Gold Holding Its Own

Commodities / Gold and Silver 2018 Apr 10, 2018 - 09:44 AM GMTBy: Richard_Mills

As a general rule, the most successful man in life is the man who has the best information

As a general rule, the most successful man in life is the man who has the best information

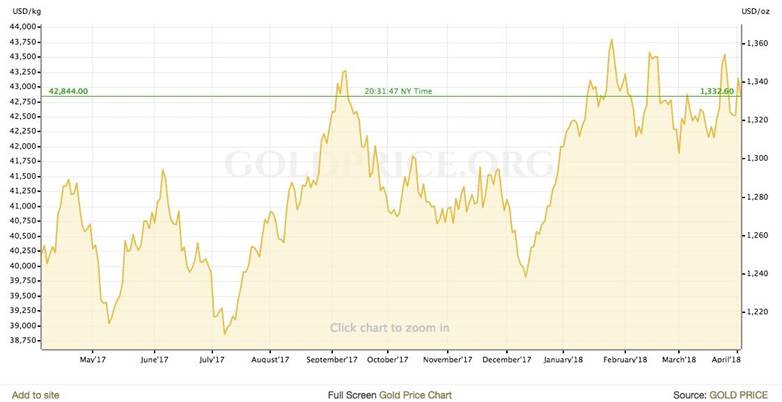

What the heck is going on with gold? The past few weeks have seen global equities falling amid a broad selloff in tech stocks, but the traditional safe haven metal has barely budged, floating along in a fairly tight range of between around $1320 and $1330 an ounce with the exception of a spike to $1354 on March 26 and a slip on March 16 and 20. See the tech stock-dominant Nasdaq one-month chart versus one-month gold.

Why isn't gold rising more than it has? On the other hand, with all the good economic indicators that normally cause the precious metal to fall, gold has held its own, climbing steadily from a low of $1208 in July 2017 to a high of $1362 on January 25, 2018 – a gain of 12.7%. Despite the rise of cryptocurrencies which sucked a lot of wind out of its sails, Federal Reserve interest rate hikes, QE stopped in the US and winding down in Europe and Japan, and cross-the-board global growth, gold still managed to gain 12.5% from January to December 2017.

Of course the “fear trade” so often cited by US Global Investors CEO Frank Holmes was well in place last year, with low real interest rates (interest rates minus rate of inflation) grinding down government bond yields, a falling US dollar, deficit spending, and geopolitical uncertainty all playing their part in propping gold up. But arguably due to so much good news going on in the US and elsewhere right now, gold should be getting crushed. But it's not. Why not? This article will try to find some answers.

Economic health check

A year ago the global economy was stagnant following the recession of 2007-09, an overhang from the debt crisis in Europe, and slowing Chinese growth which had seen double-digit GDP numbers throughout the 2000s. According to the International Monetary Fund, 75% of the world is now enjoying a full recovery. The IMF predicts global growth to hit 3.7% this year, the fastest rate since 2010.

One of the best indicators of economic growth are purchasing managers' indices. PMIs are based on monthly surveys of carefully selected companies. They provide an advance indication of what is really happening in the private sector economy by tracking variables such as output, new orders, stock levels, employment and prices across the manufacturing, construction, retail and service sectors. The latest data from Yardeni Research (see chart below) shows the PMIs for the Global Composite Index (advanced plus emerging economies) at 54.8, with manufacturing and non-manufacturing PMIs not far behind. Any number above 50 is considered an expansion versus a contraction.

China, the world's second largest economy behind the US, saw its monthly PMI rise more than expected, from 50.3 in February to 51.5 in March, “as authorities lifted winter pollution restrictions and steel mills cranked up production as construction activity swings back into high gear,” reported CNBC.

Shroders, the global investment manager, said this week that due to rising PMIs, along with business and consumer confidence, global economic activity is at its highest in seven years. It therefore upped its global growth forecast by to 3.5% for 2018, and predicts 3.3% growth in 2019. Among the factors Shroders cites for its optimism are President Donald Trump's $300 billion government spending package, which “has added fuel to a US and global economy already firing on all cylinders,” Schroders’ chief economist and strategist says Keith Wade said in an April note.

