Stock Market Struggle Begins to Avert the Decline

Stock-Markets / Stock Markets 2018 Feb 08, 2018 - 02:56 PM GMT SPX futures are struggling to take back the losses that occurred just after the bell yesterday. That puts the fair market value at about 12 points below the close. There may be a bounce, but it may not last.

SPX futures are struggling to take back the losses that occurred just after the bell yesterday. That puts the fair market value at about 12 points below the close. There may be a bounce, but it may not last.

At 7:00 am ZeroHedge wrote, “U.S. stock index futures turn negative in an illiquid, volatile session as investor sentiment has yet to stabilize amid doubts whether the U.S. equity selloff is over as yields remain just south of the critical 2.85% level. S&P E-mini contracts slid 0.1%, while the VIX is up 1% to 28.1 after 2 days of declines. Including fair value, the Dow is expected to have an implied open of over 200 points lower while the S&P will open around 2,665.”

However, there is a concerted effort to open the cash market on a positive note. At 8:30 ZeroHedge reports, “Having been down over 1% overnight, US equity futures are all back in the green now, going vertical in the last few minutes as the dollar and bond yields suddenly slump...

Overnight weakness is gone...”

NDX futures declined as much as 88 points after yesterday’s close. This morning it appears to be opening about 30 points above the close…

That’s a lot of intervention in the overnight session. The central banks may be anticipating a lot of selling pressure this morning after the retracements appear to be over.

VIX futures are also down after a visit to the daily high after the close. But no new lows.

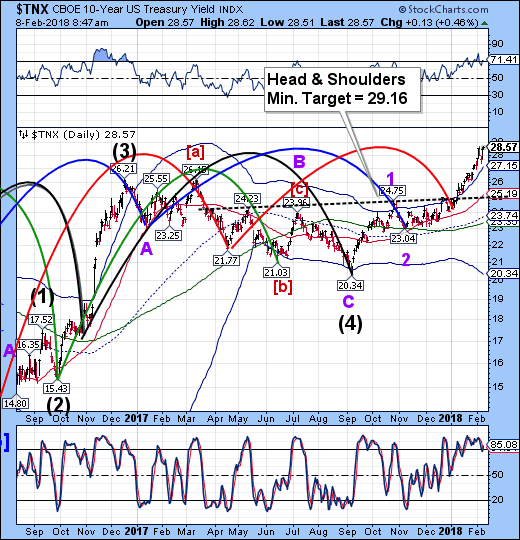

TNX is now pressing to make a new high that the Head & Shoulders target anticipates. The futures show that it has been accomplished but at this point the cash market appears to be lagging.

The Cycles Model allows strength through the weekend and possibly up to Wednesday of next week. As pointed out previously, Head & Shoulders patterns are often weaker at 4th Wave locations, We will be looking either for the target to be met or TNX falls beneath the Cycle Top support at 27.15 for a sell signal.

In casy you were wondering about the spike in yields and the sell-off in equities, the Federal reserve reduced its balance sheet by $22.09 between January 24 and January 31. If you go to the website, click on the 3 month chart to get the full impact.

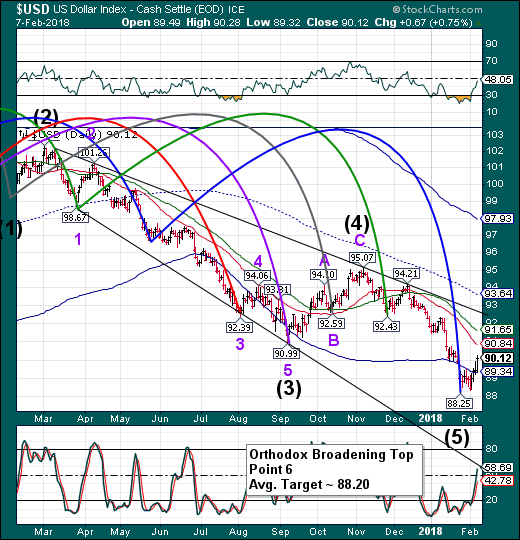

USD futures fell back to 90.00 in a probable retest the Cycle Bottom at 89.34 this morning. We may see another day or two of weakness, but strength may reappear through options expiration week.

WTI futures made a morning low at 61.09 as it starts to challenge the 50-day Moving Average support at 60.89. It is already on a sell signal which becomes confirmed beneath the 50-day. Overhead resistance is Intermediate-term and bottom trendline of the Ending Diagonal formation at 62.64.

Regards,

Tony

Our Investment Advisor Registration is on the Web.

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinve4stor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals.

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.