Bitcoin or British Pound ‘Pretty Much Failed’ As Currency?

Commodities / Gold and Silver 2018 Feb 21, 2018 - 12:48 PM GMTBy: GoldCore

– Bitcoin has ‘pretty much failed’ as a currency says Bank of England Carney

– Bitcoin has ‘pretty much failed’ as a currency says Bank of England Carney

– Bitcoin is neither a store of value nor a useful way to buy things – BOE’s Carney

– Project fear against crypto-currencies or an out of control investing bubble?

– Bitcoin will likely recover in value but is speculative and not for widows and orphans

– British pound has been a terrible store of value – unlike gold

– Pound collapsed 30% in 2016 and down 11.5% per annum versus gold in last 15 years

– Fiat currency experiment may fail and dollar set to lose reserve currency status

Sputniknews.com interview GoldCore

Sputnik: After a significant fall in the currency during December and January, Bitcoin is showing signs of a recovery in value. Could we see the coin regain value pre-2018 levels?

Mark: Yes, it’s quite possible, given the state of markets these days with the amount of liquidity that’s sloshing around the financial system due to QE and ultra loose monetary policies.

So the short answer is yes we could. But nobody has a crystal ball and nobody knows for definite. I think it’s quite interesting from a speculation point of view and I think that’s how some of the smart money around the world is seeing it — as an interesting speculation. However, it is very high risk, people need to be aware of that and it’s not for ‘widows and orphans’.

Given the degree of volatility we’ve seen in recent weeks and the massive 60% collapse we saw and also the huge risks we see with the various crypto exchanges around the world. The risk is Bitcoin’s volatility itself but also the intermediate risk and the counterpart risk behind how you own that bitcoin with exchanges having been hacked and subject to fraud.

Sputnik: Are these recent comments from Carney another attempt of asserting elements of ‘project fear’ against potential crypto-investors or a stark statement of an out of control investing bubble?

Mark: I think it’s a bit of both. I think there is a bit of an element of project fear and a lot of the central banks seem to feel threatened by Bitcoin but at the same time I think the wider cryptocurrency marketplace has been showing signs of an out of control bubble.

The cryptocurrencies – most of them, and there’s hundreds of them, were surging in value going up ten, fifty, a hundred times in value … some of them. Bitcoin, Ethereum and one or two others have real world applications, but who’s to know which cryptos will survive?

Mark Carney, Governor of the Bank of England, said they have not been a medium exchange and that’s true for a period of time now. And that’s the real vision of Satoshi Nakamoto, the Founder of Bitcoin, so it’s not a medium exchange now and it’s not showing the characteristics of storing value in recent weeks, but who’s to know? History will tell us in time whether Bitcoin does become a store for value … and it possibly could. It’s hard to know – at this stage as there is a degree of volatility that suggests that it won’t be but who knows … there are so many variables and this may change over time.

Sputnik: Back in January, we were seeing a lot people who invested in Bitcoin and other crypto-currencies actually sell and re-invest in fiat depressed currencies like Gold and Silver. Are we seeing a return of traditional assets?

Mark: There definitely was a move and we saw that ourselves, I think the smarter people in the cryptocurrency space realized the gains we were seeing were oversized and we were therefore due a sharp correction. Some of those guys were diversifying into Gold and Silver, the two primary precious metals which have a proven store of value over time with a huge amount of research behind them, showing that they are hedges and a store of value.

I think this trend will continue due to the degree of volatility we’re seeing in markets and also the big risks that are out there in terms of things like Brexit and the Trump presidency. There is a lot of political and economic uncertainty out there which will lead to an increased demand for gold.

Ultimately, Gold is a reliable store of value as fiat currencies haven’t been a store of value for some time.

