The S&P Stocks Index Will Probably Breakdown Below its 200 SMA

Stock-Markets / Stock Markets 2018 Apr 01, 2018 - 03:18 PM GMTBy: Troy_Bombardia

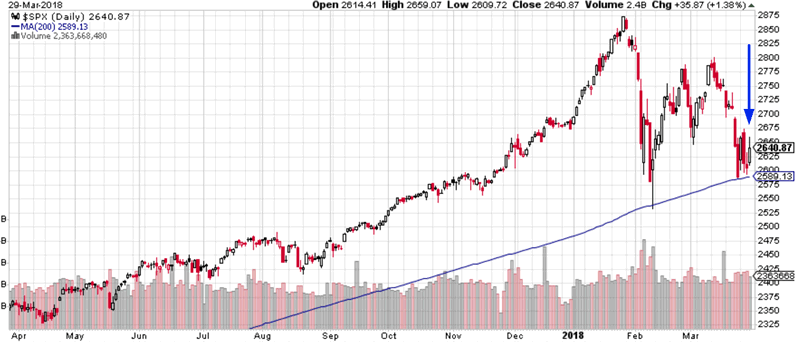

The S&P 500 is hovering just above its 200 day moving average right now.

When the S&P 500 flirts with its 200 sma but doesn’t break below it, it usually breaks below this moving average soon. This is a short term bearish sign for the stock market but has no medium-long term implications. The 200sma becomes a magnet for the S&P in the short term.

Here are the historical cases when:

- The S&P was above its 200 day moving average for at least 200 consecutive days, AND…

- 3 out of the past 4 days saw the S&P above its 200 sma without falling below it.

Here are the historical cases.

- March 28, 2018 (current case)

- May 20, 2004

- March 4, 1994

- January 18, 1990

- January 25, 1962

- September 11, 1959

- July 2, 1951

Here’s what happened next to the S&P 500.

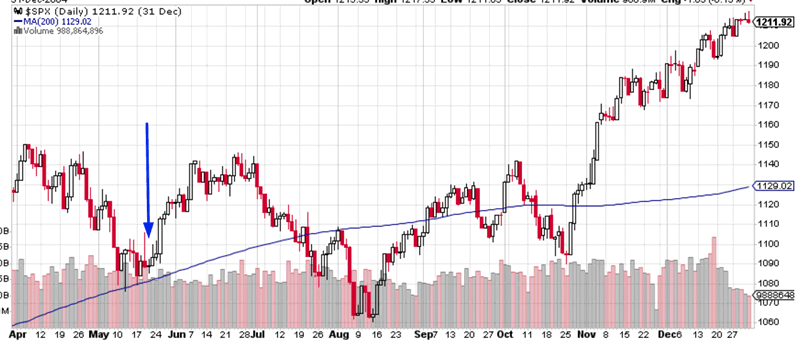

May 20, 2004

The S&P 500 bounced and then broke below the 200sma less than 2 months later.

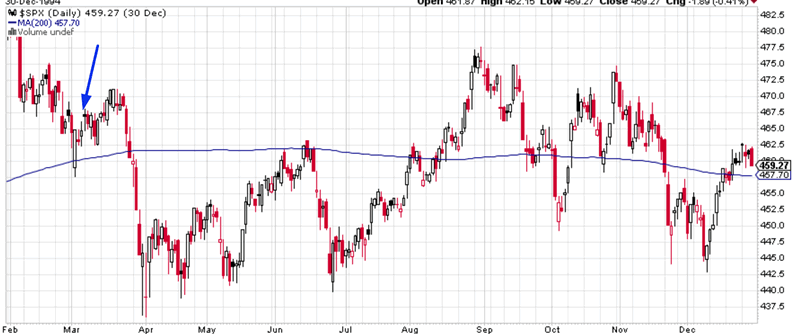

March 4, 1994

The S&P made a small bounce and then broke below the 200sma 3 weeks later.