While the US economy did see a modest pullback in March, according to the Institute for Supply Management's non-manufacturing index, the economy also created a better than expected 241,000 more jobs last month. Wall Street analysts were only predicting 205,000. Unemployment in the US sits at around 4%. Hiring is at its strongest level since 2016, judged by the participation rate – the share of Americans with jobs or seeking one – increasing to 63%, which reflects an 806,000 increase in the labor force states Bloomberg.

All indications are that companies are gearing up for a banner earnings season, which kicks off in about a week. The passage of a tax reform bill in December which slashed corporate and individual taxes “should give this year's earnings a sizeable boost. Its anticipated effect has doubled previous earnings estimates for 2018,” CNBC quotes Brian Nick, chief investment strategist at Nuveen. “Bottom-line growth from tax cuts should start to show up in the first quarter.” FactSet analysts predict an 18% increase in earnings this year.

Oil, another indicator of how well the global economy is doing, has slipped a bit since closing in on $70 a barrel at the end of March, but continues to trade above $60, double the lows reached in January 2016. With the likelihood of trade wars on the wane despite tit for tat tariffs between the US and China, oil prices rebounded on April 1. The IEA sees a supply deficit coming, with OPEC cuts still in place, and even though US shale producers continue to pump, which would push crude prices higher.

The tech meltdown and gold

Of course you'd have to be on vacation for a month without Internet access not to notice that global stock markets have been tumbling, led by a sharp selloff in tech stocks including the “FANG” quartet of Amazon, Facebook, Netflix and Alphabet/ Google. On Monday the tech-heavy Nasdaq index fell 193 points, near a correction, defined as a loss of 10% from a peak. All 11 S&P 500 sectors dropped and eight of them shed more than 2%, with the benchmark US stock market index closing below its 200-day moving average for the first time since Brexit in June 2016.

Trump is partly to blame for the tech selloff, taking aim at Amazon in a series of tweets, saying it should pay “billions more” to the US Postal Service for delivering its online goods. Trump despises Amazon CEO Jeff Bezos, owner of the Washington Post an especially aggressive Trump detractor. The spectre of a looming trade war is also holding markets back, with the Dow plunging 500 points early Wednesday after China announced new tariffs on 106 American product categories including soybeans, planes and cars – seriously upping the ante from its previous $3 billion worth of tariffs. The markets later recovered. China and the US are now each planning around $50 billion in import duties.

Forbes notes all five US equity averages ended March and the first quarter of 2018 negative, with the contagion spreading to Japan, China, India and Germany. It would be the first global quarterly fall in stock markets since early 2016.

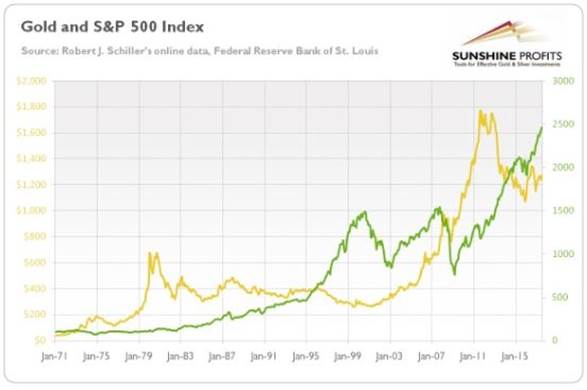

Gold has been both a benefactor and a victim of market turbulence this week. Stock market movements and gold prices typically move in opposite directions, as the historical chart below from Sunshine Profits shows.

On Monday gold futures rose $11.10 higher to $1338.40 an ounce, with silver also gaining 33 cents to $16.60. Weak equities, a lower US dollar, US-China trade tensions and geopolitical risk including potential US sanctions against Iran were named as factors in gold's rise. Spot gold finished the day at $1332.90 on Wednesday, almost unchanged from Tuesday and $8 lower than Monday's stock market selloff. Gold was down in morning trading on Thursday, reflecting rebounding stock markets and a higher dollar, at around $1325 an ounce.

Despite the turbulent week, gold bulls have a lot to cheer about, considering the safe haven metal has gained for a third quarter in a row, something it has not managed to do since the heady days of 2011. Volume on the Comex, the biggest futures contract, hit 23 million contracts in the first quarter, while holdings in bullion-backed ETFs reached 2,268.6 metric tons in March, the most since 2013. “The hoard has risen about 43 tons this year, the eighth quarterly rise in the past nine,” Bloomberg stated.

