Russia Buys 300,000 Ounces Of Gold In March – Nears 2,000 Tons In Gold Reserves

Commodities / Gold and Silver 2018 Apr 24, 2018 - 06:35 PM GMTBy: GoldCore

– Russia buys 300,000 ounces of gold in March and nears 2,000t in gold reserves

– Russia buys 300,000 ounces of gold in March and nears 2,000t in gold reserves

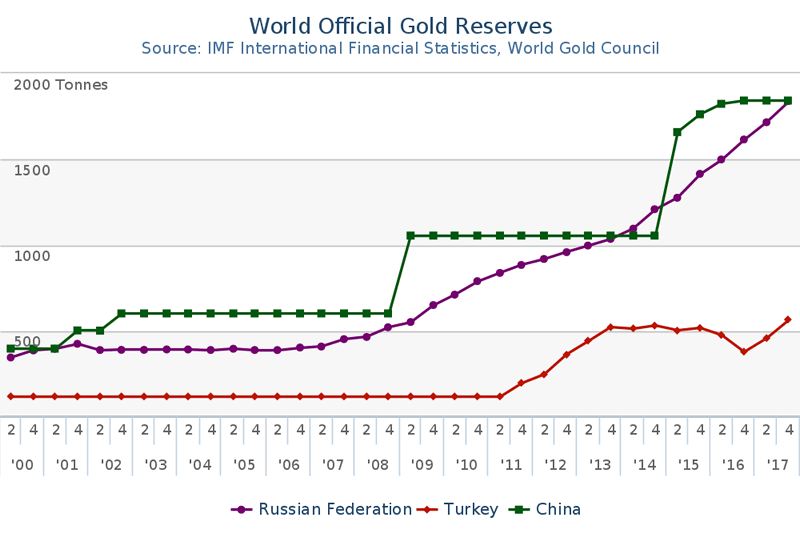

– Russia now holds just over 1,861 tonnes, more than officially reported by China at 1,842t

– Both Russia and China have the power to destabilise US dollar by dumping dollar-denominated assets

– Turkey has removed all gold held in the U.S. opting for Bank of England and BIS

– Turkey follows trend set by both Germany, Netherlands and others to remove gold reserves stored in the United States

– Central bank decisions regarding gold reserves are examples of countries becoming nervous about the outlook for the dollar under the Trump administration

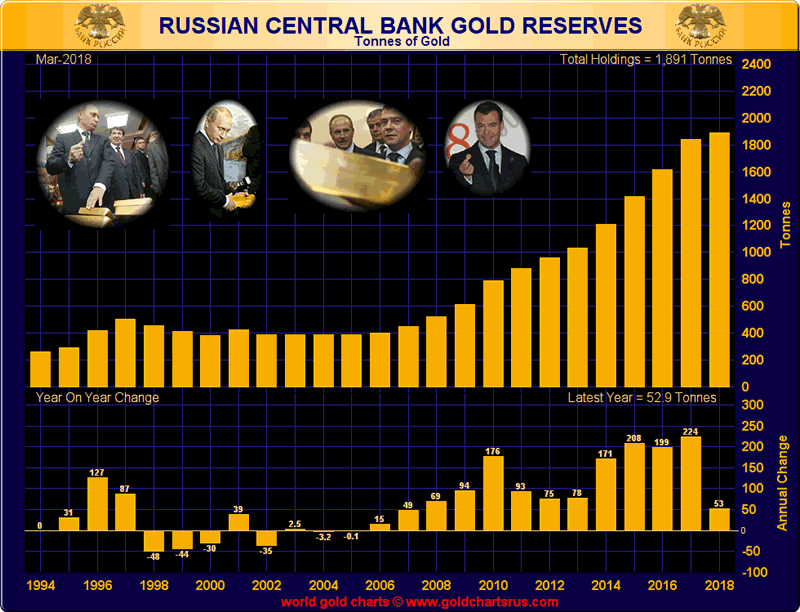

Russia bought another 300,000 troy ounces of gold in March bringing Russia’s total gold reserves to 1,861 tonnes or 60.8 million troy ounces as of the start of April, the central bank announced loudly at the weekend.

The continuing robust and steady accumulation of gold reserves continues and it was notable how Russian media channels loudly (more loudly than usual it seemed with many outlets covering) pronounced the continuing diversification into gold bullion by the Russian central bank. It suggests that gold is being used as a bulwark to protect Russia from the stealth financial, trade and currency wars which appear to be deepening.

