The Stock Market Lugnuts are Loose!

Stock-Markets / Stock Markets 2018 Feb 02, 2018 - 04:34 PM GMT SPX has crossed the neckline and round number support at 2800.00. While Kolanovic and the Risk Parity algos ignored the initial decline, they will have a harder time of it today. The real question is, how far will it go today? Panic may set in if not already, as the Head & Shoulders target appears to be an easy mark.

SPX has crossed the neckline and round number support at 2800.00. While Kolanovic and the Risk Parity algos ignored the initial decline, they will have a harder time of it today. The real question is, how far will it go today? Panic may set in if not already, as the Head & Shoulders target appears to be an easy mark.

ZeroHedge reports, “Last Friday, when the S&P hit an all time high and inexplicably melted up in the last hour of trading in a burst of frenzied buying, we warned that according to Bank of America, "Biggest Sell Signal In 5 Years Was Just Triggered." Incidentally, on that very day, the S&P 500 bull market became the second largest of all time last Friday, as the global equity market cap of $86.6TN rose $57.9TN from 2009 lows and $29.9TN from 2016 lows, according to BofA.

In retrospect, following what is shaping up as the worst week for stocks since 2016, Bank of America was right.”

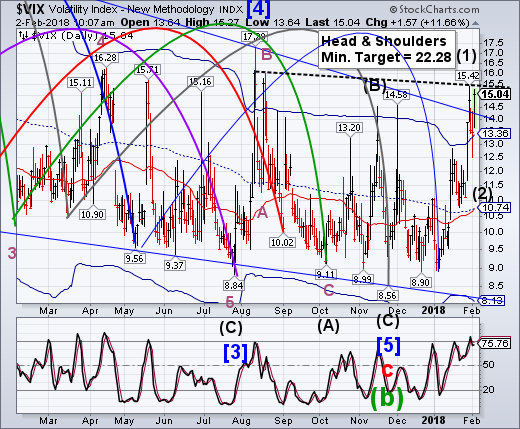

VIX is fast approaching its “wheels fall off” scenario at the Head & Shoulders neckline. The VIX ETFs are also nearly at the Tuesday highs.

It looks like a bloodbath in the making.

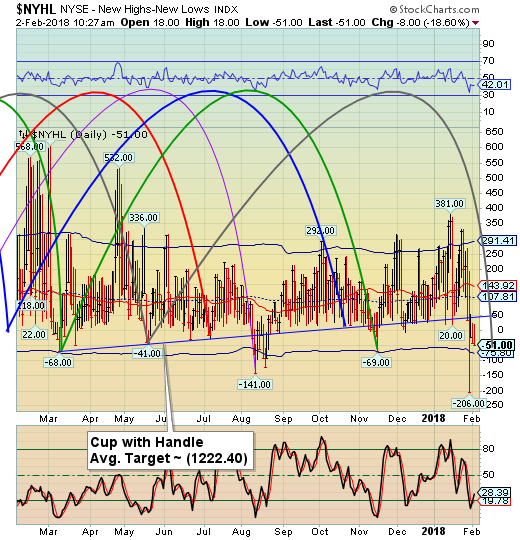

The NYSE Hi-Lo Index is clearly in “confirmed sell” territory after the trendline held at the bounce. This is very good action for the short positions.

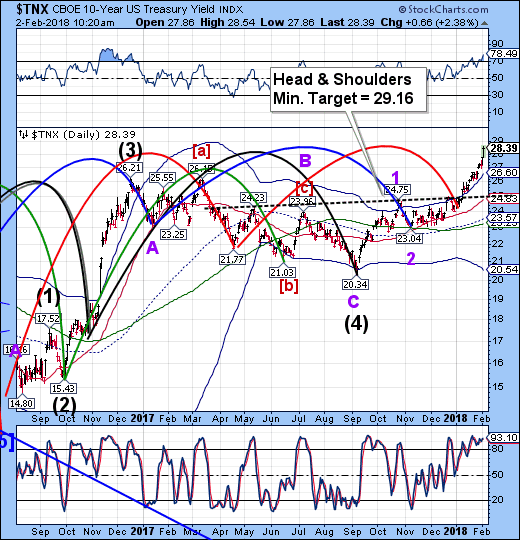

TNX is in an awesome move this morning. Given the propensity to overshoot the Head & Shoulders target at 1.382 X Wave 1, I would suggest a higher Fib, such as 1.618 X Wave 1 at 30.18.

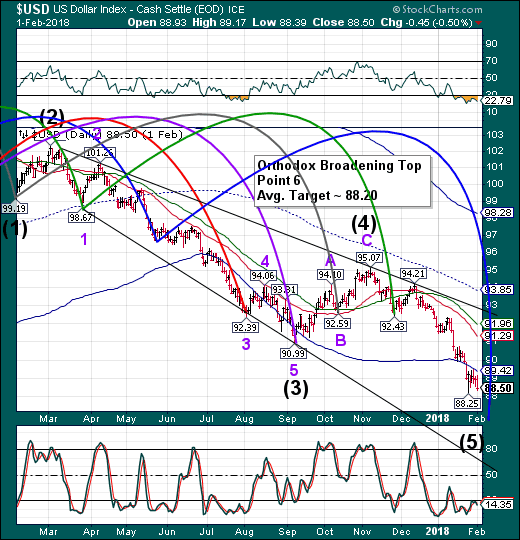

USD futures have jumped to a high of 89.24, but may be testing the Cycle Bottom at 89.42 before making a final probe lower. A rally above the Cycle Bottom implies the decline is over. USD has some leeway in the Cycles Model for another probe lower.

Regards,

Tony

Our Investment Advisor Registration is on the Web.

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinve4stor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals.

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.