What Happens Next When the Stock Market is Very Volatile

Stock-Markets / Stock Markets 2018 Mar 28, 2018 - 05:56 AM GMTBy: Troy_Bombardia

The stock market’s volatility is very high right now. And by “volatility”, we’re not referring to VIX. We’re referring to the S&P 500’s daily % movements.

The stock market’s volatility is very high right now. And by “volatility”, we’re not referring to VIX. We’re referring to the S&P 500’s daily % movements.

The stock market’s high volatility right now is not rare. There were a lot of historical periods with high volatility. What’s rare is that the stock market’s high volatility right now was preceded by a period of extremely low volatility (i.e. 2017 – January 2018).

Here’s today’s study: what happens next when:

- This is the first time in 1 year (252 trading days) in which….

- The S&P closed up or down at least 1% vs yesterday’s CLOSE….

- For 21 or more trading days out of the past 42 trading days (2 months).

Here are the historical cases

- March 26, 2018 (current case)

- January 25, 2016

- August 29, 2011

- September 4, 2007

- March 7, 2000

- December 15, 1997

- September 27, 1990

- October 27, 1987

- November 15, 1982

- April 7, 1980

- July 11, 1973

- June 4, 1970

- June 15, 1962

Let’s look at these historical cases in detail.

*We are eliminating all the cases that occurred near a recession because the economy is nowhere near a recession today. U.S. economic growth is solid. The next recession is at least 1 year (12 months) away. The economy and stock market move in the same direction over the medium-long term.

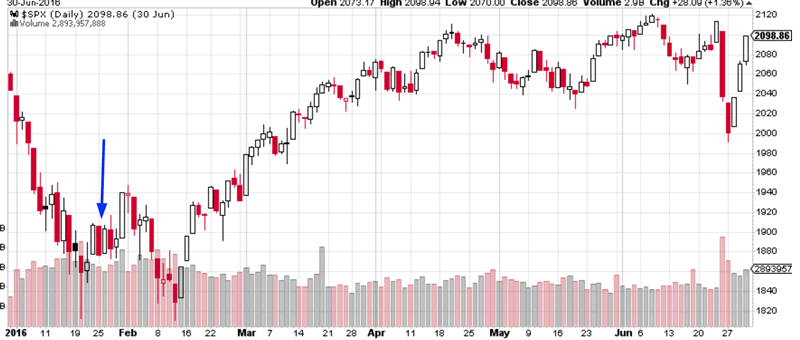

January 25, 2016

The S&P went down over the next 3 weeks. The next 6%+ “small correction” began 5 months later in June.

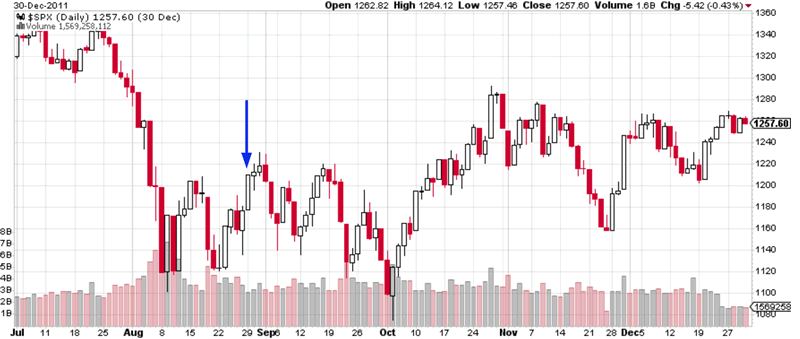

August 29, 2011

The S&P went down over the next month. The next 6%+ “small correction” began 7 months later in April 2012.

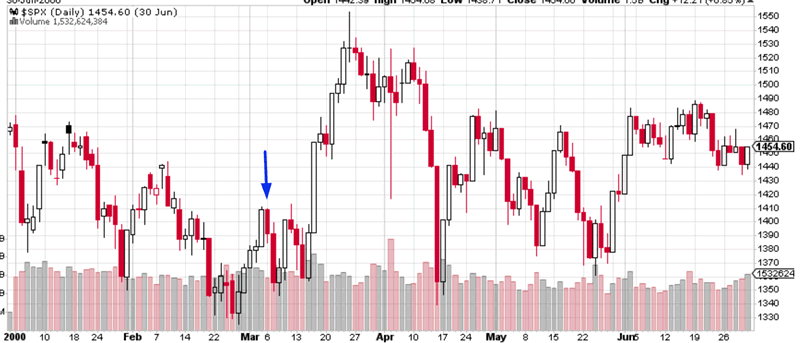

March 7, 2000

The S&P swung sideways over the next week. Then it rallied for 2 more weeks before the bull market topped on March 24.