Tailwinds for gold

One of the most important determinants of the gold price is the US dollar, and like gold and stock markets, they usually move in opposite directions. We can see that trend in comparing a one-year gold chart with a USD chart from the same period.

Recently the US dollar index has been hurt by the trade dispute between the US and China, with a fall in the dollar occurring on Monday after China slapped fresh tariffs on the States, following a good last week for the greenback when it looked like China's response would be more muted (just $3 billion worth of tariffs) and Trump decided to exempt the EU, Canada, Mexico and a few other nations from steel and aluminum tariffs.

Kitco wrote on Monday that gold is likely to continue to benefit from a low dollar despite rising bond yields. Yields are rising because of a perception that more government spending will require more issuing of Treasury bills (another QE). Usually that means the dollar goes up because the demand for Treasuries requiring dollars also rises, but foreign demand for safe assets like the dollar are falling according to analysts at CrossBorder Capital quoted by Kitco. Earlier this year there was a rumor that China was about to lessen or stop buying US Treasuries, causing US bond prices to drop and yields to spike. In fact in January China did scale back its bond purchases, but it is still the largest US bond holder at $1.7 trillion worth of Treasuries. With a trade dispute in full swing, China could hurt the US by dialling back on more purchases, which would make interest rates on those bonds soar to attract investors – thus hurting individuals and businesses who borrow money based on bond rates. On the other hand, China has few options other than US T-bills to invest its ample foreign exchange reserves, earned from excess dollars due to its large trade surplus with the US.

Worsening trade deficit

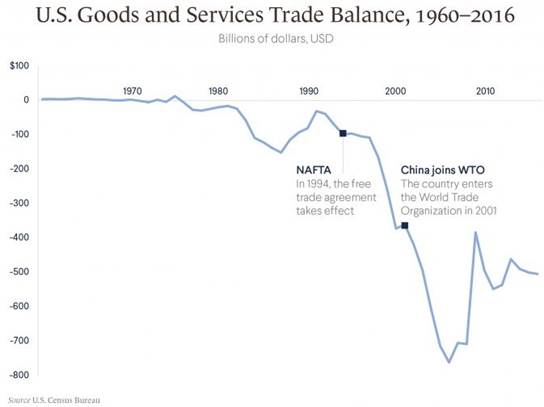

Trump has been talking about unfair trade practices and the widening gap between imports and exports since his election campaign kicked off. A plan to do something about the $375 billion trade deficit with China and closing the deficit gap with its other trading partners is behind the Trump tariffs, and the re-negotiation of NAFTA.

In 2017 the total US trade deficit soared 12.1% on record imports, reaching $566 billion, the highest it’s been since 2008. Trump believes that cheap foreign imports and “horrible trade deals” have hurt America's competitiveness and costs jobs, for example in the steel industry. His Administration thinks that closing the deficit gap and cutting taxes will boost economic growth by an annual 3%, perpetually.

So what's the connection between the deficit and gold? The US dollar index is affected by changes in the balance of trade. If imports are more than exports (a deficit), there is high demand for foreign currencies to pay for those exports, which means an outflow of US dollars. Over time this leads to a devaluation of the dollar, which of course is good for gold. Therefore, trade deficits are good for gold.

What is the likelihood of the US closing the trade deficit? I've written extensively about this before, and the answer is, “not very likely at all.” I agree with Trump that running trade deficits is foolish, but the problem is that without a global reserve currency (ie. A currency or basket of currencies other than the US dollar), the US will continue to run deficits because it is the reserve currency. Why? Because of the Triffin Dilemma, which arises when a national currency also serves as the international reserve currency. This causes conflicts between a country’s national monetary policy and its global monetary policy:

“In October of 1959, a Yale professor sat in front of Congress' Joint Economic Committee and calmly announced that the Bretton Woods system was doomed. The dollar could not survive as the world's reserve currency without requiring the United States to run ever-growing deficits. This dismal scientist was Belgium-born Robert Triffin, and he was right. The Bretton Woods system collapsed in 1971, and today the dollar's role as the reserve currency has the United States running the largest current account deficit in the world.

