Stock Market End Is Near

Stock-Markets / Stock Markets 2018 Feb 20, 2018 - 04:05 PM GMTBy: Arkadiusz_Sieron

The doomsayers have been calling for recession for years. Mainstream economists laughed at them, painting a rosy picture. However, the recent plunge in the stock market strengthened the pessimists’ hand. They interpret the dive as a signal of a coming recession. Is the end of the stock market boom really near?

The doomsayers have been calling for recession for years. Mainstream economists laughed at them, painting a rosy picture. However, the recent plunge in the stock market strengthened the pessimists’ hand. They interpret the dive as a signal of a coming recession. Is the end of the stock market boom really near?

What Lies Ahead?

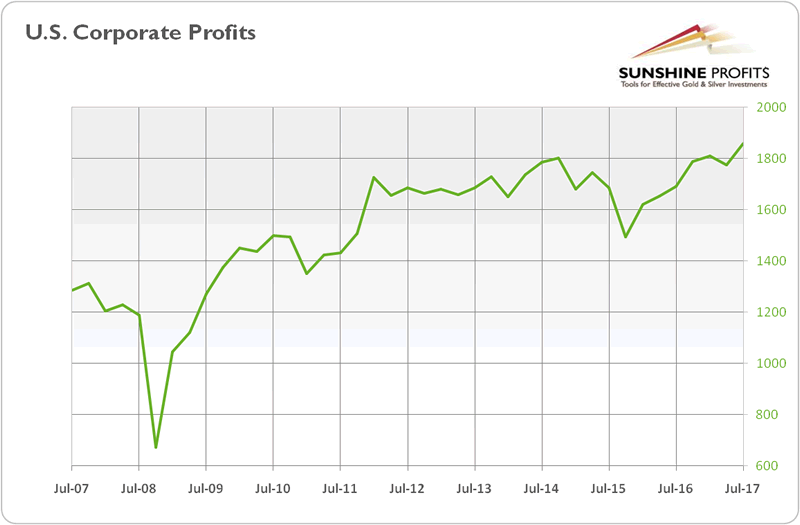

The recent stock market turmoil brought traders to their knees. We, of course, covered the descent for our readers, calling for calm. We urged investors not to panic about the free-fall, as it wasn’t driven by any meaningful change in the underlying fundamentals. Actually, corporate earnings have been rising recently, as one can see in the chart below.

Chart 1: U.S. Corporate Profits after Tax (billions of dollars) over the last ten years.

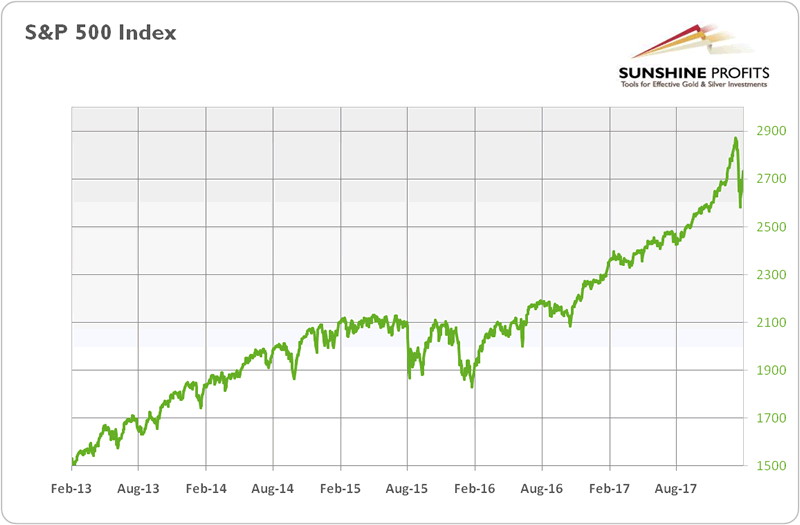

And, indeed, the pullback was temporary and equities recovered over half the decline last week (see Chart 2). However, the question remains: “Was this a healthy correction after months of continuous gains, or the beginning of a great financial calamity?” The answer is crucial – not only for stocks, but also for gold.

The Case for a Downturn

Fed. The main argument for the approaching crisis is the U.S. central bank. It’s not surprising, given that most of the recessions were triggered by monetary policy tightening. Why should it be different now? The Fed is hiking interest rates and unwinding its mammoth balance sheet. Actually, this time may be much worse, as the bank is withdrawing from unprecedented easy monetary policy, including quantitative easing and ZIRP.

And we shouldn’t forget about the Fed’s rationale behind the unconventional monetary policy. The U.S. central bank purchased bonds to encourage an asset-substitution effect. The idea was simple: to make investors shift out of bonds and into equities. The plan worked. It even went too well, as the S&P 500 soared more than 300 percent since 2009 (the chart below displays the rise over the last five years). These impressive gains were partially caused by the economic recovery, for sure. But the exceptionally depressed interest rates and embarrassingly low bond yields also were responsible for the stock market bonanza.

Chart 2: S&P 500 Index over the last five years.

The implication is inexorable. When interest rates normalize, the stock prices will adjust accordingly. With higher yields, bonds become more attractive, while equities become less attractive. It’s so simple. This is what investors are afraid right now. That Fed will kill the expansion. In such a regime, good economic news means bad news for the stock market, as it increases the odds of the next interest rate hike.

The Case against a Downturn

This narration is convincing. Happy times don’t last forever. And the U.S. economic expansion is quite old. But it doesn’t say anything about timing. The current bull market may, thus, still last a while. Given its poor track-record, there are non-negligible chances that the Fed will overact, risking a premature recession. However, it has been staying one step behind so far. The FOMC may turn a bit more hawkish this year, but the revolution is not likely. The financial conditions should remain easy.

Conclusions

What does it all mean for the gold market? The recessionary scenario would be much better for bullion, of course. But – in spite of many risks – the end may be not so near. However, markets are forward-looking. The longer the expansion lasts and the longer the Fed tightens, the more concerned the investors may become. The stock market volatility is already on the rise. Combined with worries about inflation and erroneous trade and fiscal policies, it may prompt investors to reconsider purchasing some safe-havens, such as gold. The weak dollar also supports the price of gold. Actually, PIMCO analysts claim that the U.S. conducts a cold currency war and weakens the greenback on purpose. Even if it is not true, the policy mix – the Fed behind the curve plus trade protectionism plus a fiscal expansion at the wrong time of the business cycle – works as if this were the case. It implies that even if the recession is not around the corner, gold may shin

If you enjoyed the above analysis and would you like to know more about the gold ETFs and their impact on gold price, we invite you to read the April Market Overview report. If you're interested in the detailed price analysis and price projections with targets, we invite you to sign up for our Gold & Silver Trading Alerts . If you're not ready to subscribe at this time, we invite you to sign up for our gold newsletter and stay up-to-date with our latest free articles. It's free and you can unsubscribe anytime.

Arkadiusz Sieron

Sunshine Profits‘ Market Overview Editor

Disclaimer

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Arkadiusz Sieron Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.