Will Chinese Dragon Boost or Devour Gold?

Commodities / Gold and Silver 2018 Jan 11, 2018 - 04:42 PM GMTBy: Arkadiusz_Sieron

China may slow down its U.S. debt buying. Will gold rally or plunge, then?

China may slow down its U.S. debt buying. Will gold rally or plunge, then?

Dragons Love Hoarding Gold and Not Only

Dragons love gold. In Greek mythology, dragons were set by the gods to guard golden treasures. It makes perfect sense, since it would be rather difficult to find better guards. Everybody who watched The Hobbit series knows that this is true – the powerful Smaug hoarded a lot and was really obsessed with his shiny treasure.

The Chinese dragon is also believed to hoard a lot of gold. With more than 1,800 tons of gold officially owned, China has the fifth largest gold reserves in the world (and many analysts speculate that the country’s true gold reserves might be much higher than the official number). The impact of Chinese holdings on gold prices is rather questionable, but the importance of China’s economy for the global markets is beyond doubts. Three years ago, the stock market crisis in Shanghai caused the global stock market sell-off in August. 2016 started with a Chinese bang, when the global stock markets – worried about an economic slowdown in China – plunged.

Will China Dump U.S. Treasuries?

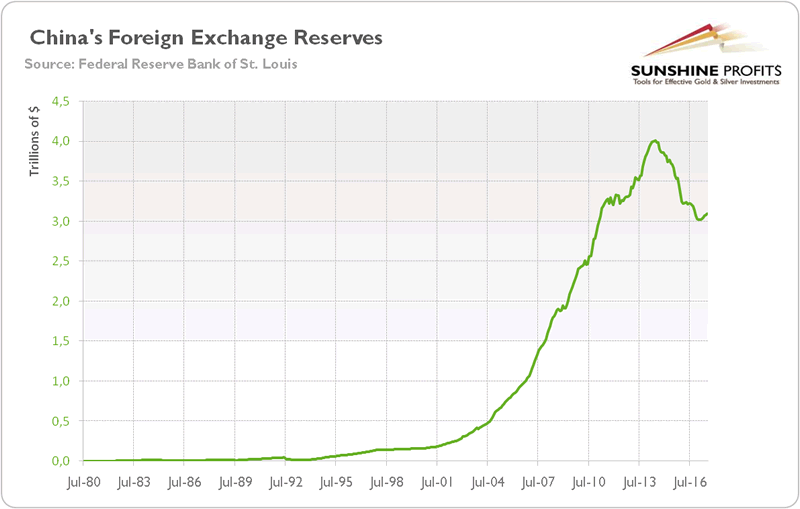

Now, concerns arose that China could stop or slow U.S. Treasuries buying. Is there anything to worry about? Yes. And no. Let’s see. China is one of the largest official holders of U.S. assets and world’s biggest foreign holder of U.S. Treasuries. As one can notice in the chart below, China’s foreign reserves excluding gold exceed $3 trillion.

Chart 1: China’s foreign reserves excluding gold from 1980 to 2017.

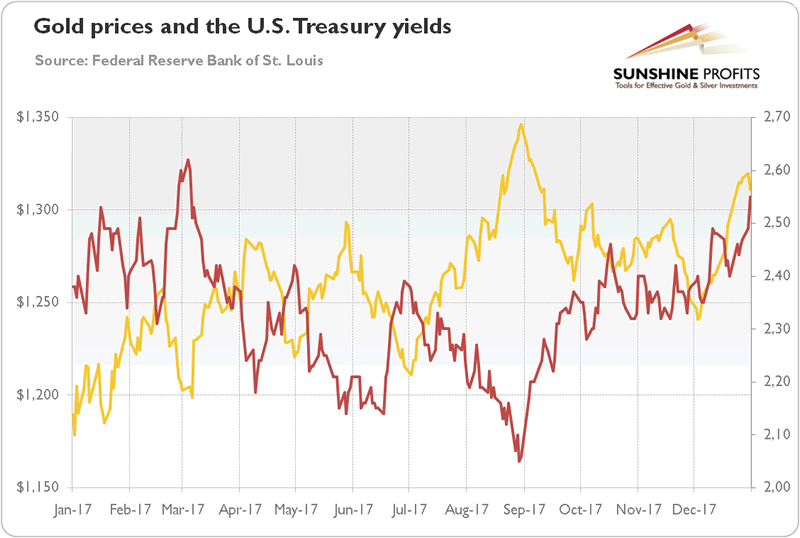

According to Bloomberg, “senior government officials in Beijing reviewing the nation’s foreign-exchange holdings have recommended slowing or halting purchases of U.S. Treasuries”. The report sent U.S. Treasury yields higher. As the next chart shows, the yields had already been rising due to less intense buying from central banks and the expectations of widening fiscal deficits. On Wednesday, the 10-year Treasury yield jumped even further, reaching a 10-month high.

Chart 2: Price of gold (yellow line, left axis, London P.M. Fix, in $) and yields on 10-year Treasuries (red line, right axis, in %) over the last twelve months.

Implications for Gold

What does it all mean for the gold market? Well, rising bond yields should be negative for the yellow metal, which does not bear any interest and becomes less attractive when rates are climbing. Bill Gross claims that a bear market in bonds has begun. As the U.S. Treasuries are also considered a safe-haven, such a change could sink gold prices as well.

However, we cannot end the analysis here. Most analysts do so, as they focus on simple correlations. People are not aware that relationships may change depending on the broad economic context. We are. Look at the chart above. In December, the correlation between 10-year Treasury yields and gold prices turned positive.

Why? You see, what really matters is not the change in yields, but the reason behind it. When bond yields rise because investors expect faster economic growth, it is clearly bad for gold. But when bond yields jump as traders are afraid of inflation or don’t want to hold the U.S. dollar, it doesn’t have to be negative for the yellow metal. Actually, the opposite might be true.

Conclusions

On Wednesday, concerns emerged that China could stop or slow their buying of U.S. Treasuries. We believe the fears were slightly exaggerated, as China has to manage its renminbi exchange rate, so large changes to the composition of the foreign exchange reserves are not likely (we wrote about China and the gold market in the October edition of the Market Overview). Nevertheless, bond yields have been rising recently, which should make gold struggle. This hasn’t happened yet and the correlation between bullion and Treasury yields broke down thanks to the depreciation of the U.S. dollar, which supported gold prices.

However, if rates continue to rise, the price of gold should eventually drop, especially when the greenback rebounds. Please be aware of that. We have analyzed the drivers of the gold market thoroughly and real interest rates are among the most important factors. The positive correlation may last a while, but the current situation is unlikely to last in the long term. Either rates drop and gold continues to drop, or yields continue its upward move and the yellow metal declines. Given the current economic environment (solid economic growth, monetary policy tightening), the second scenario is more likely to us. You have been warned. Good luck!

Thank you.

If you enjoyed the above analysis and would you like to know more about the gold ETFs and their impact on gold price, we invite you to read the April Market Overview report. If you're interested in the detailed price analysis and price projections with targets, we invite you to sign up for our Gold & Silver Trading Alerts . If you're not ready to subscribe at this time, we invite you to sign up for our gold newsletter and stay up-to-date with our latest free articles. It's free and you can unsubscribe anytime.

Arkadiusz Sieron

Sunshine Profits‘ Market Overview Editor

Disclaimer

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Arkadiusz Sieron Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.