By "agreeing" to have its currency used as a reserve currency, a country pins its hands behind its back. In order to keep the global economy chugging along, it may have to inject large amounts of currency into circulation, driving up inflation at home. The more popular the reserve currency is relative to other currencies, the higher its exchange rate and the less competitive domestic exporting industries become. This causes a trade deficit for the currency-issuing country, but makes the world happy. If the reserve currency country instead decides to focus on domestic monetary policy by not issuing more currency then the world is unhappy.

Becoming a reserve currency presents countries with a paradox. They want the "interest-free" loan generated by selling currency to foreign governments, and the ability to raise capital quickly, because of high demand for reserve currency-denominated bonds. At the same time they want to be able to use capital and monetary policy to ensure that domestic industries are competitive in the world market, and to make sure that the domestic economy is healthy and not running large trade deficits.

Unfortunately, both of these ideas – cheap sources of capital and positive trade balances – can't really happen at the same time.” How The Triffin Dilemma Affects Currencies, investopedia.com

My article also addressed the question of whether a global reserve currency is feasible. It could be, with gold backstopping it just as gold backed the US dollar until the gold standard was abandoned by President Nixon in 1971. The question being asked right now is whether the US dollar will remain the world's reserve currency (the answer is yes), but the reality is that there is simply no other currency that would be able to replace it, despite the rise of China's “petro-yuan”, symbolized by China's March launch of an oil futures contract denominated in yuan, or renminbi, and convertible into gold.

According to the IMF, dollar-denominated assets among foreign exchange reserves were at $6 trillion in Q4, a 14% increase from the fourth quarter of 2016 and 42% higher than in Q4 2014. Out of total official exchange reserves held by central banks, two-thirds are US dollars. Euros were second at 20% and the yuan represented a measly 1.2%. (see graph below). And if the yuan were to gain more international standing, the US has plenty of ways to knock it down:

For example, if China chooses to resist Trump’s demands for concessions on trade, the US could prohibit the renminbi’s use in invoicing or settlements by US businesses transacting with Chinese partners. It could discourage, or establish new barriers to, investments in renminbi-denominated assets. Or it could offer swap agreements on favorable terms to any central bank that is prepared to abandon its agreement with China. The list of possible punitive actions is long. - Project Syndicate

In sum, whether the US continues to be the world's reserve currency and is therefore obligated to run a deficit, or another, “global” (not national) currency comes along to replace it, both scenarios are good for gold. In the first case because a deficit means a lower dollar and therefore higher gold prices, and in the second case, a world currency would almost certainly be backed by gold, given the resounding failure of the current monetary system, based on fiat currencies, to avoid global trade imbalances, which are one of the major reasons for financial crises. Countries become trapped in a vicious spiral – they accumulate debt because they are sustaining a trade deficit. The bigger their debt grows year after year, the harder it becomes to generate a trade surplus. Only the countries with a trade surplus have any room to manipulate policy; there’s very little debtor nations can do.

Higher debt

Gold loves higher government debt because it typically means that governments need to print more money (Ie. Issue Treasury bills) to service that debt and pay for goods services. This also means rising inflation, which sends equity investors flocking to the safety of bullion. Why? Because gold is not affected by investments denominated in dollars or other currencies, which lose value with inflation. Just the hint of rising inflation causes central banks to look at raising interest rates to cool down runaway prices. Finally, rising debt also undermines confidence in the economy and worries over whether the government can make its debt payments. Today’s federal debt is $20,493,401,574,964.07. The amount is the gross outstanding debt issued by the US Treasury Department since 1790 and reported here. And it's only going to get worse. According to Newsweek the Congressional Budget Office says the Republican tax cuts will add more than $1 trillion to the national debt over the next decade.

