Why Did You Send Gold Lower, Mr. Powell?

Commodities / Gold and Silver 2018 Mar 01, 2018 - 10:44 PM GMTBy: Arkadiusz_Sieron

Not nice, Mr. Powell! Gold prices fell more than 1 percent after your comments as the Federal Reserve’s new chairman. What did you say – and what are the implications for the precious metals market?

Not nice, Mr. Powell! Gold prices fell more than 1 percent after your comments as the Federal Reserve’s new chairman. What did you say – and what are the implications for the precious metals market?

As We Warned, Powell Is More Hawkish

We have been alerting investors about the hawkish turn at the FOMC for a long time. For example, in the Gold News Monitor on February 13, we wrote that Powell could move faster on normalization than Yellen, as the macroeconomic conditions have become more favorable. As the Fed Chairman pointed out during his first testimony to the House Financial Services Committee,

While many factors shape the economic outlook, some of the headwinds the U.S. economy faced in previous years have turned into tailwinds: In particular, fiscal policy has become more stimulative and foreign demand for U.S. exports is on a firmer trajectory.

Exactly. Fiscal policy became more accommodative, the GDP growth accelerated, the U.S. dollar weakened, strengthening the exports. Inflation ticked up and the composition of the FOMC changed and now includes more hawks than in 2017. In such an environment, Powell has no choice but to adopt a more firm position. If such a stance finally manages to strengthen the greenback, gold may suffer.

Gradual Tightening Remains, but…

Surely, Powell will continue the Yellen’s policy of gradual normalization. The most highlighted in media paragraph underlined the balance between allowing the economy to grow more without triggering a bust and preventing overheating:

In gauging the appropriate path for monetary policy over the next few years, the FOMC will continue to strike a balance between avoiding an overheated economy and bringing PCE price inflation to 2% on a sustained basis.

Powell also added further gradual increases in the federal funds rate will be the best policy stance. So brace yourselves for an interest rate hike in March and two further increases later this year. At least two. Will gold survive them?

…we Could See 4 Hikes in 2018

Powell will generally continue the gradual tightening. But it may be a bit faster than under Yellen. In 2017, the Fed raised the federal funds rate three times. This is still a consensus among the Fed officials. But Powell – accidentally or not – hinted the fourth hike. Responding to Rep. Carolyn Maloney, who asked what would cause the Federal Reserve to hike more than three times that the central bank’s guidance currently calls for, he said:

Thank you, Ms. Maloney. You’re right that every quarter, every participant in the FOMC submits a projection of what they feel is going to happen to the economy and also their projection for appropriate monetary policy. And at the December meeting, the median participant called for three rate increases in 2018. Now since then – we will submit another projection, all of us, in three weeks – but since then, what we’ve seen is incoming data that suggests that strengthening in the economy. We’ve seen continuing strength in the labor market. We’ve seen some data that will, in my case, add some confidence to my view that inflation is moving up to target. We’ve also seen continued strength around the globe, and we’ve seen fiscal policy become more stimulative. So I think each of us is going to be taking the developments since the December meeting into account and writing down our new rate paths as we go into the March meeting, and I wouldn’t want to prejudge that. (…) My personal outlook for the economy has strengthened since December,” he said. “I wouldn’t want to prejudge that new set of projections, but we’ll be taking into account everything that has happened since December.”

At first glance, Powell didn’t say anything extraordinary. But our impression is that he hinted that the fourth hike is definitely on the table. Thus, gold may struggle until the hike arrives.

Implications for Gold

Powell delivered his debut testimony before Congress as the Fed Chairman. He presented an upbeat view on the economy and opened the door to the fourth interest rates hike in 2018 (we has been warning about such possibility for a long time). He expressed also less concern about inequality and the performance of the stock market, pointing out that “the stock market is not the economy” and that “despite the recent volatility, financial conditions remain accommodative.”

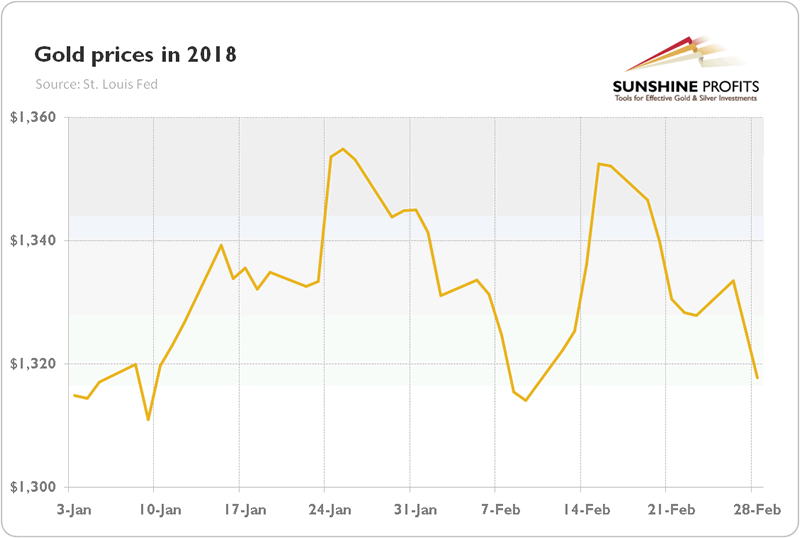

In effect, the market is now pricing a 83 percent chance of a rate hike in March. The U.S. dollar strengthened and the gold prices declined, as one can see in the chart below.

Chart 1: Gold prices in 2018 (London P.M. Fix, in $).

It may be just a short-term move. But after the first Powell’s public appearance as the Fed Chair, investors now are more certain what to expect from the new FOMC, namely that the Fed will be more hawkish this year. It should be supportive for the greenback and negative for gold. The question now is whether it will be enough to outweigh the impact of unsound fiscal and trade policy of the U.S. government (the support for the dollar from higher interest rates has weakened recently, as investors shift their focus on the U.S. twin deficit). And Powell will testify today before the Senate, so he will have a chance to modify his stance. Stay tuned!

Thank you.

If you enjoyed the above analysis and would you like to know more about the gold ETFs and their impact on gold price, we invite you to read the April Market Overview report. If you're interested in the detailed price analysis and price projections with targets, we invite you to sign up for our Gold & Silver Trading Alerts . If you're not ready to subscribe at this time, we invite you to sign up for our gold newsletter and stay up-to-date with our latest free articles. It's free and you can unsubscribe anytime.

Arkadiusz Sieron

Sunshine Profits‘ Market Overview Editor

Disclaimer

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Arkadiusz Sieron Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.