Four Key Themes To Drive Gold Prices In 2018 – World Gold Council

Commodities / Gold and Silver 2018 Mar 01, 2018 - 06:29 PM GMTBy: GoldCore

– Four key themes to drive gold prices in 2018 – World Gold Council annual review

– Four key themes to drive gold prices in 2018 – World Gold Council annual review

– Monetary policies, frothy asset prices, global growth and demand and increasing market access important in 2018

– Weak US dollar in 2017 saw gold price up 13.5%, largest gain since 2010

– “Strong gold price performance was a positive for investors and producers, and was symptomatic of a more profound shift in sentiment: a growing recognition of gold’s

role as a wealth preservation and risk mitigation tool”

– China’s gold coins and bars market recorded its second-best year ever

– German, central bank and technological demand supporting gold prices

– Latest Goldnomics podcast explores these and other themes

Editor: Mark O’Byrne

Annual Review 2017 has just been released by the World Gold Council (WGC) and it’s annual report on the gold market and the outlook for gold prices is fact based, comprehensive and well worth a read – especially the section ‘Market Outlook for 2018’.

2017 was a relatively quiet one for gold prices, which was surprising given the increasing tensions and turbulence going on in the rest of the financial and particularly political spheres. The World Gold Council’s comprehensive analysis strongly suggests that the set up for gold is very positive and we are on the verge of further gains in the coming years.

This is also our own view which we expanded upon in the just released latest Goldnomics podcast (Episode 3).

Gold demand fell slightly but supply was also down

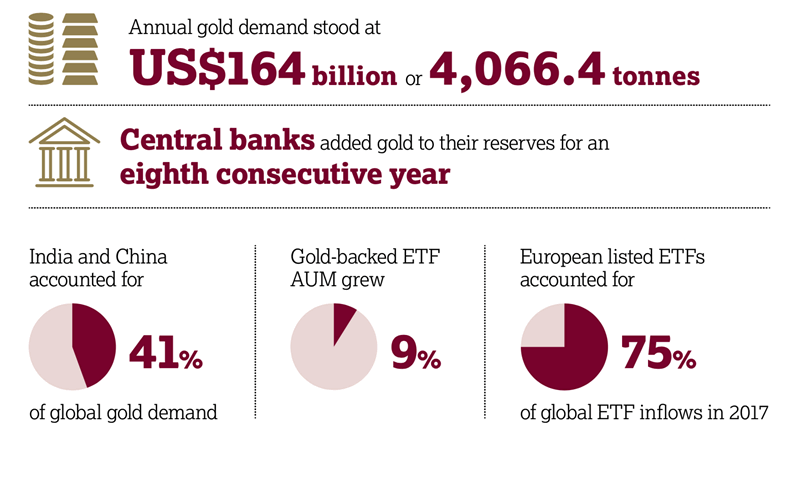

2017 was a challenging year for gold demand: it fell to its lowest level since 2009. Investment and central bank demand accounted for most of the decline.

There were two interesting positive increases in gold demand in 2017; central banks and the technology industry. Whilst central bank demand did decline from the previous year, it was still notable.

According to the World Gold Council we are set to see both of these factors rise in 2018 which bodes well for gold prices.

Central banks continue buying as tensions rise between West and East

Last year made for the eighth consecutive year that central banks added to their gold reserves. As mentioned in our latest podcast this demand is high, but it could increase even more given the level of foreign exchange reserves.

Just this last week the news broke that the Russian central bank added a further 18 tonnes to their gold reserves. By way of reminder this is the bank that last year said it was stocking up on gold in order to “beef up national security.”

2017’s most notable central banks buying gold were Russia, Turkey and Kazakhstan. The former two having made some bold statements in recent times about protecting themselves from US dollar hegemony.