Russia is not the only country diversifying into gold and many other countries are doing so as they seek to protect themselves from the coming devaluation of the US dollar and U.S. dollar hegemony. This is evidenced both by gold purchases and also in many strategic decisions regarding the storage of national gold reserves.

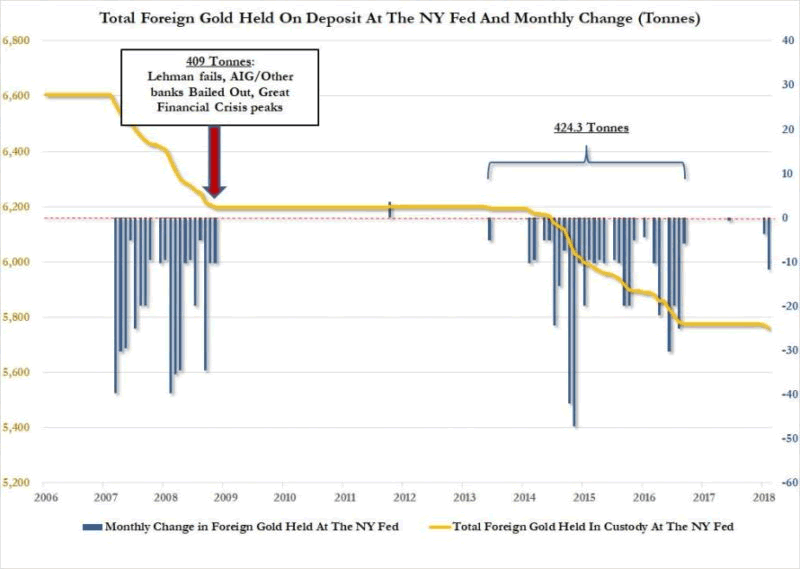

While Russia was adding to its gold reserves, taking it above China’s holdings, Russia’s new ally Turkey was busy removing all gold bullion reserves held in the United States.

Both are clear moves against US dollar hegemony. Gold reserve changes combined with the news that Russia and China have agreed to settle some trades in ruble and yuan is a clear step that the world’s super powers are looking to reduce dependence on the US dollar and the increasing move away from the US dollar as global reserve currency.

Whilst it can be difficult to look past the Western media rhetoric regarding the likes of Russia, Turkey and China, there are lessons to be learnt by the everyday investor and saver.

These moves have also been seen by western nations such as the Netherlands and Germany who recently made the decision to bring some (if not all) of their reserves back to Europe.

The Gold Mission

Putin has long been on a mission to build up the country’s gold reserves after previous Russian governments ran the country’s reserves down to less than 300 tonnes.

The current president has made it clear that the country should be holding gold, rather than US dollars. For many years, the Russian central bank has consistently bought gold, driven by Putin’s believe in the financial sovereignty offered by gold and its protection against geopolitical and economic risks.

“Under the instruction by President Putin, the Bank of Russia has been implementing the program of increasing the absolute share of gold in the gold and currency reserves of Russia for many years.”

First Deputy Chairman of the Russian regulator Sergey Shvetsov

Putin first came to power in 2000 and since then the country has had more months than not, when it has purchased gold bullion. A large jump in reserves was seen in 2014 after Western sanctions were imposed and Russia has been the world’s largest gold buyer ever since. It is now the fifth largest gold holder after the United States, Germany, Italy, and France.

Russia is also the third largest producer of the precious metal. As a result, the majority of its purchases are locally sourced, giving the country an additional edge when it comes to protecting its finances. This is something that China is also wise to. It does not allow the export of any gold mined in the country, further evidence of the desire to protect the country’s financial system and economy and position the yuan as an alternative to the dollar in the long term.

The golden noose?

The build-up of gold reserves by non-Western countries is something which could end up tipping the scales of the global order.

Many believe that should bad relations continue between the US and these nations then US-denominated assets currently held in forex holdings by the relevant central banks, could be dumped for alternatives. Nations may opt to diversify into the Chinese yuan (in the case of Russia) but also gold. Most likely it would just take either Russia or China to do this, before many others followed suit.

We know from recent comments by the likes of Erdogan and Putin that this is a possibility not far from their minds:

“With the dollar the world is always under exchange rate pressure. We should save states and nations from this exchange rate pressure. Gold has never been a tool of oppression throughout history.” Turkish PM Erdogan, April 2018

At the same conference Erdogan explained how he was pushing for international loans to no longer be made in dollars, but instead gold:

“I made a suggestion at a G20 meeting. I asked: Why do we make all loans in dollars? Let’s use another currency. I suggest that the loans should be made based on gold.”

