Have Stock Investors Gone Insane?

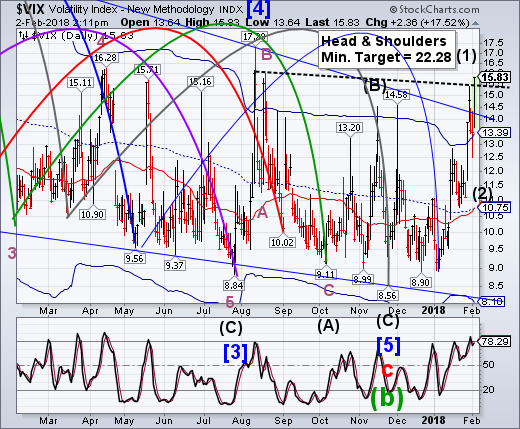

Stock-Markets / Stock Markets 2018 Feb 03, 2018 - 09:13 AM GMT This has the appearance of a Wave (iii) of a Leading Diagonal Wave [i]. Thus far it has not succeeded in making its Head & Shoulders target, but it may not be complete. This may be where the wheels fall off, so I am hesitant to put a label on the structure yet. It doesn’t look very good, does it?

This has the appearance of a Wave (iii) of a Leading Diagonal Wave [i]. Thus far it has not succeeded in making its Head & Shoulders target, but it may not be complete. This may be where the wheels fall off, so I am hesitant to put a label on the structure yet. It doesn’t look very good, does it?

ZeroHedge advises, “With positioning at extremes, and leverage at extremes, and valuations at extremes, Deutsche Bank's Binky Chadha raises the red flag as the correlation across asset-classes soars to record highs signaling extreme contagion risk.

Very strong momentum across asset classes has seen oil up, the dollar down, equities and bond yields up, with the average correlation between them rising to 90%.”

VIX is now above the neckline of its Head & Shoulder formation, confirming its buy signal. Is there anyone paying attention???

ZeroHedge blames it on the FISA memo release.

Bill Blain “can detect a shift in the Market.” Even the best analysts are still mumbling about, not ready to commit themselves to a sound judgement call on what’s going on. They have all gone temporarily insane.

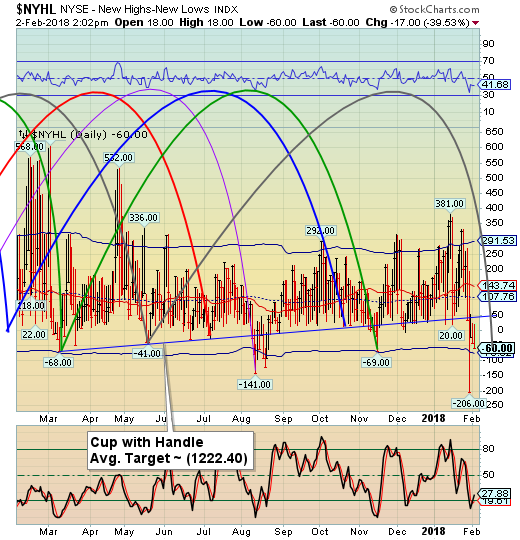

The NYSE Hi-Lo Index is moving steadily down all day. There’s no doubt from our indicators that this is a confirmed sell…and probably a near panic situation.

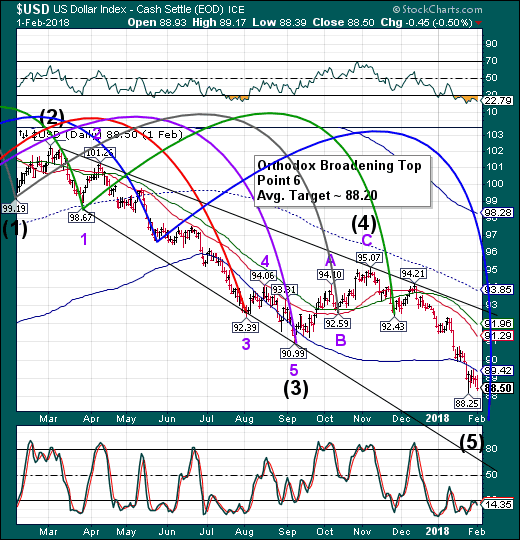

As mentioned earlier, the USD bounce was stopped under the Cycle Bottom resistance at 89.43. It still has more decline to go.

ZeroHedge notes, “Strong 'headline' earnings growth (despite all the caveats) has sparked a hawkish tilt to trading sending bond yields higher and spiking the dollar index by the most since Jan 2017.

There's just one thing though...

The 0.9% spike in the dollar index is the most since January 18th 2017 and sounds impressive, but for a trader, it appears the spike is for fading as it hits the Trump Rescue highs and rolls over...”

On another note, I just got off the phone with my son who lives in Boston. He slipped on some black ice while coming home from work and broke his ankle bone. He is in surgery now and I may fly out over the weekend to be with him while he convalesces. I may not be able to write my Weekend Update as a result.

Regards,

Tony

Our Investment Advisor Registration is on the Web.

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinve4stor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals.

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.