Silver Soared, So It’s Bullish, Right? Wrong

Commodities / Gold and Silver 2018 Mar 07, 2018 - 01:27 PM GMTBy: P_Radomski_CFA

It’s been only a couple of days since Thursday, when we closed our short positions and we have already seen a sizable rally in gold and silver. In fact, yesterday’s upswing was so significant that both precious metals already moved to the target areas that we featured on Monday, even though they were “scheduled” to move there at the end of the week. Is the top already in? Silver’s short-term outperformance definitely seems to suggest that it’s either in or at hand…

It’s been only a couple of days since Thursday, when we closed our short positions and we have already seen a sizable rally in gold and silver. In fact, yesterday’s upswing was so significant that both precious metals already moved to the target areas that we featured on Monday, even though they were “scheduled” to move there at the end of the week. Is the top already in? Silver’s short-term outperformance definitely seems to suggest that it’s either in or at hand…

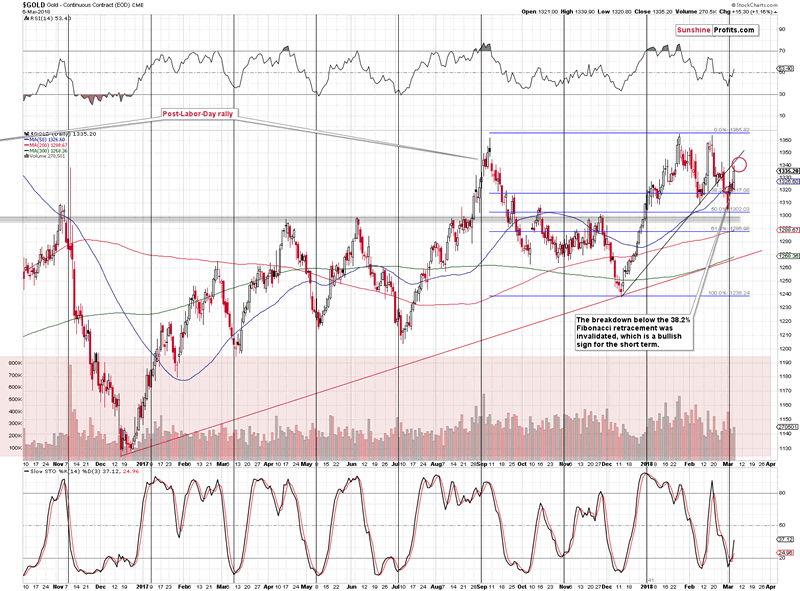

Let’s jump right into the charts, starting with gold (chart courtesy of http://stockcharts.com).

Gold’s Target Reached

On Monday, we argued that gold could move to the $1,340s before the rally is over and we marked this level with the red ellipse. Why there? That’s where we have the previous intraday high and the rising resistance line. The combination of these short-term resistance levels and the pace at which gold usually rallied both fit a scenario in which gold forms the next local top about $20 higher at the end of the week or very close to it.

But, gold has already moved to the middle of the target area, so is there any point in waiting an additional few days before viewing the outlook as bearish? After all, gold shouldn’t rally much higher from here if the rising resistance line is to hold.

In short, the above is mostly true – yesterday’s rally made the situation already somewhat bearish, but at the same time it’s not certain if the final short-term top for this week is already in. We could have a daily pause or so and another upswing before the final top is in. Still, it seems that we are already close to the top.

The most important bearish signs, however, don’t come from the gold market, but from the confirmations that we saw in other parts of the precious metals sector.

