Gold Up 3.8% In Week – If Closes Above $1,360/oz Will Be Biggest Weekly Gain In Nearly 2 Years

Commodities / Gold and Silver 2018 Feb 16, 2018 - 11:57 AM GMTBy: GoldCore

Gold rose as the dollar fell to near a three-year low against a basket of currencies on Friday, heading for its biggest weekly loss in nine months, as a slew of bearish factors including firming inflation and a fall in retail sales and industrial production hit the dollar.

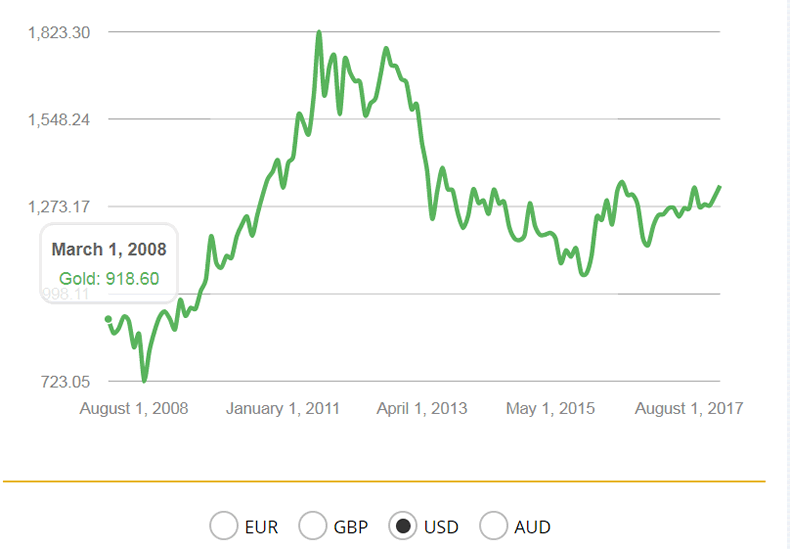

Gold in USD – 10 Years – (GoldCore)

U.S. producer prices accelerated in January, boosted by strong rises in the cost of gasoline and healthcare, offering more evidence that inflation pressures are building. The U.S. producer price index for final demand rose 0.4% last month after being unchanged in December.

In a second U.S. report yesterday, initial claims for state unemployment benefits increased by 7,000 to a seasonally adjusted 230,000 for the week ended February 10. U.S. President Donald Trump’s tax reform may help boost U.S. growth in the short term but could have negative consequences for the U.S. deficit and debt in the medium term, warned International Monetary Fund chief Christine Lagarde yesterday.

Inflation was also surprisingly high in this week’s regional Fed reports, which saw a surge in the Prices Paid index, the clearest indicator of input cost inflation, which in both the Philly and New York reports jumped to 6 year highs.

U.S. industrial production and retail sales were also weaker than expected this week. U.S. retail sales unexpectedly fell sharply in January, recording their biggest drop in nearly a year. Households cut back on purchases of motor vehicles and building materials.

This in conjunction with the high inflation numbers suggests that there is an increasing risk of stagflation taking hold in the U.S.

Gold Prices (LBMA AM)

15 Feb: USD 1,353.70, GBP 962.21 & EUR 1,084.45 per ounce

14 Feb: USD 1,330.75, GBP 959.74 & EUR 1,077.77 per ounce

13 Feb: USD 1,329.40, GBP 955.04 & EUR 1,077.61 per ounce

12 Feb: USD 1,321.70, GBP 955.19 & EUR 1,077.45 per ounce

09 Feb: USD 1,316.05, GBP 945.58 & EUR 1,072.84 per ounce

08 Feb: USD 1,311.05, GBP 944.87 & EUR 1,071.13 per ounce

07 Feb: USD 1,328.50, GBP 956.12 & EUR 1,075.95 per ounce

Silver Prices (LBMA)

15 Feb: USD 16.83, GBP 11.98 & EUR 13.49 per ounce

14 Feb: USD 16.58, GBP 11.97 & EUR 13.43 per ounce

13 Feb: USD 16.61, GBP 11.94 & EUR 13.46 per ounce

12 Feb: USD 16.43, GBP 11.86 & EUR 13.39 per ounce

09 Feb: USD 16.36, GBP 11.83 & EUR 13.37 per ounce

08 Feb: USD 16.35, GBP 11.70 & EUR 13.36 per ounce

07 Feb: USD 16.69, GBP 12.02 & EUR 13.52 per ounce

Please share our research with family, friends and colleagues who you think would benefit from being informed by it.

Mark O'Byrne

This update can be found on the GoldCore blog here.

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information containd in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.