Bond Market Interest Rate Yields Are Rising Again… Stocks Are on Thin Ice

Stock-Markets / Stock Markets 2018 Mar 11, 2018 - 05:51 PM GMTBy: Graham_Summers

The financial media is awash with claims that Gary Cohn’s resignation as Chief Economic Advisor is triggering a market collapse.

The financial media is awash with claims that Gary Cohn’s resignation as Chief Economic Advisor is triggering a market collapse.

While it’s true that a market collapse is starting again, it has nothing to do with Gary Cohn.

How do I know?

Because Gary Cohn first wrote a resignation letter back in August 2017 in the wake of the Charlottesville mess… and stocks exploded higher beginning one of their greatest rallies in history.

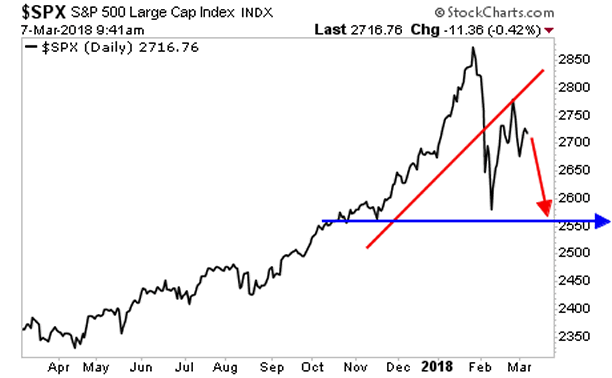

Put simply: stocks are not diving because of Gary Cohn; they are diving because the issue that first triggered the market meltdown in early February (rising rates) continues!

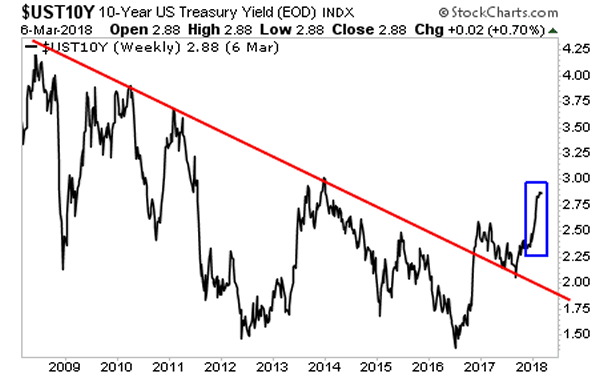

Remember, as I explained in my best-selling book The Everything Bubble: The Endgame For Central Bank Policy, the ENTIRE market rally following the 2008 Crisis was triggered by the Fed creating a bubble in US Sovereign Bonds, also called Treasuries.

Because our current financial system is based on debt, these bonds represent the bedrock for the entire financial system, with their yields representing the “risk free rate” of return against which EVERY asset class on the planet is priced.

As a result of this, when bond yields begin to rise, EVERY ASSET CLASS in the system (including stocks) adjusts accordingly.

In chart terms, THIS was what triggered the first leg down during this market collapse.

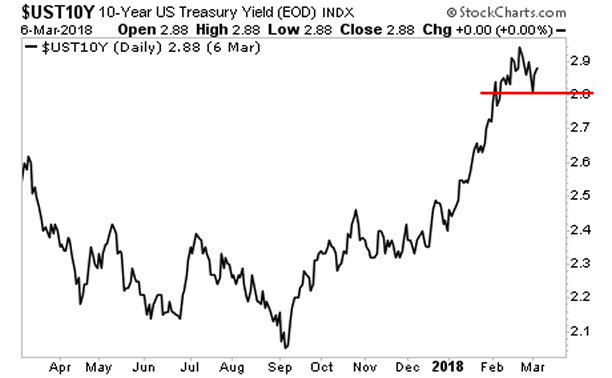

And guess what? Bonds yields bounced off support and are already turning back up again.

Which means… stocks will soon be revisiting the February lows.

On that note, we are already preparing our clients for this with a 21-page investment report titled the Stock Market Crash Survival Guide.

In it, we outline the coming collapse will unfold…which investments will perform best… and how to take out “crash” insurance trades that will pay out huge returns during a market collapse.

We’ve extended our offer to download this report FREE by one week. But this week is the last time this report will be available to the general public.

To pick up one of the last remaining copies…

https://www.phoenixcapitalmarketing.com/stockmarketcrash.html

Graham Summers

Phoenix Capital Research

http://www.phoenixcapitalmarketing.com

Graham also writes Private Wealth Advisory, a monthly investment advisory focusing on the most lucrative investment opportunities the financial markets have to offer. Graham understands the big picture from both a macro-economic and capital in/outflow perspective. He translates his understanding into finding trends and unde74rvalued investment opportunities months before the markets catch on: the Private Wealth Advisory portfolio has outperformed the S&P 500 three of the last five years, including a 7% return in 2008 vs. a 37% loss for the S&P 500.

Previously, Graham worked as a Senior Financial Analyst covering global markets for several investment firms in the Mid-Atlantic region. He’s lived and performed research in Europe, Asia, the Middle East, and the United States.

© 2018 Copyright Graham Summers - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Graham Summers Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.