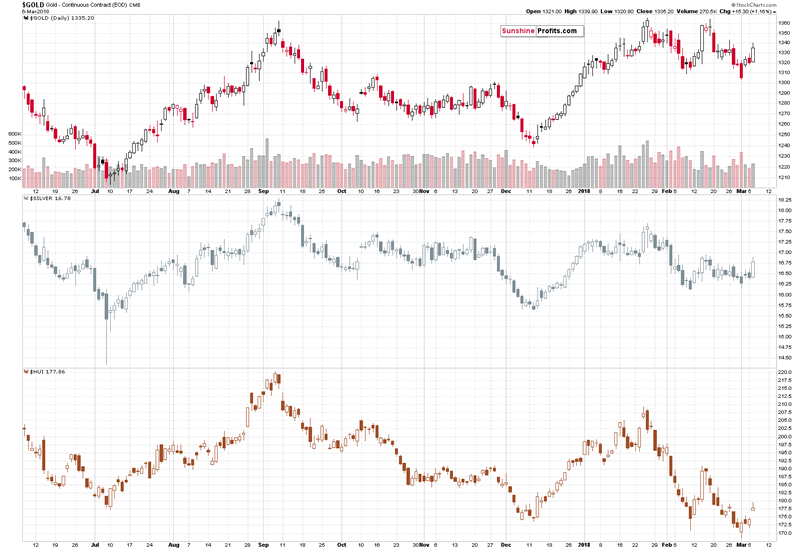

Precious Metals Sector’s Relative Performance

The two key things that simultaneously confirmed the bearish outlook for the precious metals sector are: silver’s very short-term outperformance and mining stocks weakness.

The above strength in silver and weakness in the miners become apparent when you compare yesterday’s upswing to the February 14th top. Gold is about halfway back to this level after the late-February decline. Silver almost reached its Valentine’s Day top and gold stocks (HUI) only managed to move to their February 26 top, which is very far from the February 14 high.

That’s a very classic sell signal – underperforming miners suggest that a top is near and the soaring and outperforming silver (on a very short-term basis) serves as an effective confirmation.

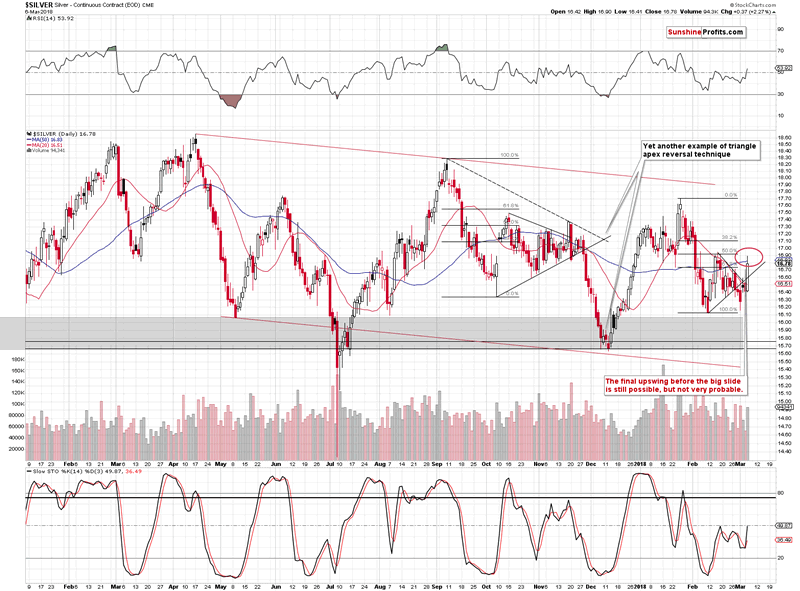

Silver Details

On Monday, we described silver’s similarity to the post-September 2017 decline, so we won’t get into the details again here, but we want to emphasize that that the pattern continues with remarkable accuracy.

The sudden jump in the price of silver that we saw yesterday is most likely the analogy to the November 17, 2017 daily rally. The rally that preceded the big daily downswing and that was shortly followed by a decline of over $1.50. The implications here are bearish, not only in light of this specific analogy, but because silver outperformed gold on a very short-term basis right before declining multiple times in the past.

