Will the Stock Market Make a Double Bottom?

Stock-Markets / Stock Markets 2018 Feb 18, 2018 - 03:21 PM GMTBy: Submissions

Troy Bombardia writes:The S&P 500 has already fallen more than -10% (-11.8% to be precise). A brief study using VIX suggested that the stock market would retest its lows in the next few weeks. Let’s expand that study.

Troy Bombardia writes:The S&P 500 has already fallen more than -10% (-11.8% to be precise). A brief study using VIX suggested that the stock market would retest its lows in the next few weeks. Let’s expand that study.

What happens when the S&P falls at least -10% and then retraces 50% of the decline? Is the bottom in? Or does the S&P at least retest its lows?

Here are the historical cases

- April 12, 2012

- July 16, 2007

- January 3, 2000

- July 19, 1999

- October 7, 1997

- February 19, 1997

- May 23, 1996

- January 3, 1990

- August 27, 1986

- October 10, 1983

- September 25, 1967

- May 13, 1965

- August 3, 1959

- September 23, 1955

- January 5, 1953

- June 12, 1950

*We exclude “significant correction” cases because the Medium-Long Term Model does not believe that the current “small correction” will turn into a “significant correction”.

Here are the historical cases in detail.

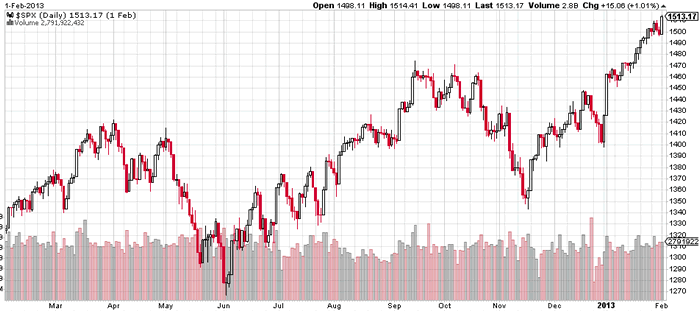

April 12, 2012

The S&P fell more than 10%, bounced (50% retracement) and never made a retest or marginal new low.

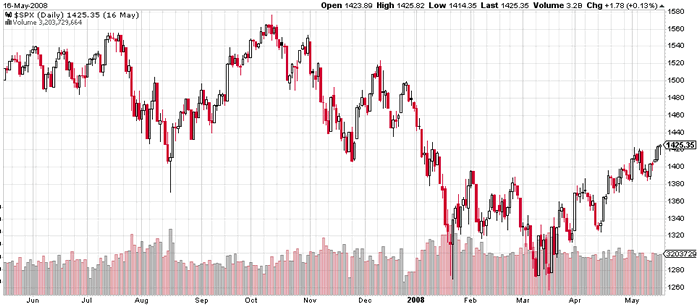

July 16, 2007

The S&P fell more than 10%, bounced (50% retracement) and never made a retest or marginal new low before making a new high.

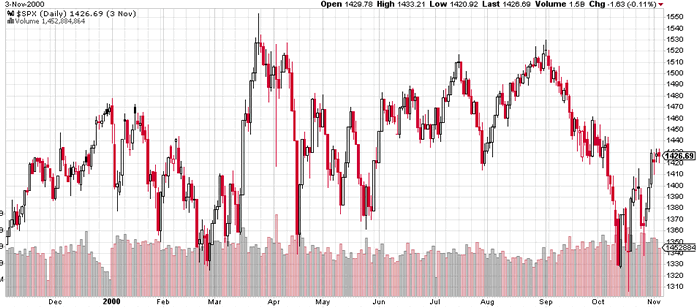

January 3, 2000

The S&P fell more than 10%, bounced (50% retracement) and never made a retest or marginal new low before making a new high.

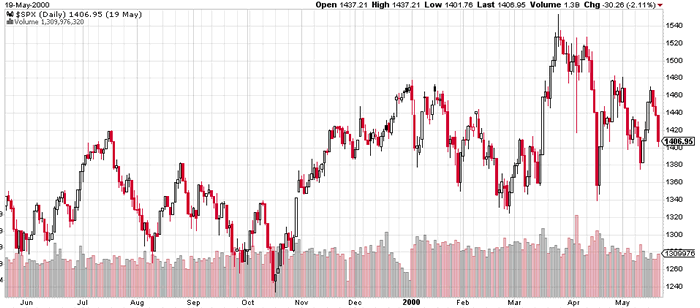

July 19, 1999

The S&P fell more than 10%, bounced (50% retracement), and continued to make lower lows in September-October 1999.

