IS Today Thee Stock Market Turn Day?

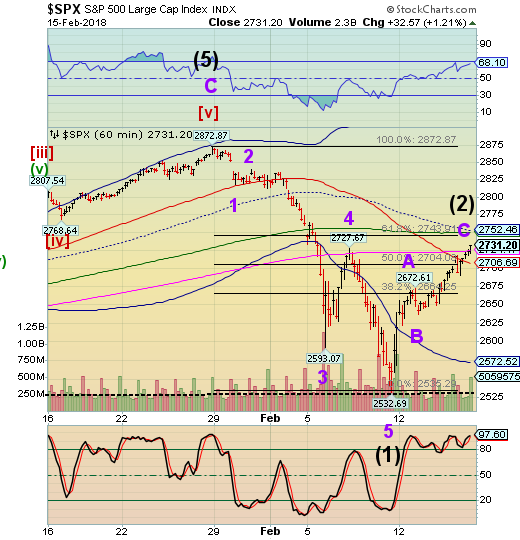

Stock-Markets / Stock Markets 2018 Feb 16, 2018 - 03:05 PM GMT SPX futures were higher overnight, but appear to be coming back down as the cash open approaches. The total retracement was 58.5%, an overshoot that was carried by the all-pervading enthusiasm to buy the dip coupled with a stop hunt to remove any timid short sellers who thought they could protect themselves with stop-losses.

SPX futures were higher overnight, but appear to be coming back down as the cash open approaches. The total retracement was 58.5%, an overshoot that was carried by the all-pervading enthusiasm to buy the dip coupled with a stop hunt to remove any timid short sellers who thought they could protect themselves with stop-losses.

.ZeroHedge reports, “Global stocks were set to post their best week of gains in six years on Friday after two consecutive weeks spent in the red, shrugging off a rise in global borrowing costs while the dollar hit its lowest level since 2014. The MSCI world index rose 0.4% after European bourses opened. .After suffering its biggest weekly drop since August 2015 last week, this week’s recovery puts the index on track for its best weekly showing since early December 2011.”

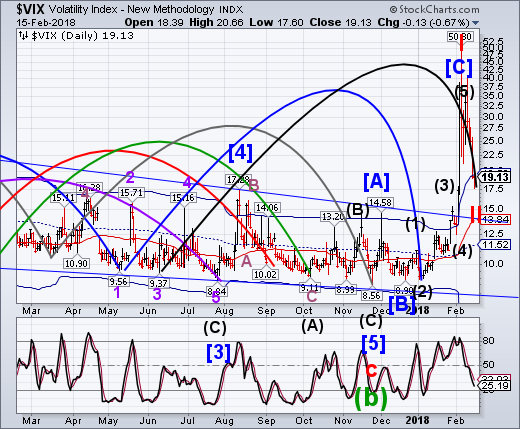

VIX futures pulled back but did not make new lows in the overnight session. At the present, the futures are nearing breakeven with the close, which is positive.

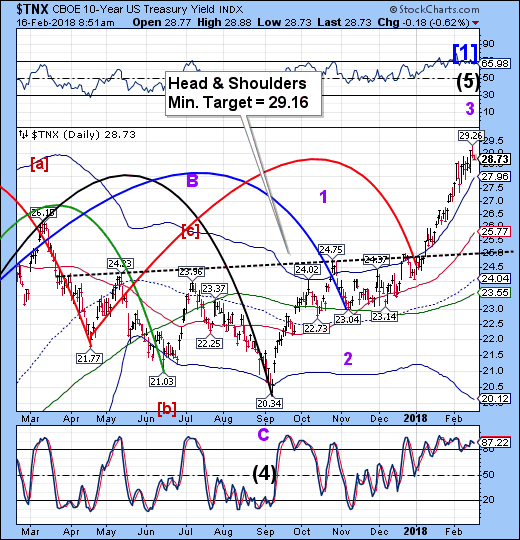

TNX is pulling back from the high made yesterday. The Cycles Model suggests that it may be the Wave 3 high. If so, we may see TNX decline toward the neckline at 25.00.

ZeroHedge observes, “Earlier this week, GMO's James Montier repeated verbatim one of our recurring puzzling observations about the current market: while "a recent Bank of America ML survey showed the highest level of those citing “excessive valuation” ever. Yet despite this, the same survey showed fund managers to still be overweight in equities." Back in August, we called this just one of the many bizarre market paradoxes observed in the market.

Here is another paradox.

As we noted earlier, after last week's volocaust, this week was the best week for global stocks since 2011 as traders and algos furiously BTFD (and sold vol), clearly forgetting what happens when markets become too stretched, as they are becoming again.

It wasn't just stocks: junk bond yields dropped the most in three months, and CCC yields saw the biggest drop in more than five weeks yesterday amid what is reportedly buying flurry. As Bloomberg put it, "it was as if high yield investors were making up for the lost week" with HYCDX rising the most in 11 months, and junk bond ETFs, JNK and HYG, saw the biggest increase in three months.”

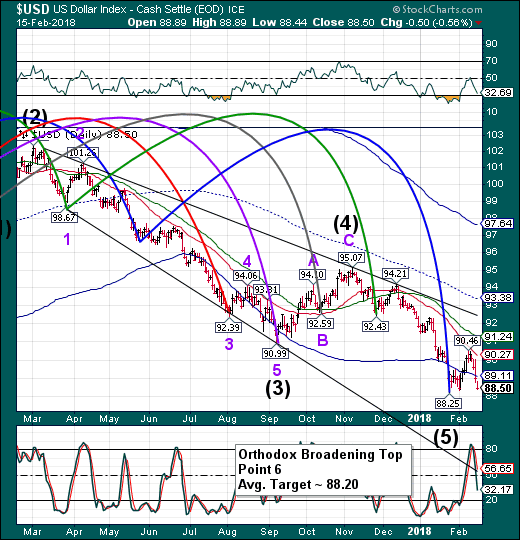

USD futures made a new low in the overnight at 88.16, hitting the point 6 target. It may not show in the cash market which won’t be reported until after the close. The Master Cycle low that has been recorded occurred on day 247, 11 days prior to the mean. Should there be a new low registered today, it will be 11 days after the mean (258 days).

The real issue is that the USD shorts are overcrowded. The situation is ripe for a rip-roaring rally back to the Cycle Top at 97.64.

Regards,

Tony

Our Investment Advisor Registration is on the Web.

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinve4stor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals.

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.