We wrote that silver was likely to rally above its short-term declining resistance line and the 50-day moving average and to top close to its mid-February high, likely outperforming gold. This is exactly what we saw yesterday when silver moved to our target area and thus it seems that a bearish outlook is once again justified.

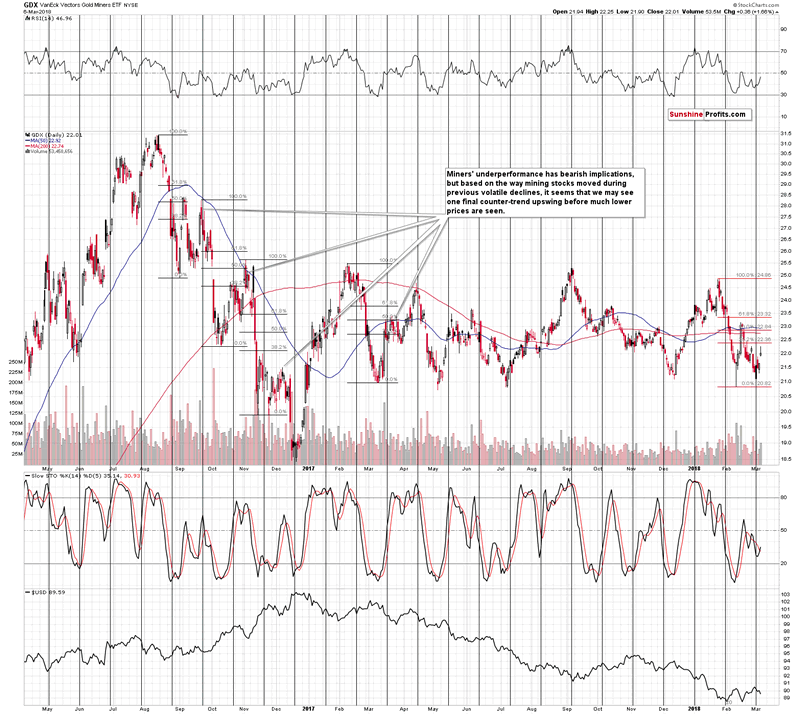

Miners’ Second Rally

Mining stocks (we’re using the GDX ETF as a proxy) are underperforming not only relative to the late-February decline. They underperform also relative to the previous cases that we marked on the above chart. During the previous volatile declines, mining stocks used to bounce twice before the decline resumed and the second bounce was not as small as what we saw this week. The implications of the underperformance are bearish.

Moreover, please note that yesterday’s session took form of a shooting star candlestick, which is a classic reversal sign if it is accompanied by sizable volume. The latter was not huge, but it was definitely sizable, and the bearish implications are already present.

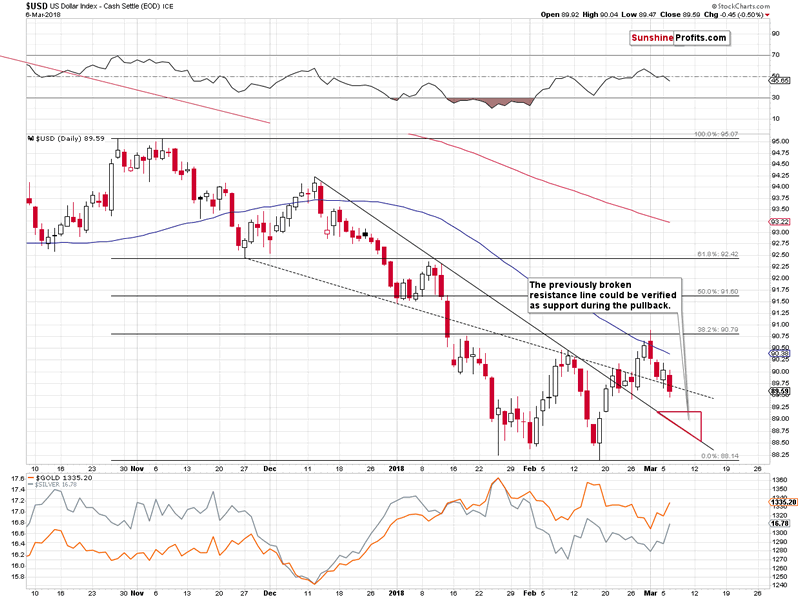

USD Index and Its Short-term Downswing

On Monday, we wrote that the decline to the February low could be seen, but that we doubted it. The reason was that the USD was after breakouts above the declining short-term support / resistance lines, so a move back to one of them seemed more likely. The implication is the above red triangle target area.