When loans are made in dollars, the debtor is instantly taken hostage by the issuing central banks’ policies. The central bank determines the price of dollar through monetary policy and it’s value thanks to currency printing. Were loans to be issued in gold these huge counter party pressures would no longer be a feature of the largely dollar based debt-system.

Hands off our gold

China for many years has made it clear that gold purchased in China is to stay in China. Russia and Turkey are of the same belief.

The news broke last month that Erdogan’s central bank had decided to call back its gold reserves held in the United States. There were reportedly 220 tonnes stored in the country. The move was followed by the country’s largest private banks also moving their gold from the country. One example was Halk Bankasi bank which transferred 29 tons of gold back to Turkey

The decision followed Erdogan’s call to “to get rid of exchange rate’s pressure and to use gold against the dollar.”

Speaking to RT about Turkey’s decision to repatriate its gold from the US Federal Reserve, Anatoly Aksakov (chairman of the State Duma Committee on Financial Markets) said: “We do not have a gold reserve in the US, we have only Forex (foreign exchange) reserves abroad. No one can lay hands on our gold.“

By removing gold from one jurisdiction to another you are making one very loud and political statement – we can look after our gold and we don’t want you anywhere near it.

Decisions by both western and non western countries to repatriate their gold tells the US that they will no longer have power over their foreign reserves and that they do not trust them to look after them.

Conclusion – Be your own central bank and take delivery or own in safest vaults, in safest jurisdictions in the world

Russia and increasingly Turkey and China are countries that are increasingly seen as threats to the West, in one form or another. As a result various measures have been taken against them to make international trade and negotiations very difficult.

Whether through sanctions or trade tariffs countries are beginning to really feel the weight of the US and its allies’ powers. As a result, they are using gold to protect themselves and to protect their foreign exchange reserves and hard earned national savings.

Investors can learn something here. Fiat currencies will always have a counterparty that is far more powerful than the saver or pension holder. There is rarely little interest by the fiat issuer to take note of how it’s currency management is affecting the individual’s savings and investments.

Gold removes this risk. Central banks are unable to impact the supply or holding of physical gold that an investor holds legal title to and stores in a safe jurisdiction.

The likes of Russia, Turkey and China recognise the financial independence holding gold bullion can bring, they also understand the importance of storing it at a location that cannot be compromised by western sanctions, central bank screw-ups, political targeting and nationalisation of gold assets and gold companies.

Investors should follow suit and act as their own central bank. Prepare financially by having a sensible allocation to physical gold so that it is protected from central banks massive monetary experiment that risks destroying all hard earned wealth.

Gold also serves to protect in times of heightened geopolitical risk, terrorism and war. Follow the same steps as these aforementioned countries – own physical gold, store in a safe jurisdiction and ensure you have legal title to your bullion through allocated and segregated bullion ownership.

Listen on SoundCloud , Blubrry & iTunes. Watch on YouTube below

Gold Prices (LBMA AM)

23 Apr: USD 1,328.00, GBP 950.45 & EUR 1,085.64 per ounce

20 Apr: USD 1,340.15, GBP 953.52 & EUR 1,089.14 per ounce

19 Apr: USD 1,347.90, GBP 950.54 & EUR 1,090.59 per ounce

18 Apr: USD 1,346.55, GBP 949.59 & EUR 1,088.95 per ounce

17 Apr: USD 1,342.95, GBP 937.24 & EUR 1,084.57 per ounce

16 Apr: USD 1,344.40, GBP 941.21 & EUR 1,087.62 per ounce

Silver Prices (LBMA)

23 Apr: USD 16.94, GBP 12.14 & EUR 13.85 per ounce

20 Apr: USD 17.11, GBP 12.15 & EUR 13.91 per ounce

19 Apr: USD 17.20, GBP 12.09 & EUR 13.91 per ounce

18 Apr: USD 16.95, GBP 11.93 & EUR 13.70 per ounce

17 Apr: USD 16.63, GBP 11.60 & EUR 13.44 per ounce

16 Apr: USD 16.60, GBP 11.61 & EUR 13.42 per ounce

Mark O'Byrne

This update can be found on the GoldCore blog here.

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information containd in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.