US-China Trade War Escalates As Further Measures Are Taken

Politics / China US Conflict Feb 19, 2018 - 03:05 PM GMTBy: GoldCore

– Trade war between two superpowers continues to escalate

– Trade war between two superpowers continues to escalate

– White House likely to impose steep tariffs on aluminium and steel imports on ‘national security grounds’

– US may impose global tariff of at least 24% on imports of steel and 7.7% on aluminium

– China “will certainly take necessary measures to protect our legitimate rights.”

– China is USA’s largest trading partner, fastest-growing market for U.S. exports, 3rd largest market for U.S. exports in the world.

– If the U.S. continues to escalate its trade actions against China, experts say retaliation is likely.

– Global markets are unprepared, investors should invest in gold to protect portfolios

President Trump has long accused China of ‘one of the greatest thefts in the history of the world’ and he campaigned hard on the issue during his run for the White House. So, it is no surprise that his administration are doing something about what they view as an unfair trade set-up.

President Trump has long accused China of ‘one of the greatest thefts in the history of the world’ and he campaigned hard on the issue during his run for the White House. So, it is no surprise that his administration are doing something about what they view as an unfair trade set-up.

Last week commerce secretary Wilbur Ross announced the possible ‘global tariff of at least 24% on imports of steel and 7.7% on aluminum after investigations into trade in both metals determined that import surges seen in recent years “threaten to impair [US] national security.”’

Unsurprisingly China have responded, calling the US reckless and confirming that they would take steps in order ‘to protect our legitimate rights.’

There is a lot at stake here both financially and politically. In 2016 the two countries did $578.6bn worth of trade and both are seen as global super-powers competing for hegemony in an increasingly polarised world.

Brewing for some time

At the end of 2017 Trump warned that he would be taking tough measures on China who he sees as an existential economic threat on his country, “We are declaring that America is in the game and America is going to win,”. At that point Trump had done more talking than actually doing anything to impact trade with China.

The China Foreign ministry responded:

“We urge the United States to stop the strategic intention of deliberately distorting China and abandon the outdated concepts of Cold War thinking and zero-sum game, or else it will only harm itself.”

2018 has been quite different with two separate sets of announcements regarding tariffs and trade with China. The first focused on solar panels, the latest on industrial metals. Both are major exports and sources of income for the Communist country.

With this in mind, it is unlikely that the Chinese super-power is going to take these moves lying down or that global financial markets will not be affected. But, in the meantime they will likely bide their time:

“China has lots of cards to play but is in no rush to play them,” said Xu Hongcai at the China Center for International Economic Exchanges, a government-affiliated think-tank in Beijing. “For now there is small-scale trade friction, not a trade war. Our moves have always been defensive. We will not escalate the situation.” As reported in the FT.

Trade war or war of words?

For now the trade war is unlikely to go too far past a war of words, on China’s side. They have other tools up their sleeves which could impact the US economy but not be seen as a full on defensive against America’s trade policies.

For now, all they have done is announce that it is investigating U.S. exports of sorghum and imposing measures on styrene, which is used to make plastic products. These measure are unlikely to go too far, for example Chinese farmers need American soybeans to feed their livestock.

But there are other areas China could make things sting a little too.

The country is one of the top five buyers of US cars, currently. By 2022 it is expected to contribute to over half of the world’s car market growth. The government could easily instruct Chinese citizens to no longer buy US cars, hurting the latter’s automotive industry.

We also see huge spending from China when it comes to tourism. By 2025 Chinese tourists are forecast to spend $450bn on vacations abroad. The US is increasingly benefitting from the 130 million Chinese tourists that venture into the world each year.

However the biggest tool they have up their sleeve, away from trade policies is the selling of US debt, of which it owns more than $1tn. As Jim Rickards reminded us, last week:

China leaked an announcement last month that the People’s Bank of China was considering allocating its reserves away from additional purchases of U.S. Treasury securities. That should be taken not as an immediate threat but as a shot across the bow indicating how China could retaliate for U.S. tariffs or other trade penalties.

This new trade war will get ugly fast and the world economy will be collateral damage.

Global implications

Whilst the US begins to fight against globalisation and China tries to embrace it, both are forgetting how intertwined it makes the world. A trade war between the two countries will not only impact them but also emerging countries in Asia.