So far, the USD Index hasn’t moved to it, stopping at the late February lows. But does it have to move lower? Not necessarily.

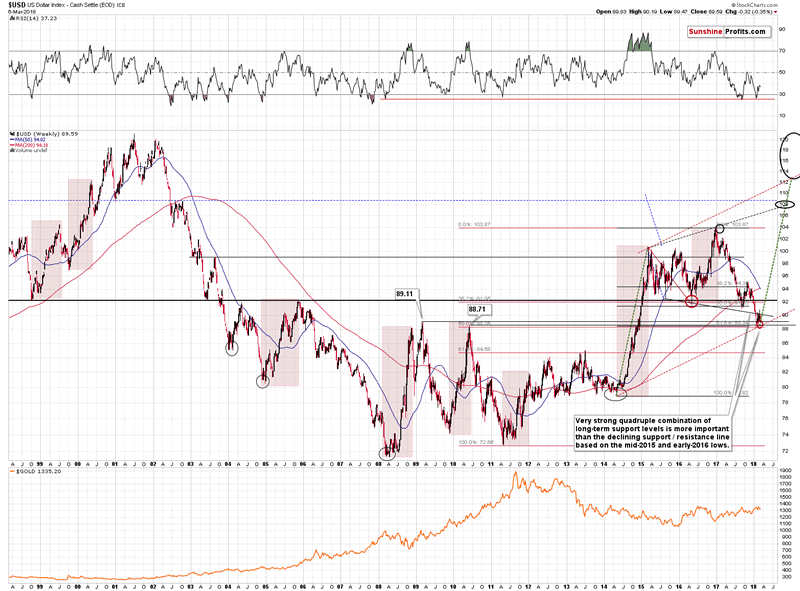

Let’s keep in mind that the USD Index is above a combination of very strong support levels and the big picture remains bullish. Consequently, the surprises are likely to be to the upside.

Still, with looming comments from Mario Draghi and the employment numbers, it seems that we could see some short-term volatility before the end of the week.

Will the USD decline further? It’s possible, but not inevitable. Will gold, silver and mining stocks rally further? They could, but we have already seen bearish confirmations and our target areas were reached, so the outlook is already bearish. It could get more bearish (or it could be invalidated) if the USD Index moves significantly lower in the following days and PMs refuse to really react to this sign. If this is the case we’ll send follow-up alerts.

Summary

Summing up, a major top in gold, silver and mining stocks is probably in, and based on the signs that we saw yesterday, the follow-up top could also be in. The key short-term signs: silver’s outperformance and miners’ underperformance point to it, but at the same time we should be prepared for another move lower in the USD and higher in PMs due to Draghi’s comments and the upcoming jobs report. Either way, it shouldn’t take long for the precious metals sector to reverse its course and move lower once again.

Thank you.

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Tools for Effective Gold & Silver Investments - SunshineProfits.com

Tools für Effektives Gold- und Silber-Investment - SunshineProfits.DE

* * * * *

About Sunshine Profits

Sunshine Profits enables anyone to forecast market changes with a level of accuracy that was once only available to closed-door institutions. It provides free trial access to its best investment tools (including lists of best gold stocks and best silver stocks), proprietary gold & silver indicators, buy & sell signals, weekly newsletter, and more. Seeing is believing.

Disclaimer

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Przemyslaw Radomski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.