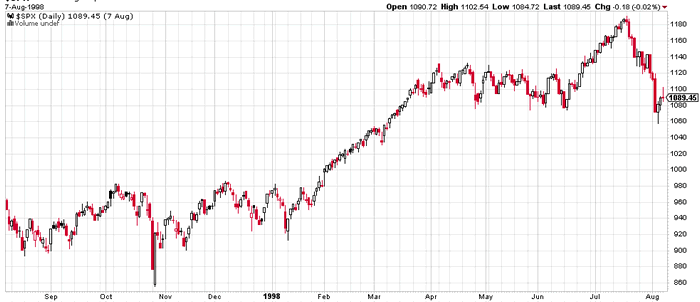

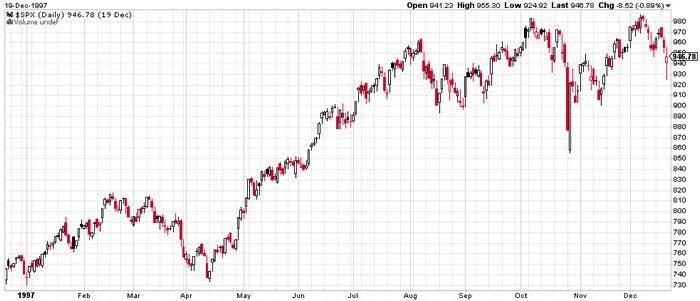

October 7, 1997

The S&P fell more than 10%, bounced (50% retracement) and never made a retest or marginal new low before making a new high.

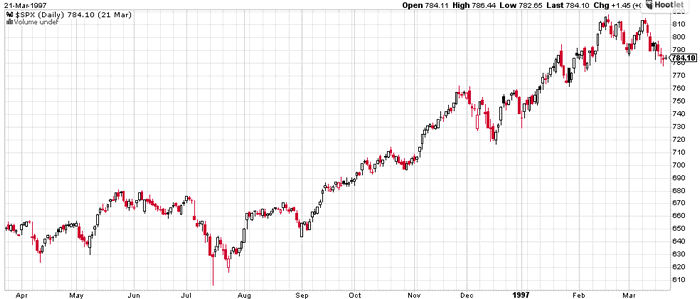

February 19, 1997

The S&P fell more than 10%, bounced (50% retracement) and never made a retest or marginal new low before making a new high.

May 23, 1996

The S&P fell more than 10%, bounced (50% retracement) and never made a retest or marginal new low before making a new high.

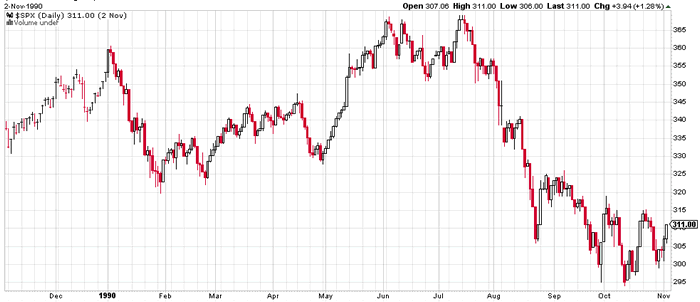

January 3, 1990

The S&P fell more than 10%, bounced (50% retracement) and never made a retest or marginal new low before making a new high.

*The S&P came very close to retesting its previous low.

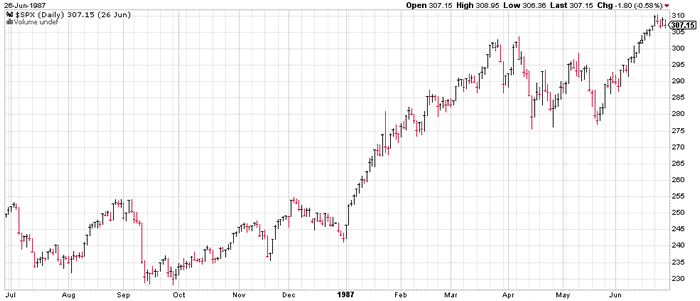

August 27, 1986

The S&P fell more than 10%, bounced (50% retracement) and never made a retest or marginal new low before making a new high.

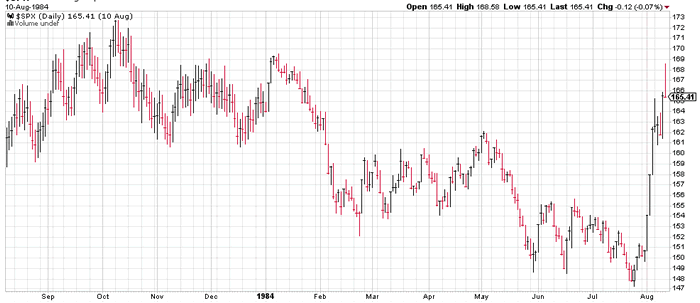

October 10, 1983

The S&P fell more than 10%, bounced (50% retracement) and never made a retest or marginal new low before making a new high.

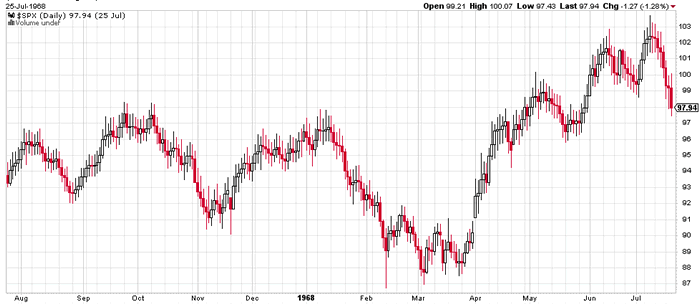

September 25, 1967

The S&P fell more than 10%, bounced (50% retracement) and never made a retest or marginal new low before making a new high.