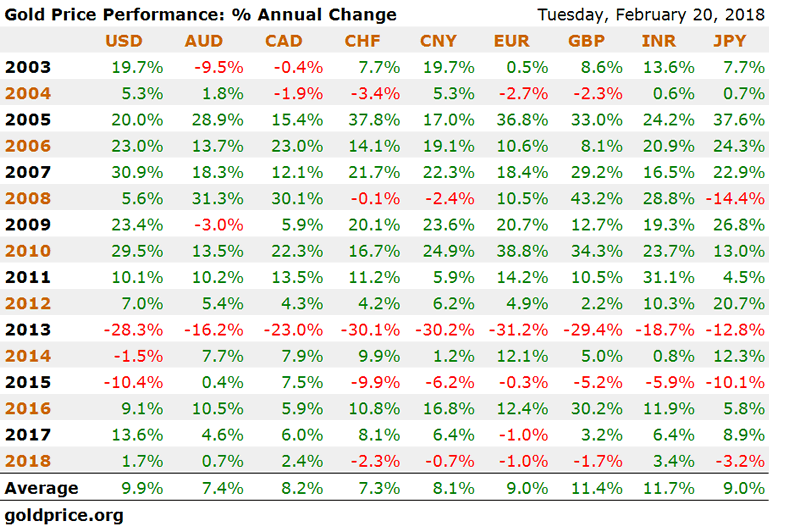

Mark Carney is now presiding over The Bank of England and sterling itself has been a terrible store of value. Sterling fell 30.2% in 2016 alone after the Brexit vote and that’s a massive fall in the value of sterling in one year. Over the last 15 years sterling was down 11.4% per annum against gold (see table above).

Gold has clearly shown its characteristics as a way to protect yourself as a true store of value against devaluation of fiat currencies. Fiat currencies lose their value over time.

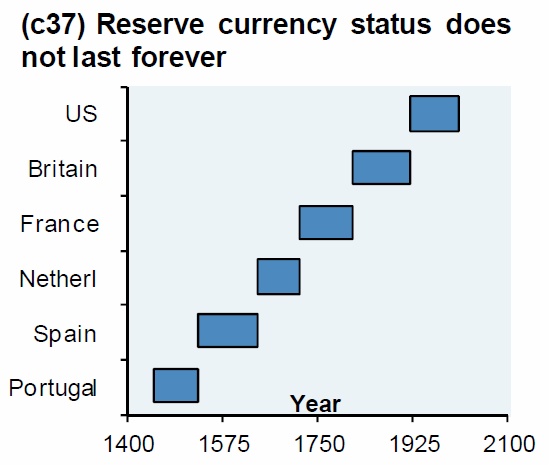

There have been many reserve currencies throughout history. If you go back to 1450, it was the Portuguese who had the reserve currency of the world. It was then the Spanish, then the Dutch, then the French, then England during the British Empire and finally, more recently we have the American Dollar as the reserve currency of the world.

The dollar and the degree of debt that Trump is running up is out of control. Trump is running up a 1 trillion-dollar plus deficits now so I think there is a real risk that the dollar and other fiat currencies are going to be further debased in the coming years.

It’s for this reason that so many techies and investors believe in Bitcoin, because they think it will act as a hedge against this risk in the same way that gold does. I think that this has yet to be seen. It may well do, but there is no guarantee because there are so many variables.

Sputnik.com interview transcript here

Gold Prices (LBMA AM)

20 Feb: USD 1,337.40, GBP 955.97 & EUR 1,083.83 per ounce

19 Feb: USD 1,347.40, GBP 961.10 & EUR 1,085.47 per ounce

16 Feb: USD 1,358.60, GBP 964.61 & EUR 1,086.47 per ounce

15 Feb: USD 1,353.70, GBP 962.21 & EUR 1,084.45 per ounce

14 Feb: USD 1,330.75, GBP 959.74 & EUR 1,077.77 per ounce

13 Feb: USD 1,329.40, GBP 955.04 & EUR 1,077.61 per ounce

12 Feb: USD 1,321.70, GBP 955.19 & EUR 1,077.45 per ounce

Silver Prices (LBMA)

20 Feb: USD 16.57, GBP 11.85 & EUR 13.42 per ounce

19 Feb: USD 16.72, GBP 11.92 & EUR 13.46 per ounce

16 Feb: USD 16.84, GBP 11.97 & EUR 13.49 per ounce

15 Feb: USD 16.83, GBP 11.98 & EUR 13.49 per ounce

14 Feb: USD 16.58, GBP 11.97 & EUR 13.43 per ounce

13 Feb: USD 16.61, GBP 11.94 & EUR 13.46 per ounce

12 Feb: USD 16.43, GBP 11.86 & EUR 13.39 per ounce

Please share our research with family, friends and colleagues who you think would benefit from being informed by it.

Mark O'Byrne

This update can be found on the GoldCore blog here.

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information containd in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.