Sell the Stock Market Rally!

Stock-Markets / Stock Markets 2018 Jan 26, 2018 - 03:26 PM GMT Good Morning!

Good Morning!

SPX futures are higher, but no new records. Today is day 253 of the Master Cycle that began at the May 18, 2017 low. As mentioned, we may call this an inverted Master Cycle because of its uninterrupted rally since then. An inverted Master Cycle may also mean the end of a trend, since it sows the seeds of its own destruction. While the uptrend hasn’t yet been broken, the range of the consolidation is becoming narrower and may lead to a breakout or breakdown.

The argument for a breakout is that the Fed still hasn’t diminished its balance sheet as promised. On December 6, 2017 the balance sheet hit its low point of $4,437,848,000.00. It added $15 billion by December 13, 2017 for a new balance sheet total of $4,452,726,000.00. The most recent reading on January 17 shows a balance of $4,439,145,00.00 which is $2 billion more than it had on December 6! Whether it is directly or indirectly participating in the market, its refusal to reduce the balance sheet show a certain trepidation on their part about withdrawing support to the market, in my opinion.

The argument for a breakdown is that, due to the tremendous inflows into stocks in January, the month-end rebalancing will be an eye-popper. Year-end pension contributions had their deadline on January 15, at the end of Wave [iii]. You can see the result. Next week is rebalancing week for those same pensions and the estimated withdrawal from equities may be $15 billion or more. That may be why we are seeing the rallies being sold already, regardless of the Fib relationships.

ON the other hand, Treasuries may have reached their Master Cycle low on Monday. The bounce appears to have already begun. The bounce isn’t appreciable, yet, but those same pensions that are selling stocks must rebalance an estimated $24 billion into their bond portfolios. Couple that with the huge speculative short position in bonds and you have a potentially explosive mix. The target for a Wave 2 is normally the mid-Cycle resistance at 125.23. The 61.8 Fibonacci retracement is at 125.35. Chances are very good that that target will be reached.

The TNX futures appear to be range-bound as it tentatively pulls back from its high.

VIX futures are steady this morning as it awaits the next move in equities. A breakout in VIX may be explosive. It is on an aggressive buy pending a breakout above 12.81.

USD futures are heading lower this morning. The Cycles Model reveals that the USD Master Cycle low is not due for at least another week. While it may reverse at any time, the Wave structure does allow another probe to or beneath its point 6 target at 88.20. This is the point where the longs “give it up” and sell because they have been so beaten up they have no confidence in the market any more.

ZeroHedge reports, “It's deja vu all over again as the dollar resumed its decline against all major peers on Friday amid concerns over U.S. trade policy, after a brief rally that followed Trump’s comment on favoring a stronger dollar, setting the Bloomberg Dollar Spot Index heading for its seventh weekly loss. That would be the longest losing streak since 2010.”

Dana Lyons comments, “The dropping Dollar is trying to hang onto a potentially important line of support.

There has been very intriguing action of late in financial markets across the spectrum. And whether it’s various equity markets, foreign or domestic, commodities, currencies or fixed income, much of the action can be tied to, if not attributed to, one thing – the falling U.S. Dollar. Obviously the Dollar can have a significant impact on other markets. That fact has many market participants asking “where will the falling buck stop?” Well, from a glance at the chart of the U.S. Dollar Index (DXY), there is a technical argument for at least a halt in the pace of the Dollar’s decline right here.”

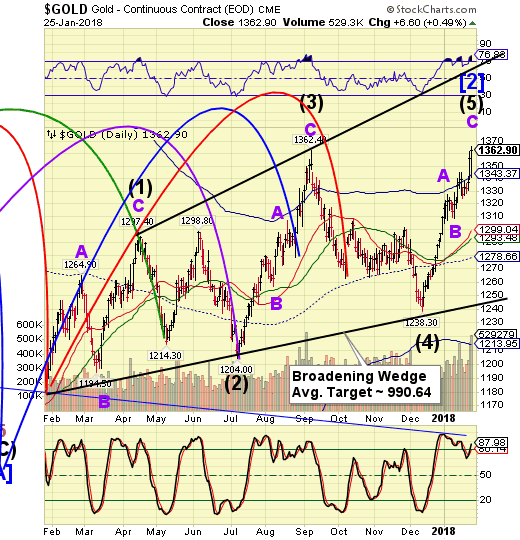

Gold futures are down and may challenge the Cycle Top support at 1343.37 very soon. It may have completed its final probe mentioned on Wednesday, so be on the lookout for a break of support at the Cycle Top where an aggressive short position may be taken.

It appears that commodities and precious metals will join equities in the coming downturn.

WTI futures appear to be consolidating this morning after a reversal yesterday. You may recall that WTI had a major Fib resistance at 66.40 which was hit yesterday.

The Cycles Model suggests a bottom may be found the week of February 5. However, its still needs to break the uptrend. Action levels for WTI appear to be the upper trendline at 64.00 and the Cycle Top at 636.05 where an aggressive sell signal may occur. Confirmation of the sell occurs at Intermediate-term support at 60.63.

Regards,

Tony

Our Investment Advisor Registration is on the Web.

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinve4stor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals.

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.