Central Banks Are Going to Have to “Pull the Plug” on Stocks

Stock-Markets / Stock Markets 2018 Jan 21, 2018 - 06:42 PM GMTBy: Graham_Summers

It’s no secret that Central Banks have been funneling liquidity both directly and indirectly into stocks. However, what most investors don’t realize is that this liquidity pump is about to end.

It’s no secret that Central Banks have been funneling liquidity both directly and indirectly into stocks. However, what most investors don’t realize is that this liquidity pump is about to end.

Why?

Because the endless streams of liquidity (Central Banks continue to run QE programs of $100+ billion per month despite the global economy stabilizing) have unleashed inflation.

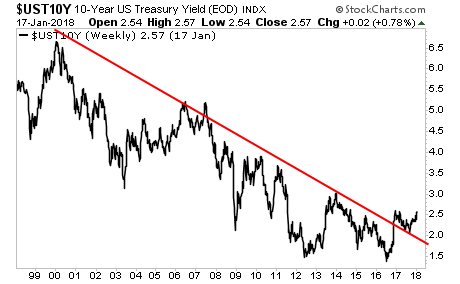

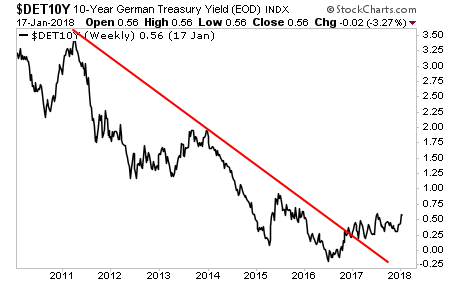

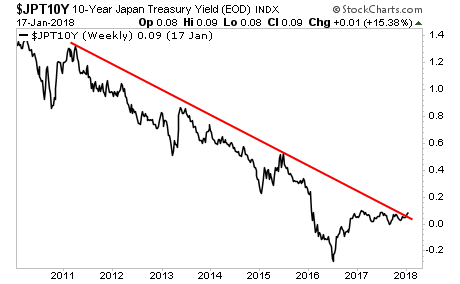

Forget the “official” date. That stuff is all propaganda. Take a look at what is happening in the bond markets which trade based on inflation in the real world.

When inflation rises, bond yields rise. And right now, sovereign bond yields are rising around the world.

The yield on the US 10-Year Treasury has broken its 20-year downtrend.

The US is not alone… the yield on 10-Year German Bunds has also broken its downtrend.

Even Japan’s sovereign bonds are coming into the “inflationary” crosshairs with yields on the 10-Year Japanese Government Bond just beginning to break about their long-term downtrend.

Because if bond rates continue to rise, many countries will quickly find themselves insolvent.

Globally the world has added over $60 trillion in debt since 2007… and all of this was based on interested rates that were close to or even below ZERO.

Central Bank cannot and will not risk blowing up this debt bomb. So they are going to be forced to “pull the plug” on liquidity and “let stocks go.”

Put simply, if the choice is:

1) Let stocks drop and deal with complaints from Wall Street…

Or…

2) Let the bond bubble blow up, destabilizing the entire financial system and rendering most governments insolvent…

Central Banks are going to opt for #1 Every. Single. Time.

On that note, we are putting together an Executive Summary outlining all of these issues as well as what’s in terms of Fed Policy when The Everything Bubble bursts.

It will be available exclusively to our clients. If you’d like to have a copy delivered to your inbox when it’s completed, you can join the wait-list here:

https://phoenixcapitalmarketing.com/TEB.html

Graham Summers

Phoenix Capital Research

http://www.phoenixcapitalmarketing.com

Graham also writes Private Wealth Advisory, a monthly investment advisory focusing on the most lucrative investment opportunities the financial markets have to offer. Graham understands the big picture from both a macro-economic and capital in/outflow perspective. He translates his understanding into finding trends and unde74rvalued investment opportunities months before the markets catch on: the Private Wealth Advisory portfolio has outperformed the S&P 500 three of the last five years, including a 7% return in 2008 vs. a 37% loss for the S&P 500.

Previously, Graham worked as a Senior Financial Analyst covering global markets for several investment firms in the Mid-Atlantic region. He’s lived and performed research in Europe, Asia, the Middle East, and the United States.

© 2018 Copyright Graham Summers - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Graham Summers Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.