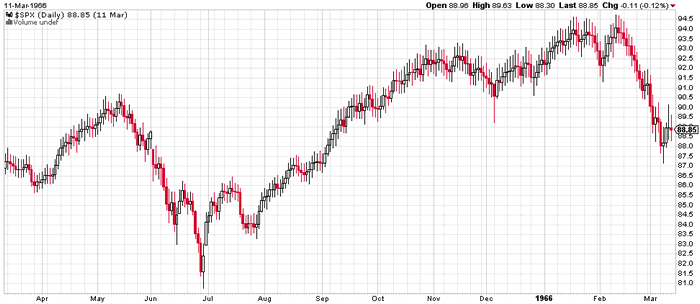

May 13, 1965

The S&P fell more than 10%, bounced (50% retracement) and never made a retest or marginal new low before making a new high.

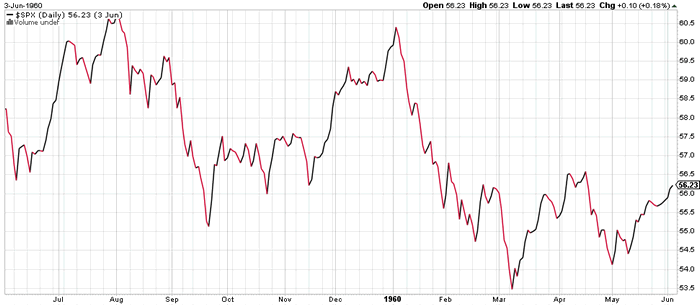

August 3, 1959

The S&P fell more than 10%, bounced (50% retracement) and never made a retest or marginal new low before making a new high.

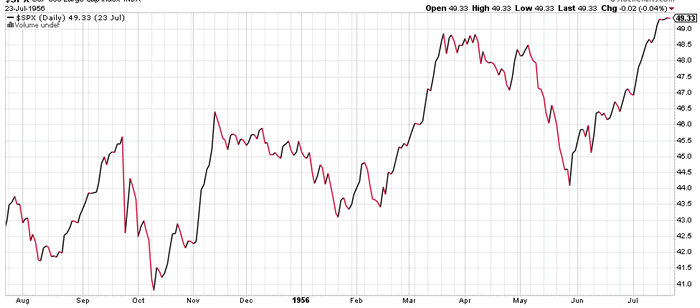

September 23, 1955

The S&P fell more than 10%, bounced (50% retracement) and never made a retest or marginal new low before making a new high.

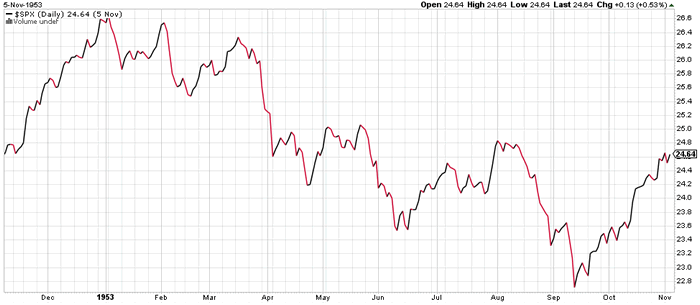

January 5, 1953

The S&P fell more than 10%, bounced (50% retracement) and never made a retest or marginal new low before making a new high.

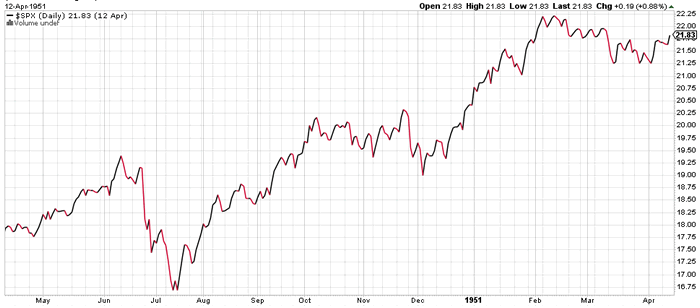

June 12, 1950

The S&P fell more than 10%, bounced (50% retracement) and never made a retest or marginal new low before making a new high.

Conclusion

This study suggests 2 things:

- Only 1 of these 16 cases saw the S&P retest the previous low or make new lows.

- The stock would retrace 50-61.8% of the bounce before rallying higher.

Based on this study, I do not expect the S&P to retest its 2532 low. Even if the S&P does retest this low, I do not expect it to be anything more than a marginal new low. The medium-long term downside risk is limited.

I think there’s a >50% chance that the S&P will retrace 50-61.8% of its recent bounce before rallying higher. That’s my short term outlook. Keep in mind that the short term is notoriously hard to predict.

By Troy Bombardia

I’m Troy Bombardia, the author behind BullMarkets.co. I used to run a hedge fund, but closed it due to a major health scare. I am now enjoying life and simply investing/trading my own account. I focus on long term performance and ignore short term performance.

Copyright 2018 © Troy Bombardia - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.