US Markets vs Govt Shutdown: Stock Markets at all time highs

Stock-Markets / Stock Markets 2018 Jan 22, 2018 - 07:03 AM GMTBy: Submissions

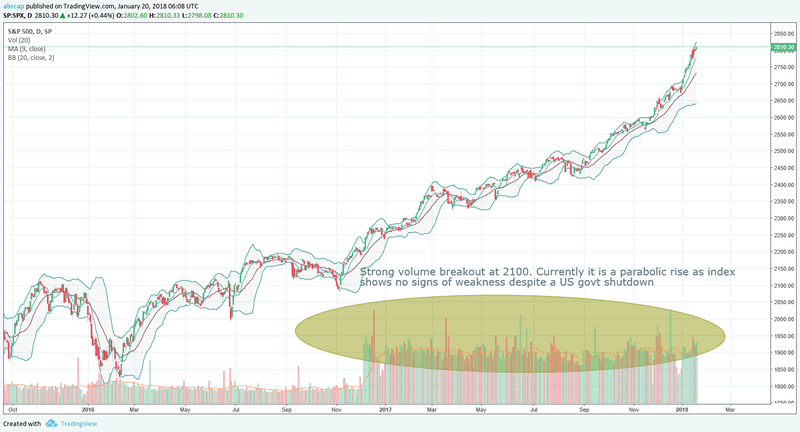

ARB Cap writes: As US government shuts down, markets march higher. Political turmoil does not seem to immediately affect equity bulls. Much of it has o do with the US bond market selling off with 10 year rising over 3% mark only for the second time in the last 5 years. As money pours out of bond markets, it is rolling into equity markets. Are we on the cusp of a super inflation cycle of the likes seen in 1980s ?

ARB Cap writes: As US government shuts down, markets march higher. Political turmoil does not seem to immediately affect equity bulls. Much of it has o do with the US bond market selling off with 10 year rising over 3% mark only for the second time in the last 5 years. As money pours out of bond markets, it is rolling into equity markets. Are we on the cusp of a super inflation cycle of the likes seen in 1980s ?

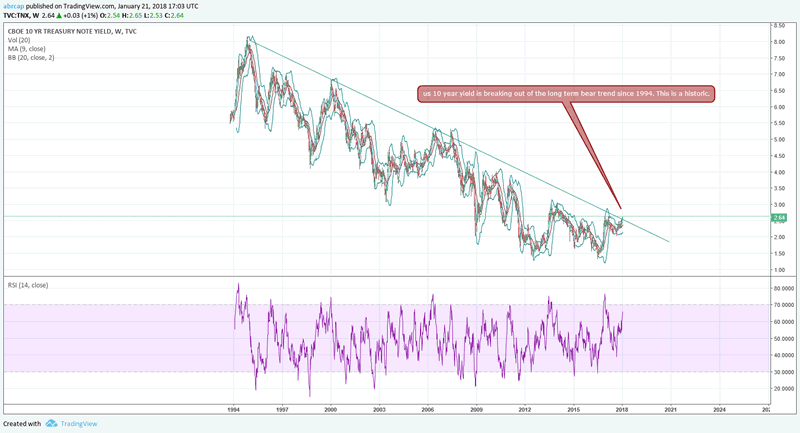

The 10 year US treasury bond yield is at 2.64% but it is breaking above the long term bear trend existing since 1994. Money is pouring out of bond markets as the carnage is about to begin. As yields rise, markets start to expect higher inflation cycle which in turn raise rate hike expectation. It is worthwhile to remind the last it did flirt with breaking out of the bear trend in 2014, yield fell back sharply down again.

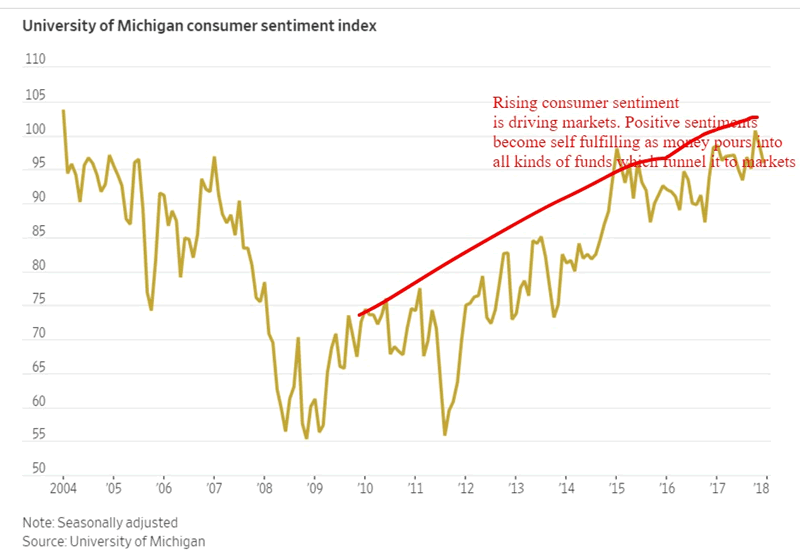

Consumer Sentiment

The consumer sentiment trend has been rising.

Technicals

Volume breakout in S&P500 index. The index is at all time highs even as political turmoil takes over in washington.

