’d like to have a copy delivered to your inbox when it’s completed, you can join the wait-list here:

https://phoenixcapitalmarketing.com/TEB.html

Graham Summers

Phoenix Capital Research

http://www.phoenixcapitalmarketing.com

Graham also writes Private Wealth Advisory, a monthly investment advisory focusing on the most lucrative investment opportunities the financial markets have to offer. Graham understands the big picture from both a macro-economic and capital in/outflow perspective. He translates his understanding into finding trends and undervalued investment opportunities months before the markets catch on: the Private Wealth Advisory portfolio has outperformed the S&P 500 three of the last five years, including a 7% return in 2008 vs. a 37% loss for the S&P 500.

Previously, Graham worked as a Senior Financial Analyst covering global markets for several investment firms in the Mid-Atlantic region. He’s lived and performed research in Europe, Asia, the Middle East, and the United States.

© 2017 Copyright Graham Summers - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Graham Summers Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.