Negative real interest rates

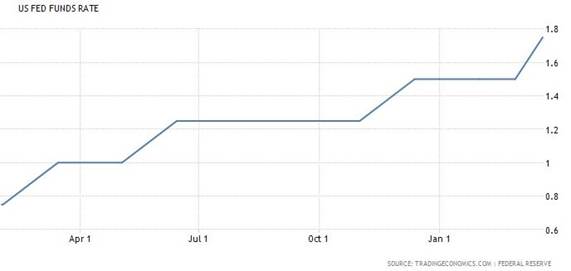

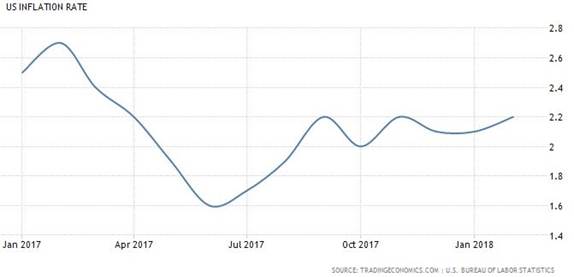

As mentioned one of the key drivers of gold in 2017 was negative real interest rates, which happens when the inflation rate subtracted from interest rates (the Funds rate) falls below zero. The graphs below show that this trend is continuing. From April 2017 to present, real interest rates have been negative: -1.2% in April 2017, 0.4% in July, -0.6% in January 2018, and -0.45% in April 2018.

Because inflation has been shifting upward, moving from 1.6% in the summer of 2017 to 2.2% currently, investors turned to gold because inflation squeezes the yield on government bonds. Bonds tend to sell off when investors believe more inflation is coming. That’s because the yield gets eaten away by inflation (Eg. you own a 10-year Treasury bill that pays 3%. If inflation is 2%, your real return is only 1%.)

Inflation could climb even higher, once the effects of Trump's policies are felt throughout the economy, such as new tariffs, the withdrawal of the US from the Trans Pacific Partnership, a new NAFTA agreement, and $300 billion in new government spending. If it does, real interest rates will go even further negative, increasing the appeal of gold.

Flattening yield curve

Those concerned about a recession watch the yield curve, which is the difference between the two-year Treasury yield and the 10-year Treasury yield. As the two yields move closer together, they are said to “flatten” and when the yield curve inverts (Ie. goes below 0%) history shows us that a recession is likely to occur.

In January the spread was around 0.49 – the flattest it's been since 2007 - as of Tuesday, April 3 it was 0.51. If a recession were to occur gold is a safe place to be. It's also notable that there is a strong correlation between bond yields and stock prices. Rising bond yields pressure stock prices. "Bond king" Jeffrey Gundlach told CNBC Wednesday that he thinks stocks will end the year in negative territory due to rising yields on government debt and the slump in cryptocurrencies, whose rise correlated with the stock market top in 2017 and whose fall could be a harbinger for lower equity prices.

CNBC reported a 2.63% yield on the benchmark 10-year Treasury note marks “a line in the sand” for stocks, which are currently in correction territory. “The stock market can’t take higher bond yields,” said Gundlach. The 10-year yield was at 2.8% on Wednesday. A continued stock market correction would clearly be good for gold.

ETF inflows

Another strong factor supporting gold right now is investors piling into so-called “paper gold” aka gold ETFs. According to the World Gold Council, gold-backed exchange traded funds added 197.5 tonnes to their holdings in 2017, a gain of 8.4% from 2016.

In December the world's largest gold ETF, the SPDR Gold Trust ETF (GLD) rose for 11 straight days before finally turning red, its longest rally since it started in 2004 that many probably missed as they were focusing on the meteoric rise of crypto instead.

The ETF party continued into 2018 with GLD seeing steep inflows at the end of January, corresponding with a Jan. 25 gold price high of $1362 an ounce. The fund saw $873.6 million flow into it that week, which represented nearly half of the $1.99 billion in inflows from the preceding 12 months.

Hedge funds are jumping back into gold, Kitco reported on Monday, the day the stock markets sold off. The precious metals site noted that after four weeks of selling, hedge funds were buying again.

The CFTC’s disaggregated Commitments of Traders report for the week ending March 27 showed money managers increased their speculative gross long positions in Comex gold futures by 34,928 contracts to 183,080. At the same time, short bets fell by 15,428 contracts to 20,917. Gold’s net length increased to 162,163 contracts.