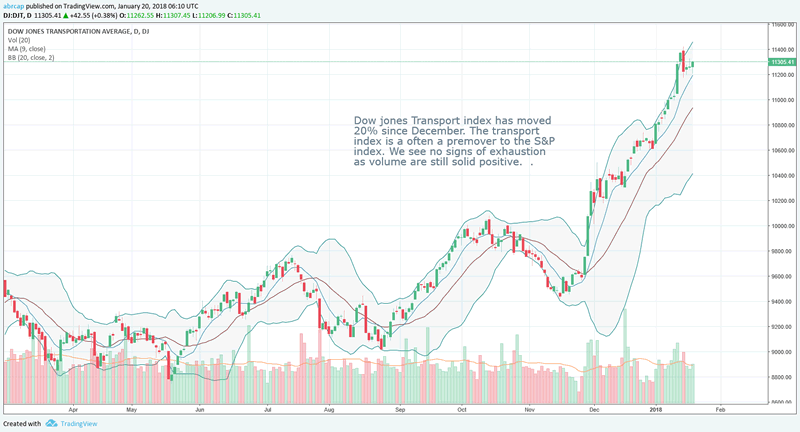

Dow jones Transport index has moved 20% since December. The transport index is often a premover to the S&P index. We see no signs of exhaustion as volume are still solid positive.

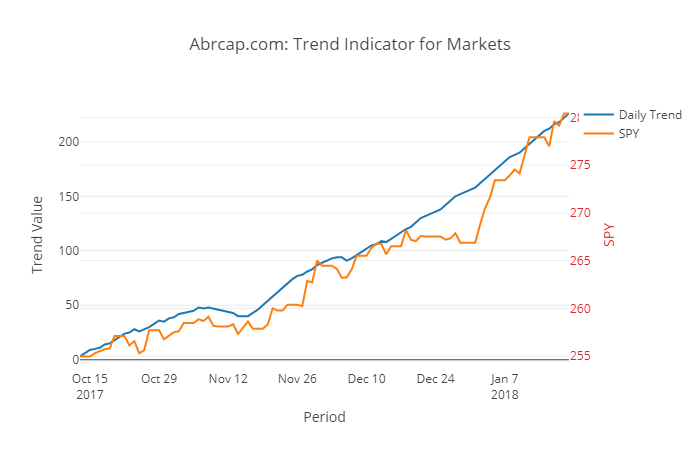

The TREND indicator from abrcap is strongly positive as markets break to new highs. As many of you know, this indicator has always stayed positive for the last 3 months and even when markets has been taking intermediate corrections, the indicator has been screaming buy. Currently it is at +4 which is the highest it can go. Market internals are strongly bullish.

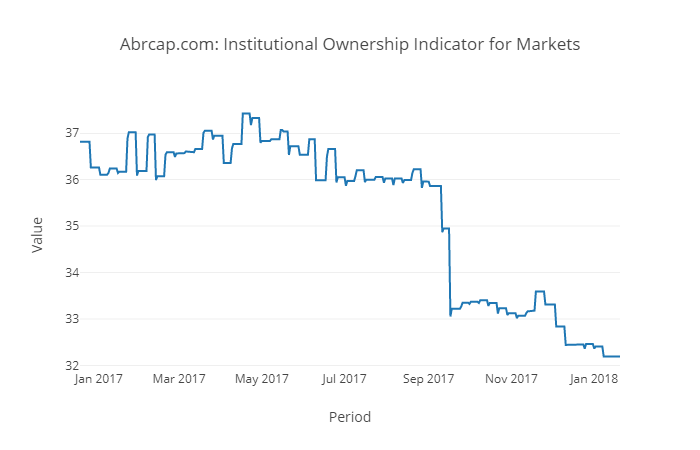

The institutional ownership on an average has been falling all through 2017. For a sustainable rally long term, one needs the institutional money to keep supporting the rally. It seems more if retail money is taking over from institutional hands. So weak hands are replacing strong hands. It does raise the question then if we are in the last of a superlative bull run in equity markets.

The reason for rising yield on 10 year could also be sustained political uncertainty is making overseas investor nervous onto holding US bonds. China has conveyed that it will be reducing its US treasury purchases. Things are starting to bleak for US bonds.

US Market shutdown

If lawmakers can’t get the job done by 12:01 a.m. Eastern Time on Saturday, hundreds of thousands of workers would be furloughed, many federal contracts with businesses would be suspended and government services that support private firms would be halted. That means, for example, mortgage applications would be delayed and drilling permits languish. While it’s difficult to separate effects of the 16-day shutdown in 2013 from debt limit brinkmanship during the same period, a report from the Obama administration budget office estimates the last partial closure knocked 0.2-0.6 percentage point off of GDP for the quarter.

GENESIS is abrcap.com premier investing dashboard. It offers the following:

Free Registration

Strategies: ABRCAP runs four stellar trading strategies. They run on a 100,000 USD account. Trades are shared with clients. All four strategies have made over +200% return this year. You can easily replicate them into your portfolio.

Stock Scoring: Over 13000 stocks scored on fundamentals, volume data, price data. Individual ratings allow investors to get an immediate understanding of whether to analyse a stock further.

Screens: GENESIS provides ETF, Industry and stock level screens. The screener inside GENESIS is indepth. It provides both fundamental and technical filteration.

User Screens: Users can share their own portfolio of stocks and others can view and interact.

Come become part of our community

Live Trade Room: All clients get to use the live trade room where live updates and earning releases are updated real time. Manual setups are discussed and all in all a great place to enjoy others company.

About us:

abrcap.com is a US stock data analytics firm offering advanced trading strategies, live trade room and an advanced boutique screener. Daily stock market updates, Earning releases, Earning analysis and Earning transcripts are sent to all clients. Register free at http://abrcap.com/wp-login.php

© 2018 ARB Cap - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.