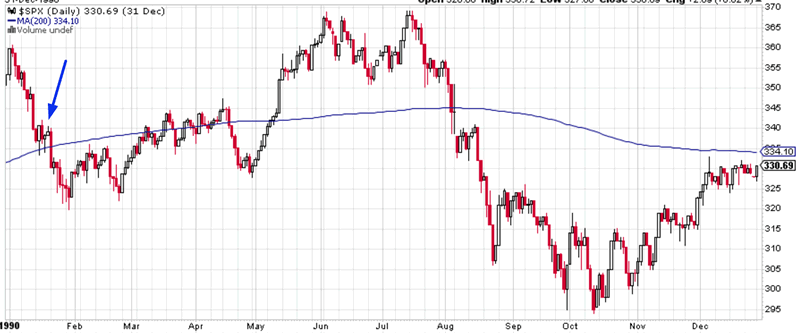

January 18, 1990

The S&P broke below the 200sma almost immediately. That was the bottom of the S&P’s “small correction”.

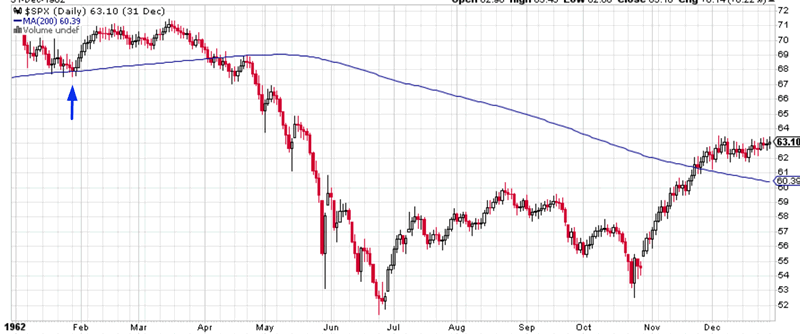

January 25, 1962

The S&P bounced and crashed below this moving average 2 months later.

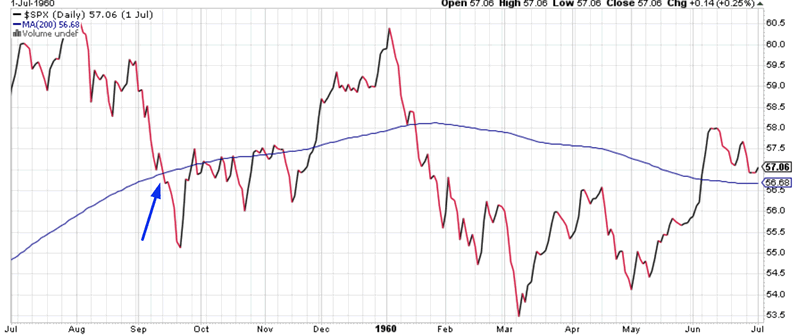

September 11, 1959

The S&P broke below its 200sma almost immediately.

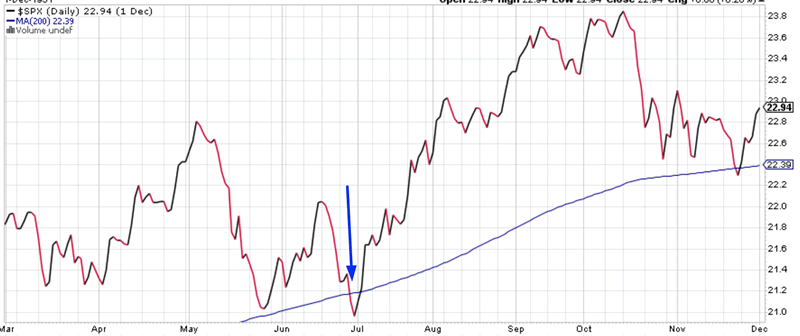

July 2, 1951

The S&P broke below its 200sma almost immediately. That was the bottom of the S&P’s “small correction”.

Conclusion

We can draw 2 conclusions from this study:

- The S&P will probably break and close below its 200sma very soon. This supports a previous study.

- A break below the 200 day moving average has no predictive value for the medium-long term. Sometimes the market makes a medium term bottom soon after it breaks below the 200sma. Sometimes the market falls much more below its 200sma. A breakdown is irrelevant for the medium-long term.

By Troy Bombardia

I’m Troy Bombardia, the author behind BullMarkets.co. I used to run a hedge fund, but closed it due to a major health scare. I am now enjoying life and simply investing/trading my own account. I focus on long term performance and ignore short term performance.

Copyright 2018 © Troy Bombardia - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.