Stocks Appear to be Under Pressure

Stock-Markets / Stock Markets 2018 Mar 20, 2018 - 01:34 PM GMT SPX has bounced off the 2-year trendline (not shown) yesterday. Overnight futures have only made a half-hearted rally, so we may see SPX remain under the mid-Cycle resistance at 2722.23. The 38.2% retracement level is at 2720.30. Should that be the case, the decline may resume after a brief probe to that level.

SPX has bounced off the 2-year trendline (not shown) yesterday. Overnight futures have only made a half-hearted rally, so we may see SPX remain under the mid-Cycle resistance at 2722.23. The 38.2% retracement level is at 2720.30. Should that be the case, the decline may resume after a brief probe to that level.

ZeroHedge reports, “After yesterday's violent selloff which was sparked by a series of negative tech stories including Facebook’s escalating data scandal and a fatal accident involving an Uber self-driving car, Tuesday trading has so far been relatively calm and muted with Europe bourses paring early gains and Asian stocks trading slightly lower...

while S&P futures were hugging the unchanged line as Nasdaq futures pointed to more tech declines.”

NDX bounced from the combined 50-day and mid-Cycle support at 6817.60. NDX futures are flat this morning.

ZeroHedge observes, “Former Lehman trader and current Bloomberg commentator Mark Cudmore can take a bow: just hours after his latest Macro View forecast predicted more turbulence for stocks and "another swoon", the S&P tumbled to just about 2,700 yesterday.

So after that quick elevator ride down, is it time to take the escalator back up? Not just yet.

In fact, in his latest macro view released overnight, Cudmore remains decidedly bearish, and notes that after yesterday "triple-whammy" of blows to the tech sector - Uber, FaceBook and crypto regulations - "those diverse stories will all converge to a similar, very negative outcome for the tech space: tighter regulation and oversight, plus an increase in compliance and legal costs and a significant blow to sentiment."

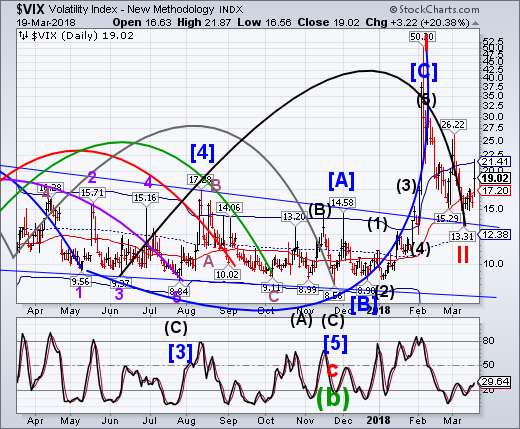

VIX futures are lower this morning. It’s odd that VIX appears to be suppressed without driving the price of stocks higher.

Bloomberg reports, “The burgeoning bludgeoning of large-cap U.S. technology stocks Monday -- largely driven by the Facebook data-misuse controversy -- has traders acutely anxious about the near-term outlook for the S&P 500 Index.

The VIX futures curve, whose contracts track the implied volatility of the benchmark U.S. stock index over time, is in backwardation. That is, March’s contract is more expensive than the second-month contract, and so on out to September.”

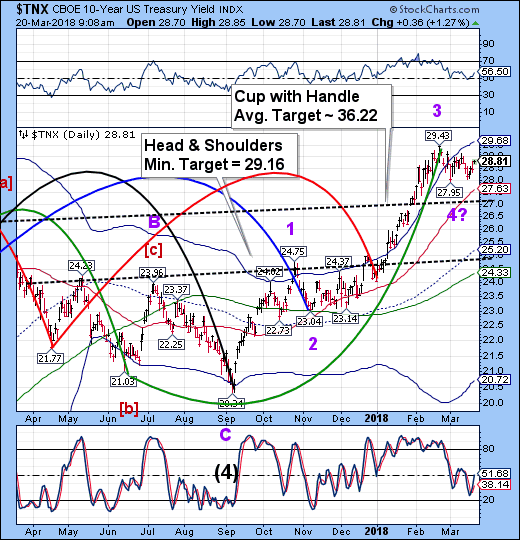

TNX is moving higher, but hasn’t broken out above prior highs. All of the moves since February appear to be corrective so it is difficult to ascertain the true direction from the patterns alone. The Cycles Model suggests a decline may start that would last through early April that is likely to complete Wave 4.

Regards,

Tony

Our Investment Advisor Registration is on the Web.

We are in the process of updating our website at http://mrpracticalinvestor.com/ to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinve4stor.com .

Anthony M. Cherniawski, President and CIOhttp://mrpracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals.

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.