The data show that the gold market saw its most significant shift in bullish sentiment in nearly two years. Gold’s net length jumped 45% from the previous week. The strong buying momentum pushed prices up by more than 2% during the survey period, hitting a five-week high.- Kitco

Central bank buying

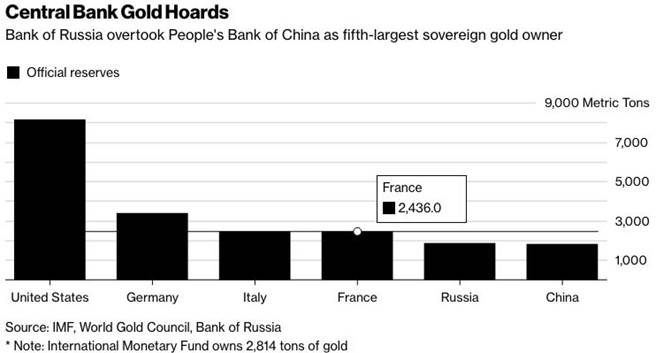

How about central bank buying? Central banks buy gold as a store of value and to purchase hard currencies like the US dollar which most commodities are priced in. In February Russia overtook China's central bank gold hoard, with both countries running close gold tonnages, at 1,857 for the Bank of Russia versus 1,843 for the People's Bank of China. It makes sense for Russia to hoard gold that it can convert into other assets besides the US dollar, in order to skirt sanctions.

Bloomberg said that Russia has increased its holdings every month since March 2016, while China last reported buying gold in October 2016. Both nations however are nowhere close to the amount of gold owned by the US central bank, which reportedly has 8,134 tons.

Gold demand

Demand for gold actually slipped in 2017 as global investors turned to stocks instead of bullion and assets with lower growth potential. But it was a different story for physical gold, with demand for gold jewelry up 4% from 2016; 10% in India alone.

The demand for physical gold in the form of coins and bars was led by China, which according to the World Gold Council purchased 306.4 tonnes in 2017 – 8% higher than the previous year. These officials figures however are likely way off the real total. Sharps Pixley analyst Lawrie Williams has written that actual Chinese gold consumption is probably at least 50% higher than the WGC figures, with Chinese gold imports from Hong Kong last year totalling 628.2 tonnes and 299.8 tonnes imported from Switzerland. “China’s own gold output during the year was, according to the [Chinese Gold Association], 426.14 tonnes, so from these sources alone China will have absorbed 1,354.1 tonnes of gold.” Williams notes this doesn't include yet to be revealed figures from the UK, the US, Australia and Russia. China for the 11th year in a row was the world's biggest gold consumer.

Supply squeeze

More a long-term issue than a current factor in the strength of gold prices, the mined supply of the precious metal is shrinking as most of the “low-hanging fruit” has been mined and the rest is either in remote locations or buried deep in the earth, meaning higher extraction costs.

“Production is coming off, and that means the upward pressure on the gold price could be very intense,” Cambridge House recently quoted Pierre Lassonde, chairman of Franco-Nevada, on the matter of declining gold supply.

Goldcore said last year that “peak gold” was “the biggest gold story not being reported,” noting that 2016 was the first year that mine production fell since 2008. It's a view shared by Randall Oliphant, chairman of the World Gold Council, who told Bloomberg in September that “Production is likely to plateau at best...”

Indeed in February, the WGC in its annual gold trends report said that total gold supply slipped in 2017 to 4,398 tonnes – a drop of 4% from 2016. Mine production was about the same as last year, 3,268.7 tonnes, but recycled gold fell 10% to 1,160 tonnes. Key gold producers that saw drops last year were China and Tanzania.

Tightening gold supply will feed into higher prices as long as demand factors hold. Stephen Letwin, CEO at Iamgold, believes it could happen sooner than later. Speaking at a mining conference in Hong Kong this week, Letwin said gold prices are set to climb due to a lack of exploration and majors failing to replace the ore they've mined. Iamgold however is exploring near existing mines as well as ramping up production in Canada.

“Gold has a much higher probability of moving north as opposed to south,” he was quoted saying. “I’ve been around a long time; when you’re in an industry that’s not replacing what it produces, eventually, the price has to move up.”