Consider the steep 30% U.S. tariffs on imports of solar panels and washing machines, announced at the end of January. Capital Economics issued a stark warning about how this could affect the rest of the world’s emerging markets:

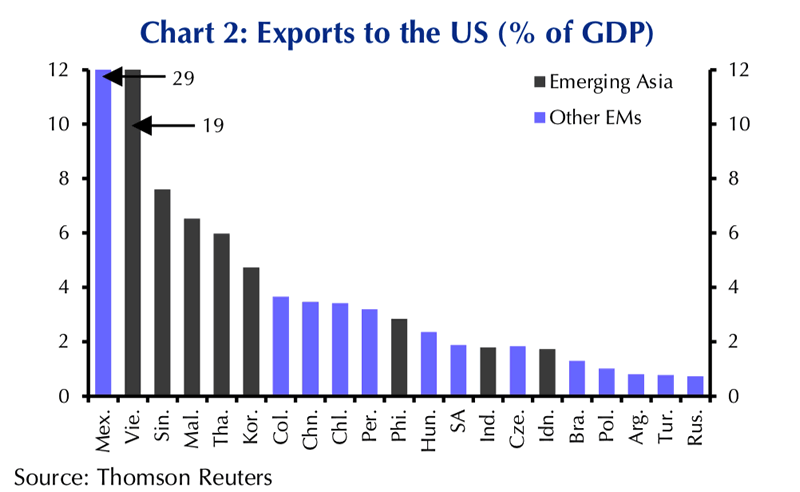

Countries in Emerging Asia export more to the US than most other emerging markets (Chart 2), and more generally have been among the biggest beneficiaries of globalisation in the world. Any moves towards protectionism would deal a blow to the region’s most trade-dependent economies such as Singapore, Taiwan and Vietnam. Korea would also be badly hit if instead of trying to renegotiate the Korea- US Free Trade Agreement (KORUS), the US completely withdrew from the deal.

There have been multiple warnings and theories from experts about how a trade war between China and the US will end. Possibly the most insightful is from Edward Wong, the New York Times’s former Beijing bureau chief. In a recent essay, he concludes:

“[China’s] Communist Party embraces hard power and coercion, and this could well be what replaces the fading liberal hegemony of the United States on the global stage. It will not lead to a grand vision of world order. Instead, before us looms a void.”

Be prepared for the unprepared

In truth no-one knows how the trade war between the US and China will escalate. Both countries need one another but they are also both led by men who believe in the singular power of their own countries, across the globe.

As we saw from the markets’ reaction when China leaked they may move away from US Treasuries, the financial order is not quite prepared for a major division between the two countries.

From the two announcements by the Trump administration in the last fortnight, it is possible that the trade war could get ugly very fast. Should this happen the the world economy will be the battle ground on which is it is fought.

Now would be an excellent opportunity for investors to prepare their portfolios for volatility and stock up on gold as a safe haven.

Gold Prices (LBMA AM)

19 Feb: USD 1,347.40, GBP 961.10 & EUR 1,085.47 per ounce

16 Feb: USD 1,358.60, GBP 964.61 & EUR 1,086.47 per ounce

15 Feb: USD 1,353.70, GBP 962.21 & EUR 1,084.45 per ounce

14 Feb: USD 1,330.75, GBP 959.74 & EUR 1,077.77 per ounce

13 Feb: USD 1,329.40, GBP 955.04 & EUR 1,077.61 per ounce

12 Feb: USD 1,321.70, GBP 955.19 & EUR 1,077.45 per ounce

Silver Prices (LBMA)

19 Feb: USD 16.72, GBP 11.92 & EUR 13.46 per ounce

16 Feb: USD 16.84, GBP 11.97 & EUR 13.49 per ounce

15 Feb: USD 16.83, GBP 11.98 & EUR 13.49 per ounce

14 Feb: USD 16.58, GBP 11.97 & EUR 13.43 per ounce

13 Feb: USD 16.61, GBP 11.94 & EUR 13.46 per ounce

12 Feb: USD 16.43, GBP 11.86 & EUR 13.39 per ounce

Please share our research with family, friends and colleagues who you think would benefit from being informed by it.

Mark O'Byrne

This update can be found on the GoldCore blog here.

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information containd in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.