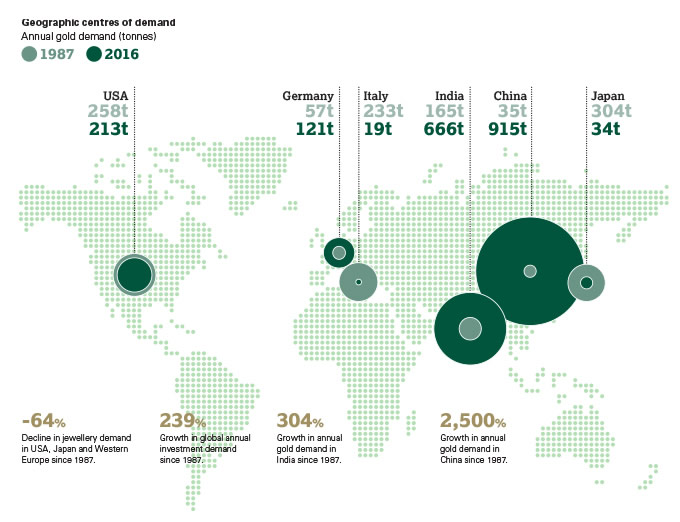

China, Russia, Iran and more recently Turkey have made no secret of their desire to operate outside of the financial and monetary control mechanisms the U.S. has managed to control for so long. China (another major central bank buyer) is the most important in this regard but each of these countries have actively encouraged private gold ownership as well as national, in order to reduce their reliance on and exposure to the US dollar.

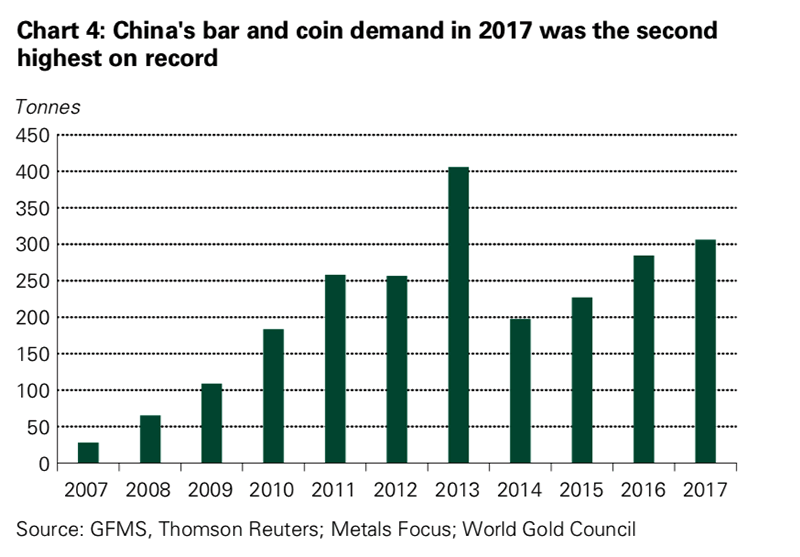

Interestingly, the WGC highlight China’s phenomenal gold buying record which rose again once again in 2017 to the second highest level on record.

Geopolitical changes are seen as driving factors for the 2018 gold price by both the WGC and ourselves.

The WGC draw particular attention to the sabre-rattling between North Korea and the United States. Whilst in our latest podcast we do touch on North Korea we also consider a number of factors including the ‘massive’ destabilisation of the Middle East. We discuss rising political tensions as well as what uncertainty and war mean for the gold price. Hint … increased safe haven demand.