Conclusion

The preceding analysis should give readers a better sense of why gold continues to show resilience in the face of some fairly strong headwinds in the form of high economic growth, robust purchasing managers indices, oil prices north of 60 dollars, and a US economy that continues to do well, despite the recent pullback in stock markets particularly tech stocks. Fear may have dissipated among investors as they enjoyed a long bull run in stocks, but it is returning in the form of negative real interest rates – a key driver for gold. As global growth stokes inflation, interest rates are creeping up, making bond yields less of a deal and gold more attractive. And while no-one wants to utter the “R” word, the flattening yield curve is a sign that the US economy may not be in that great a shape after all, which is good for gold. Rising bond yields mean that the demand for US Treasuries is falling (bond prices and yields move in opposite directions) and signal that inflation is coming, which in turn means higher interest rates and pressure on stock prices since the cost of borrowing for companies increases. The Fed has stated it expects to raise rates three times this year and two in 2019. The last increase, on March 21, was the sixth time the Fed raised rates since December 2015.

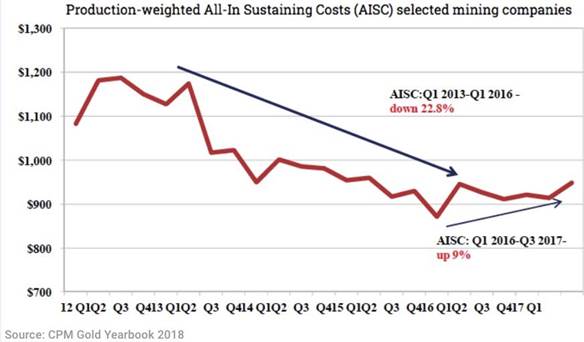

Also front and center in the gold price behaviour of late is the falling US dollar. Among the factors are a decrease in the demand for US T-bills and less confidence in the greenback due to fears of an escalating trade dispute with China. Gold has been the benefactor of a lower US dollar and will continue to be, as long as the United States continues to run a trade deficit – something I have argued the US cannot avoid if it wishes to maintain the dollar's position as the world's reserve currency. Gold ETF inflows and rising physical gold demand in the form of jewelry, coins, bars and central bank buying – particularly from China and Russia, have also bolstered the gold price. A tighter market for mined supply should also see gold holding up longer-term, which will be good for junior gold explorers as the major gold miners look to them to find new deposits which are rapidly depleting. Pretty soon all the high-graded material will be gone and the majors will be left with lower-quality ore. Their margins look good now, but their financial pictures could change drastically when that starts happening. Already we can see that gold mining costs are back on the rise after falling in step with lower gold prices, reaching a bottom in the first quarter of 2016, not coincidentally the same time that the gold price bottomed out. The CPM Group in its 2018 Gold Yearbook reports that all-in-sustaining costs are up 9% between Q1 2016 and Q3 2017. They were down 22.8% between Q1 2013 and Q1 2016.

I'm pleasantly surprised to see gold doing so well in a generally expansive economic climate, and I'll be keeping an eye on mining company earnings when they start trickling out soon. This should give a good sense of who the potential acquirers might be and who needs to sell assets to raise cash. Do you have the purchase of physical gold and a selection of good gold companies on your radar screen?

If not, maybe it should be.

By Richard (Rick) Mills

If you're interested in learning more about the junior resource and bio-med sectors please come and visit us at www.aheadoftheherd.com

Site membership is free. No credit card or personal information is asked for.

Richard is host of Aheadoftheherd.com and invests in the junior resource sector.

His articles have been published on over 400 websites, including: Wall Street Journal, Market Oracle, USAToday, National Post, Stockhouse, Lewrockwell, Pinnacledigest, Uranium Miner, Beforeitsnews, SeekingAlpha, MontrealGazette, Casey Research, 24hgold, Vancouver Sun, CBSnews, SilverBearCafe, Infomine, Huffington Post, Mineweb, 321Gold, Kitco, Gold-Eagle, The Gold/Energy Reports, Calgary Herald, Resource Investor, Mining.com, Forbes, FNArena, Uraniumseek, Financial Sense, Goldseek, Dallasnews, Vantagewire, Resourceclips and the Association of Mining Analysts.

Copyright © 2018 Richard (Rick) Mills - All Rights Reserved

Legal Notice / Disclaimer: This document is not and should not be construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment. Richard Mills has based this document on information obtained from sources he believes to be reliable but which has not been independently verified; Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of Richard Mills only and are subject to change without notice. Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, I, Richard Mills, assume no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this Report.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.