Unbiased Gold Analysis of Draghi Dropping the Bias

Commodities / Gold and Silver 2018 Mar 14, 2018 - 11:43 AM GMTBy: Arkadiusz_Sieron

The ECB dropped its easing bias on Thursday. Monetary hawks are pleased. But doves are holding tight. And what does gold do?

Hawks Awaken in Frankfurt…

A major change at the European Central Bank! On Thursday, it removed its long-standing pledge to increase bond buys if needed. In January we could read that statement:

(…) if the outlook becomes less favourable, or if financial conditions become inconsistent with further progress towards a sustained adjustment in the path of inflation, we stand ready to increase the asset purchase programme (APP) in terms of size and/or duration.

Now, it’s gone! What does it mean? The removal of that part of the monetary statement means that the ECB drops the explicit reference to the likelihood of an increase in the pace of purchases in the near future. In other words, the ECB abandoned its commitment to increase the size of quantitative easing, if necessary. It implies that the bank has taken another step away from its ultra-accommodative policy. It’s a hawkish change that should strengthen the euro further. The upward trend in the EUR/USD would support gold prices.

…but Doves Don’t Intend to Move Anywhere

Draghi pleased the hawks among the Governing Council by dropping the ECB’s intention to increase bond purchases when the outlook worsens. However, the stimulus won’t end overnight. The ECB will remain accommodative for a while. It moves at a very slow and gradual pace, in line with its doctrine of patience. Draghi will continue its quantitative easing at least until September. And even then, interest rates will remain very low for at least six months after that. Indeed, the ECB executive board member Benoit Coeure clearly told the French radio station BFM Business on Monday that “it is very clear to us that short term interest rates, the ones that are controlled by the central bank, will remain at very low levels, far beyond the horizon of our asset purchases.” It means that the ECB will remain less hawkish than the Fed. This should support the U.S. dollar, which would be bad for the gold market.

So, Who’s Right?

The ECB took hawkish action, but remains ultra-dovish. What is more important for the EUR/USD exchange rate and gold? Change, of course. Investors think at the margin. States don’t count, only changes matter – unless they don’t, since they are too small to make a difference, or are smaller than expected.

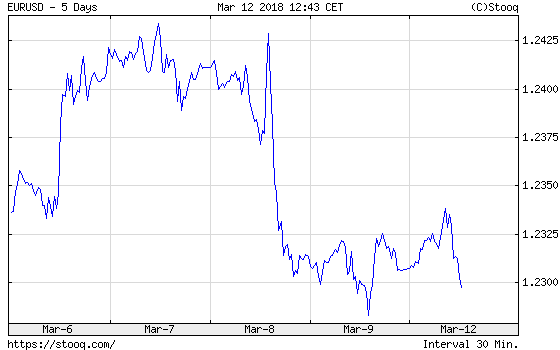

Let’s look at the chart below. As one can see, the euro initially strengthened against the U.S. dollar in response to Draghi’s comments.

Chart 1: EUR/USD exchange rate over the last few days.

So at the beginning, investors interpreted Thursday’s move as a signal that the ECB is more certain about the economic outlook for the Eurozone (the outlook for real GDP growth has been revised up for 2019) and, thus, it’s (slowly) preparing the exit from its quantitative easing program. However, after a while, the euro dropped like a stone.

What happened? Well, it seems that investors had expected that Draghi would be even more hawkish (after all, the interest rates will remain low). And on Thursday Trump signed an order to impose tariffs on steel and aluminum imports, which could affect the markets. The U.S. dollar could strengthen as part of a “sell the rumor, buy the fact” strategy.

Implications for Gold

The ECB’s removal of its easing bias is an important step towards the end of its crisis-era support. Surely, it’s a snail’s pace – but normalization is on track. Surely, it’s not revolution, but evolution. But markets are forward-looking, so the ECB’s hawkish signals, if strong enough, should be fundamentally supportive for the gold market.

However, the ECB’s doesn’t act in a vacuum. Many other factors simultaneously affect gold prices. Like Trump’s tariffs. Or the expectations of a Fed hike. The U.S. economy added 313,000 new jobs in February, well above forecasts. As a result, the market odds of a March hike increased even further and the price of gold fell. It suggests that gold may struggle in the short term, in line with the pattern of selling off ahead of the FOMC announcements and rallying after them. Stay tuned!

Thank you.

If you enjoyed the above analysis and would you like to know more about the gold ETFs and their impact on gold price, we invite you to read the April Market Overview report. If you're interested in the detailed price analysis and price projections with targets, we invite you to sign up for our Gold & Silver Trading Alerts . If you're not ready to subscribe at this time, we invite you to sign up for our gold newsletter and stay up-to-date with our latest free articles. It's free and you can unsubscribe anytime.

Arkadiusz Sieron

Sunshine Profits‘ Market Overview Editor

Disclaimer

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Arkadiusz Sieron Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.