Tech demand for gold

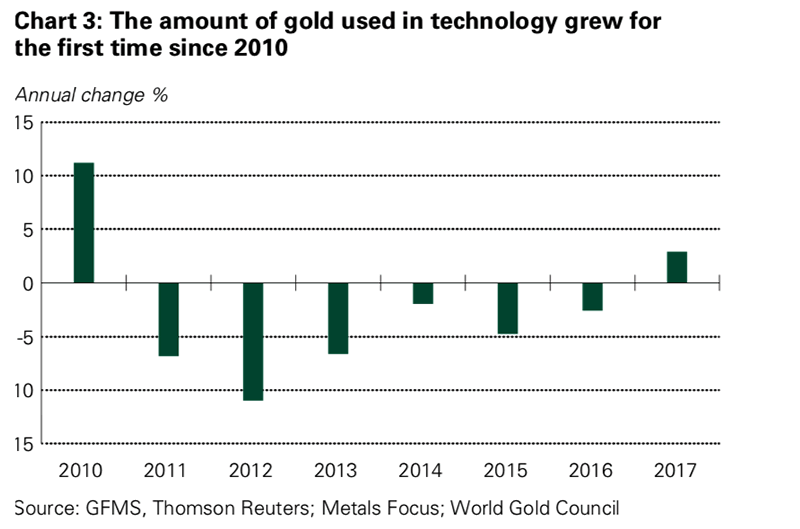

In 2017 demand for gold in technology increased for the first time since 2010. The WGC expects this to be an ongoing trend as both the semi-conductor sector and gold nanoparticle-based technologies grow in popularity.

After contracting year after year since 2010, we expect technology demand to stabilise and, in some areas, grow over the coming years.

Back to Basics: Supply and Demand

The WGC look to synchronised global economic growth, monetary policy, frothy asset prices and market transparency and access including Sharia gold demand to drive the gold market into 2018.

Monetary policy and frothy asset prices are those grabbing the headlines of late. It may be surprising to many investors but higher interest rates are good news for gold (as discussed here) whilst frothy asset prices could lead to yet another stock market crash and indeed another financial crisis. Investors should realise that cash can quickly turn to trash and how bail-ins are a very real threat today.

However, it is the basics of supply and demand which are key to the price of gold in the long-term.

The underlying fundamentals of gold, particularly on the supply side, and the advent of peak gold, help to underpin gold’s likely rise to $10,000 in the long term.

Most commentators focus on the demand side of the gold market but we consider the supply side to be just as important. As discussed in our podcast we are seeing supply drop. According to this latest report from the WGC ‘Total supply [in 2017] fell 4% compared to 2016. Declines in recycling and hedging activity offset a modest rise in mine production.’

It is increasingly expensive to mine gold and there have been no major gold discoveries in recent years. How will this play out in the long term when gold demand has been increasing on average by 18% per year in recent years?

Elon Musk’s grand plans to mine in space gets lots of headlines and uninformed press which misguided gold bears use to bolster their weak central thesis. In truth, mining gold on asteroids or on Mars is fake gold news.

There is no real threat here to the gold market. Indeed, the notion of mining on other planets is laughable nonsense. It is not feasible today and if it does become feasible, the cost per ounce of “space gold” or “asteroid gold” will be hundreds of thousands of dollars if not million of dollars per ounce.

We discuss many of the 2018 factors raised by the WGC in Goldnomics but expand into other areas, notably the key decisions and lessons investors must take in the current environment when it comes to protecting their assets and the importance of owning gold in the safest way possible. Not all types of gold are made equal.

Annual Review 2017 and Outlook 2018 can be accessed via the World Gold Council here

Gold Prices (LBMA AM)

01 Mar: USD 1,311.25, GBP 953.80 & EUR 1,075.75 per ounce

28 Feb: USD 1,320.30, GBP 951.14 & EUR 1,080.53 per ounce

27 Feb: USD 1,332.75, GBP 954.78 & EUR 1,081.26 per ounce

26 Feb: USD 1,339.05, GBP 953.00 & EUR 1,085.30 per ounce

23 Feb: USD 1,328.90, GBP 951.09 & EUR 1,079.20 per ounce

22 Feb: USD 1,323.50, GBP 952.66 & EUR 1,076.40 per ounce

21 Feb: USD 1,328.60, GBP 952.87 & EUR 1,078.16 per ounce

Silver Prices (LBMA)

01 Mar: USD 16.32, GBP 11.87 & EUR 13.39 per ounce

28 Feb: USD 16.44, GBP 11.88 & EUR 13.45 per ounce

27 Feb: USD 16.61, GBP 11.91 & EUR 13.48 per ounce

26 Feb: USD 16.67, GBP 11.88 & EUR 13.52 per ounce

23 Feb: USD 16.61, GBP 11.88 & EUR 13.50 per ounce

22 Feb: USD 16.47, GBP 11.86 & EUR 13.40 per ounce

21 Feb: USD 16.44, GBP 11.80 & EUR 13.35 per ounce

Mark O'Byrne

This update can be found on the GoldCore blog here.

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information containd in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.