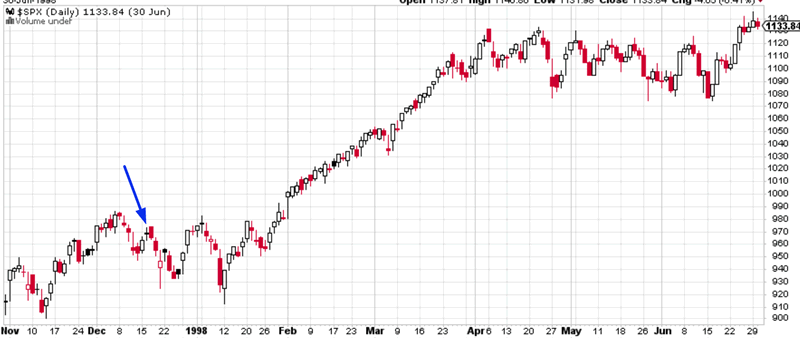

December 15, 1997

The S&P went down over the next 3 weeks. There was no “small correction” before the next “significant correction”. The next “significant correction” began 7 months later in July 1998.

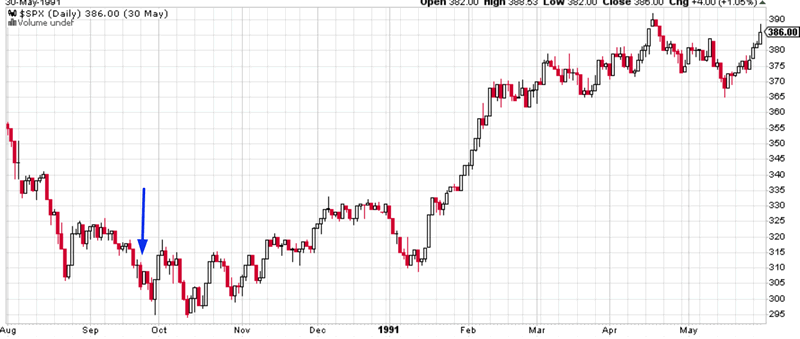

September 27, 1990

The S&P went down over the next 2 weeks. The next 6%+ “small correction” began 6 months later in April 1991.

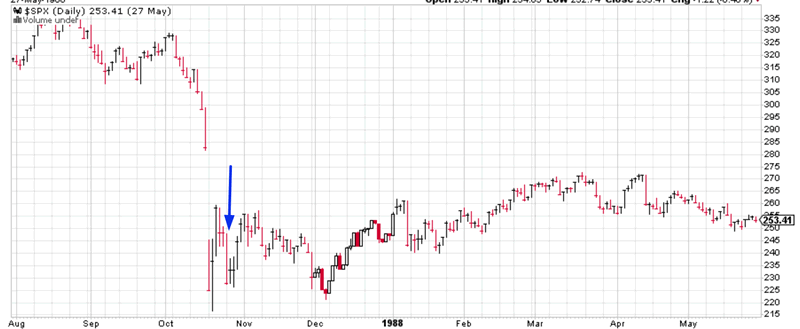

October 27, 1987

The S&P swung sideways over the next 1.5 months. Then it continued to rally fiercely until October 1989.

Conclusion

We can draw two conclusions from this study.

- The stock market’s volatility isn’t over. It’ll either swing sideways or swing downwards in a very choppy manner for the next few weeks (probably 2-3 weeks).

- The stock market’s next 6%+ “small correction” is months away. This supports another study, which suggests that the S&P 500 will make another 6%+ “small correction” in the second half of 2018.

By Troy Bombardia

I’m Troy Bombardia, the author behind BullMarkets.co. I used to run a hedge fund, but closed it due to a major health scare. I am now enjoying life and simply investing/trading my own account. I focus on long term performance and ignore short term performance.

Copyright 2018 © Troy Bombardia - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.