SPX Futures Are Sliding...

Stock-Markets / Stock Markets 2018 Feb 13, 2018 - 03:46 PM GMT SPX futures are sliding as the decline begins to take hold again. SPX retraced 71.7% of Wave 1, mainly due to the stop hunt that was done to wipe out the shorts. This constitutes a near 50% retracement of the entire decline. Most Elliotticians are still looking for a 61.8% retracement, as they believe that Wave (1) had concluded on Friday.

SPX futures are sliding as the decline begins to take hold again. SPX retraced 71.7% of Wave 1, mainly due to the stop hunt that was done to wipe out the shorts. This constitutes a near 50% retracement of the entire decline. Most Elliotticians are still looking for a 61.8% retracement, as they believe that Wave (1) had concluded on Friday.

The reason w only got a 53.5% retracement on Wave (1) is because virtually no one was short until the 50-day Moving Average was crossed. Thus we see this rebound making the 61.8% retrace, as more traders were willing to go short, but with stops.

ZeroHedge writes, “Is the dead cat bounce over?

European shares rolled over this morning after a late downswing in Asia as markets struggled to find stability despite Monday's frenzied rally, with futures this morning a bit of a mess.”

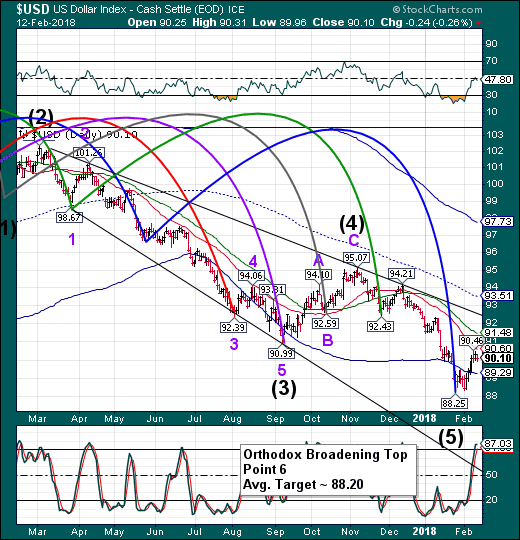

USD futures may be the blame for the decline in stocks. USD declined to 89.54 in overnight trading and may revisit the Cycle Bottom at 89.29 to launch a more spirited rally.

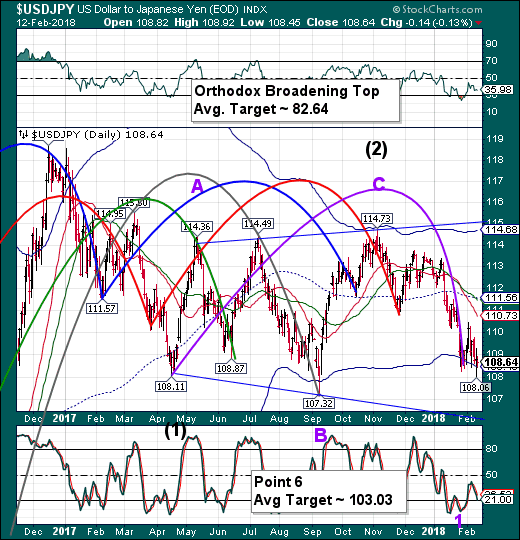

USD/JPY may be the culprit as it declined to a new low at 107.43. This is sucking the liquidity out of the markets as money flees to the Yen which is rising higher in a Wave 3. So, despite the USD rising off the bottom, it’s strength is countermanded by the flight to the Yen.

NDX futures are down as Wave 3 of (3) of [1] begins. This decline is likely to take NDX beneath its daily Cycle Bottom at 5424.85. The 6.5 year trendline lies at 5250.80, which may cause the next bounce. Crossing the 6.5-year trendline raises the probability of the complete decline targeting the October 4, 2011 low.

. VIX futures are on the rise, but no breakout yet.

Well, ZeroHedge reports what we have already suspected, “We first exposed the "conspiracy fact" that VIX manipulation runs the entire market back in 2015 as the ubiquitous VIX-crushing algo-runs coincided with a non-stop shorting of VIX futures by a seemingly bottomless-pocketed player in the market... which happened to coincide with the arrival of Simon Potter as the head of The New York Fed's trading desk...

Probably just a coincidence, right?

Then, in May of last year we academic confirmation of the rigged nature the US equity market's volatility complex, when a scientific study found "systemic VIX auction settlement manipulation."

Two University of Texas at Austin finance professors found "large transient deviations in VIX prices" around the morning auction,"consistent with market manipulation."

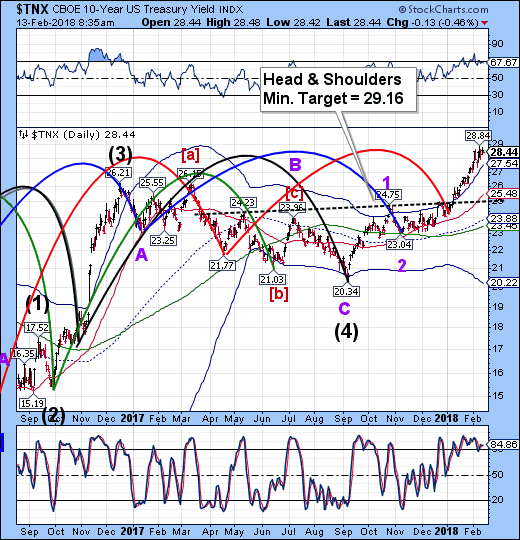

TNX still lingers at the top of its range in a consolidation that may either break up or down.

The 9.02 futures high may be the top of this move.

Bloomberg reports, “Hedge funds and other large speculators are more convinced than ever that the 2018 bond-market rout will resume in the days ahead.

The group, known for trading on momentum, boosted short bets in 10-year Treasury futures to a record 939,351 contracts, according to Commodity Futures Trading Commission data through Feb. 6. That means the violent market moves on Feb. 5, when the Dow Jones Industrial Average suffered an unprecedented drop and 10-year yields fell almost 14 basis points, weren’t enough to dissuade wagers that rates are headed higher. The next gut-check comes Wednesday, with the latest read on consumer prices.”

Interesting times…

Regards,

Tony

Our Investment Advisor Registration is on the Web.

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinve4stor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals.

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.