Gold Bulls, Brace Yourselves – Fed Interest Rate Hikes Are Coming!

Commodities / Gold and Silver 2018 Feb 22, 2018 - 09:55 PM GMTBy: Arkadiusz_Sieron

Are they? As usual, the FOMC minutes provoked diverse interpretations, both dovish and hawkish. Let’s analyze them, separating the wheat from the chaff. What do the recent minutes really mean for the gold market?

Are they? As usual, the FOMC minutes provoked diverse interpretations, both dovish and hawkish. Let’s analyze them, separating the wheat from the chaff. What do the recent minutes really mean for the gold market?

Hawks Attack Bullion

We have long warned investors about the hawkish treat. For example, as early as in the October edition of the Market Overview, we wrote that the Fed under Powell could be more hawkish than under Yellen. In December, after Powell’s nomination, we elaborated on our stance, pointing out two important changes: (1) the distinct macroeconomic environment – think about faster economic growth and more expansionary fiscal policy – in which Powell would have to act; (2) the composition of the FOMC in 2018 will move slightly from the dovish to the hawkish side. As a result, we stated that “a more hawkish policy would be a headwind for gold prices.”

Yesterday’s developments seem to confirm our opinion. The U.S. central bank published the minutes from the recent FOMC meeting. They showed that “members agreed that the strengthening in the near-term economic outlook increased the likelihood that a gradual upward trajectory of the federal funds rate would be appropriate.” The main reasons for a more optimistic outlook were Trump’s tax cuts and rising inflation. See for yourself:

The projection for inflation over the medium term was revised up slightly, primarily reflecting tighter resource utilization in the January forecast. Total PCE price inflation in 2018 was projected to be somewhat faster than in 2017 despite a slower projected pace of increases in consumer energy prices; core PCE prices were forecast to rise notably faster in 2018, importantly reflecting both the expected waning of transitory factors that held down 12-month measures of inflation in 2017 as well as the projected further tightening in resource utilization. The staff projected that core inflation would reach 2 percent in 2019 and that total inflation would be at the Committee's 2 percent objective in 2020.

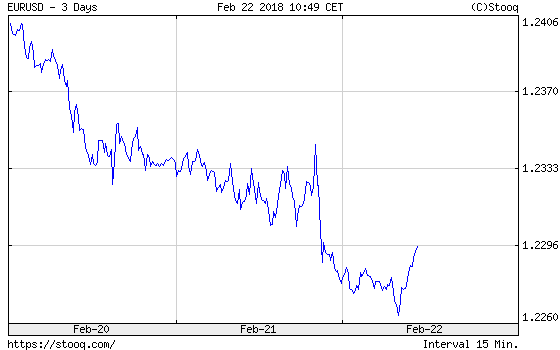

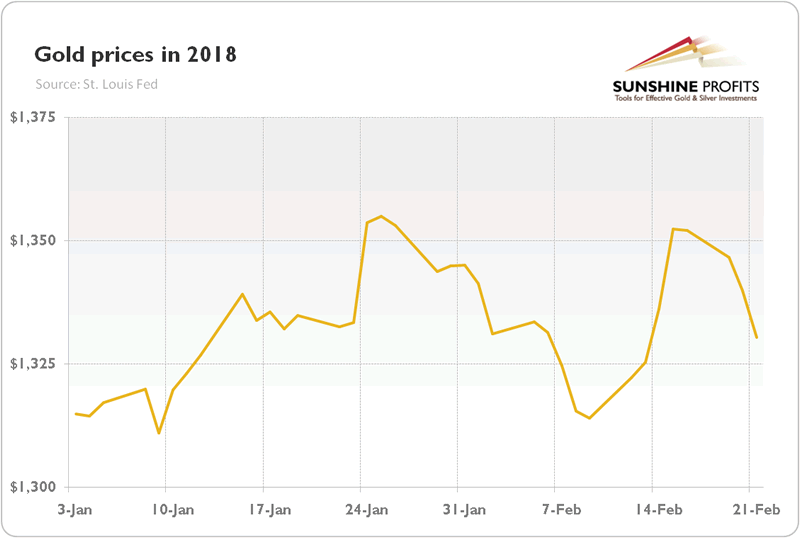

Pretty bad, huh? Higher inflation implies a more aggressive Fed. Indeed, the market odds of a March hike increased from 72 percent one month ago to 86 percent. And higher interest rates should eventually translate into a stronger greenback and lower gold prices. This relationship was (finally?) in force yesterday. As one can see in the charts below, the U.S. dollar hardened against the euro, while the price of gold dropped.

Chart 1: EUR/USD exchange rate over the last three days.

Chart 2: Gold prices (London P.M. Fix, in $) in 2018.

Doves Are Still Alive

Hold your hawks, the doves haven’t gone anywhere. First of all, only a few FOMC members worried about the outbreak of inflation:

A couple noted that a step-up in the pace of economic growth could tighten labor market conditions even more than they currently anticipated, posing risks to inflation and financial stability associated with substantially overshooting full employment.

And merely “a few” of the Fed’s 12 districts reported that entrepreneurs in their regions had more ability to raise prices.

What does it imply? Well, three rate hikes remain the base scenario for the Fed. We mean here that the minutes don’t provide new, revolutionary information about the stance of the FOMC. The latest monetary policy statement did the entire job – as we’ve already analyzed, it nicely telegraphed the upward revision of the inflation outlook.

Implications for Gold

Is gold doomed after the minutes, then? It may seem so. The market expectations of the interest rate path became more hawkish. The U.S. dollar rebounded, and gold prices fell. But let’s take a step back and review all the facts. Did we learn anything new about the Fed? No. Did the FOMC members signal four hikes this year? Not yet. To be clear: we do believe that the Fed will be more hawkish in 2018. But will it cease to stay behind the curve? Just a few weeks ago, the price of gold soared on fears about the Fed lagging the accelerating inflation. Did the recent minutes help to ease these worries? We are not so sure.

We agree that the March rate hike is probably a done deal, but the future remains obscure. Investors have to wait for Powell’s congressional testimony on monetary policy held on February 28 to hear more details. Until then, gold may stay under pressure, especially that political uncertainty related to the Italian national election on March 4 is likely to weigh on the euro in the near term. However, the U.S. trade and fiscal policies and fears about a twin deficit are strong reasons why the weakness in the greenback may continue in the medium term. Sounds nice for gold, doesn’t it?

If you enjoyed the above analysis and would you like to know more about the gold ETFs and their impact on gold price, we invite you to read the April Market Overview report. If you're interested in the detailed price analysis and price projections with targets, we invite you to sign up for our Gold & Silver Trading Alerts . If you're not ready to subscribe at this time, we invite you to sign up for our gold newsletter and stay up-to-date with our latest free articles. It's free and you can unsubscribe anytime.

Arkadiusz Sieron

Sunshine Profits‘ Market Overview Editor

Disclaimer

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Arkadiusz Sieron Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.