Have You Been Getting Run Over By This Stock Market Action?

Stock-Markets / Stock Markets 2018 Feb 16, 2018 - 10:53 AM GMTBy: Avi_Gilburt

"Stocks are going down because the economy is too good?"

"Stocks are going down because the economy is too good?"

How many times did you hear something like that quote over the last two weeks on television? And, it was accompanied by the barrage of reports proclaiming the demise of the bull market which began in 2009. But, if you are a thinking person, clearly you had to have been scratching your head.

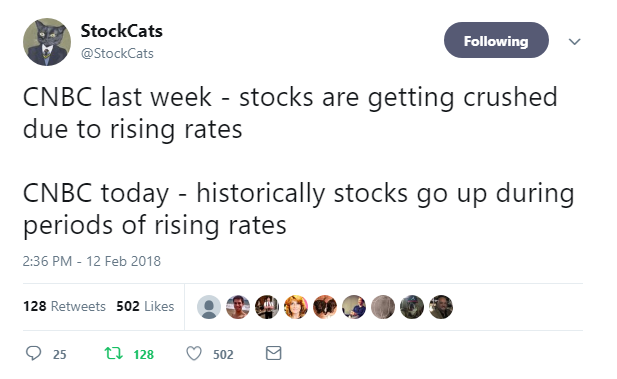

Oh, and let’s not forget about how rising rates caused us to drop off the all-time highs. I wrote about how foolish this was last week, and CNBC has proven just how ridiculous these perspectives really are.

And, today, we were told that if the CPI would suggest inflation is rearing its ugly head, the market would continue to tank. Yet, the market held the support I noted to my subscribers to the penny and continued higher, as we added another 35 points to the SPX today. So, I ask you after today’s action, is inflation good or bad for the market?

Who cares. If you have not figured it out yet, all of this is simply noise. How can one truly be able to identify how the market will move based upon all of this “data?” Anyone that has been trying would certainly have been run over. I mean, would you drive your car looking out the back window?

But, as I have noted so many times before, the market is an emotional environment, and is not data driven. While news may act as a catalyst or cause a knee jerk reaction, it has no true lasting effect upon the overall trend. As Ralph Nelson Elliott noted 80 years ago:

“The causes of these cyclical changes seem clearly to have their origin in the immutable natural law that governs all things, including the various moods of human behavior. Causes, therefore, tend to become relatively unimportant in the long term progress of the cycle. This fundamental law cannot be subverted or set aside by statutes or restrictions. Current news and political developments are of only incidental important, soon forgotten; their presumed influence on market trends is not as weighty as is commonly believed . . . At best, news is the tardy recognition of forces that have already been at work for some time and is startling only to those unaware of the trend.”

As Robert Prechter also noted:

“once you realize that even if you got [the news] in advance, you could not forecast the stock market. Though these facts are counter-intuitive, it does not take a dedicated market student long to observe the acausality of news to the stock market.”

In fact, a commenter to one of my articles on Seeking Alpha made the following astute point regarding how news affects these subconscious herding trends:

“Compare the market to a stream of ants marching by in, generally, a single direction. Run a stick across their path and there will be some momentary confusion and reaction to the direct stimuli but very soon afterwards the original parade of ants continues and the stimulus is forgotten.”

So rather than chasing your tail after the next piece of news is released, maybe you should consider that there is something stronger out there that provides direction to our markets?

As far as such direction, our target for this pullback was the 2424-2539SPX region, and the market has now struck the minimal target I had set for this wave (4) correction. In fact, once we hit those lows, I guided my subscribers to be looking for a rally back towards the 2725SPX region.

However, I still have no clear indications that this correction has run its course. Much will depend on how the next drop takes shape, and that will likely be instructive as to whether we have begun a rally to our next higher target in the SPX between 3011-3223, or if this correction will take more time, and provide us with another loop to the downside. For now, I still favor another loop to the downside, but will be listening to the messages provided by the market, rather than the ones provided by the news.

See charts illustrating the wave counts on the S&P 500.

Avi Gilburt is a widely followed Elliott Wave technical analyst and author of ElliottWaveTrader.net (www.elliottwavetrader.net), a live Trading Room featuring his intraday market analysis (including emini S&P 500, metals, oil, USD & VXX), interactive member-analyst forum, and detailed library of Elliott Wave education.

© 2018 Copyright Avi Gilburt - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.