Stock Market Close Call...

Stock-Markets / Stock Markets 2018 Jan 08, 2018 - 03:42 PM GMT Good Morning!

Good Morning!

SPX opened down…and in the nick of time, since the current Wave structure is invalidated above 2743.80. The alternate Wave structure goes much higher, thus my hesitation in writing until the open.

One measure that I missed is that Super Cycle Wave (b) is 2.618 time the size of Super Cycle Wave (a) at 2720.56. Again, using Elliott Wave, one must compare the Waves at the same degree. This is a flaw of Northman Trader that many will not pick up on.

ZeroHedge reports, “Every day is "deja vu all over again" for global stock markets which hovered close to all-time highs on Monday as the best start to a year in eight years showed little sign of running out of steam, thanks to "goldilocks" - the combination of global growth and low inflation - which has sent risk appetites into overdrive

For traders returning from holiday, Wall Street last week posted its best start to a year in more than a decade; In yet another case of "bad news is again good news", Friday’s disappointing jobs report, while weaker than expected, encouraged hopes that "brisk growth and low inflation can be sustained this year." The MSCI world index was flat, just below record highs. It has gained 2.5% in the first five trading sessions of the year, its best start since 2010, according to Thomson Reuters data.”

NDX futures are also down, although not by a lot. The decline hasn’t yet re-crossed the upper trendline at 6625.00, where we may start observing the signals.

Sir John Templeton has famously said, “Bull markets are born on pessimism, grown on skepticism, mature on optimism and die on euphoria. The time of maximum pessimism is the best time to buy, and the time of maximum optimism is the best time to sell.”

I was privileged to have a running conversation with him in early 2000. In January of that year he put on a $2 million personal short position on the NASDAQ. By March 23 when the market finally peaked I called him again to ask how he was faring. His reply was that he had lost over $600,000 on his short position. I asked whether he was giving up. His answer was, “Oh no! I am adding to my short position!” By May, his original position was worth over $3 million.

VIX is moving up handsomely. An aggressive signal may be made at the 50-day Moving Average at 10.31. Confirmation of that signal would come above the prior high at 11.07.

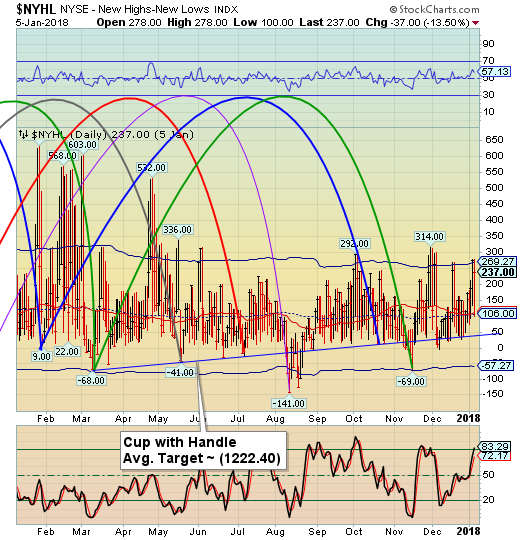

The NYSE Hi-Lo Index says we’re not out of the woods yet. You will notice that it bounce this morning off the mid-Cycle support. That level may also give us an aggressive sell signal with confirmation beneath the trendline at 50.00.

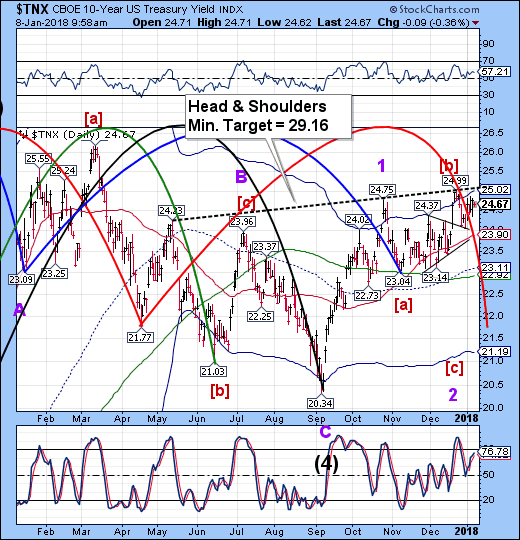

TNX made a lower high this morning, possibly using up the last of its Cyclical strength that has kept it elevated thus far. There appears to be an overdue Master Cycle low that may occur in the next two weeks. We’ll need to keep an eye on that.

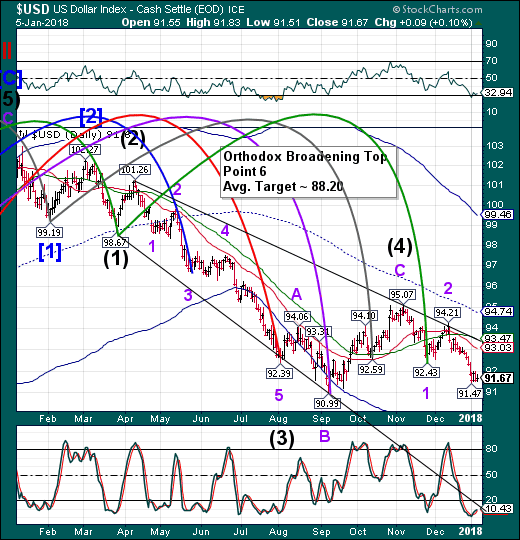

USD futures retraced to 92.10 this morning. That is nearly a .382 Fib retracement of its most recent decline. The Cycles Model suggests the period of strength in USD may be over tomorrow.

Regards,

Tony

Our Investment Advisor Registration is on the Web.

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinve4stor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals.

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.