Stock Market Surge Continues...

Stock-Markets / Stock Markets 2018 Jan 24, 2018 - 03:46 PM GMT Good Morning!

Good Morning!

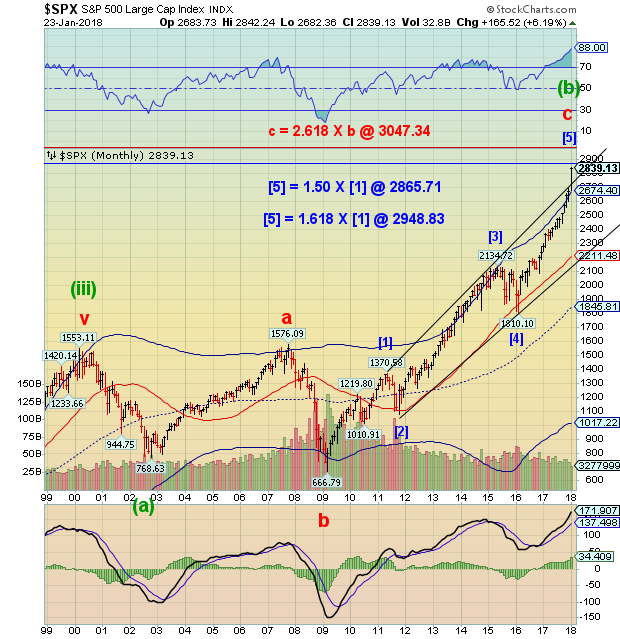

This is just a refresher of the long-term (monthly) chart of the SPX. Wave [3] is 1.5 times Wave [1] and the next level is where Wave [5] is also 1.5 times Wave [1]. The red target was first mentioned by Northman Trader in ZeroHedge two weeks ago. We are a week away from the next lunar eclipse, which is being highlighted by several Cycles Theorists. They are expecting a super blue-blood moon that has not been seen since 1866.

SPX futures are going higher this morning. By any standard this is an overthrow Wave. If correct, it may terminate near the 2865.71 target.

ZeroHedge reports, “In what has been a relatively quiet overnight session, equity futures are once again a sea of green, as the stock market meltup continues.

MSCI’s world equity index hit new highs in a continuation of a long running theme but on Wednesday it was a bit more of a mixed picture.

The biggest news, as noted earlier, is that the dollar losing streak entered its third day and the sell-off accelerated to fresh three year lows, after Steven Mnuchin welcomed its recent weakness amid concerns over an increase in U.S. protectionism, saying its decline provides a boost to the American economy through trade.”

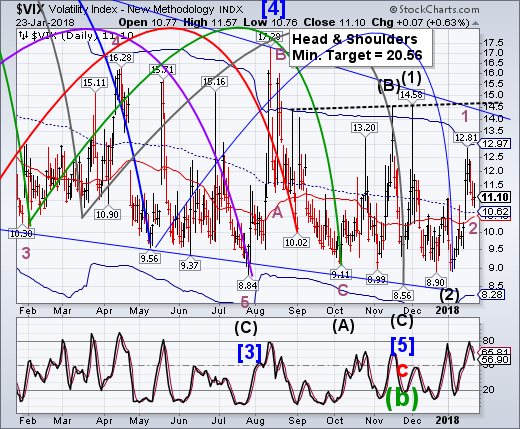

VIX futures are lower, but no new lows. It is out of sync with the SPX rally and may be giving us a warning of changes ahead.

ZeroHedge writes, “At the end of last week, we noted that VIX and the S&P 500 were behaving in an unusual manner.

Specifically, for the second week in a row, S&P and VIX were higher together... the first time since Nov 2013.”

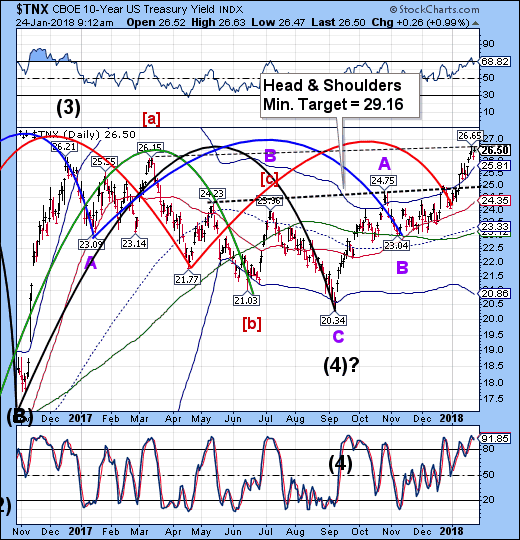

TNX futures are threatening to break out again. The Cycles Model suggests at least another week of rally in TNX.

ZeroHedge observes, “Joining the likes of Bill Gross and Jeffrey Gundlach, and echoing his ominous DV01-crash warning to the NY Fed from October 2016, Bridgewater's billionaire founder and CEO Ray Dalio told Bloomberg TV that the bond market has "slipped into a bear phase" and warned that a rise in yields could spark the biggest crisis for fixed-income investors in almost 40 years.

“A 1 percent rise in bond yields will produce the largest bear market in bonds that we have seen since 1980 to 1981," Bridgewater Associates founder Dalio said in a Bloomberg TV interview in Davos on Wednesday. We’re in a bear market, he said.”

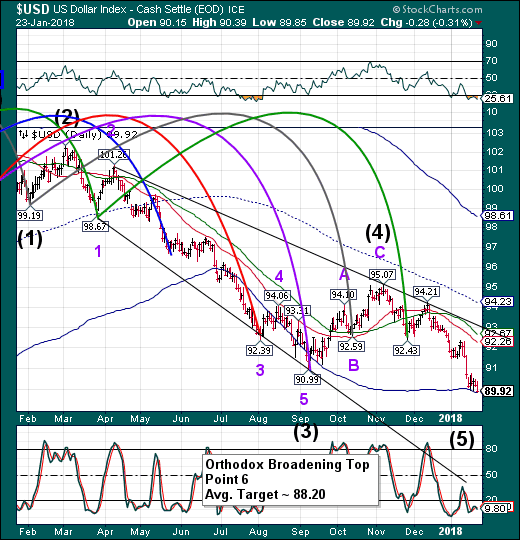

USD has made a new overnight low at 89.18 and is trending near that low. The Cycles Model suggests another two weeks of decline before it hits bottom.

ZeroHedge observes, “Caught in a relentless downward spiral which has puzzled many a trader, it wasn't as if the US Dollar needed any help in accelerating its decline, yet that's precisely what happened this morning in Davos when none other than the US Treasury Secretary Steven Mnuchin "broke with tradition" of supporting the US currency, and said that he endorsed the dollar’s decline as a benefit to the U.S. economy.”

Many traders and managers have been looking (hoping?) for a low. ZeroHedge comments, tongue-in-cheek, “To all the long-suffering dollar bulls out there, rejoice, for the dollar may be about to surge. Why? Gartman is about to liquidate his long.”

Regards,

Tony

Our Investment Advisor Registration is on the Web.

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinve4stor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals.

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.