Study: Breadth is Leading the Stock Market Higher. A Bullish Sign

Stock-Markets / Stock Markets 2018 May 12, 2018 - 03:53 PM GMTBy: Troy_Bombardia

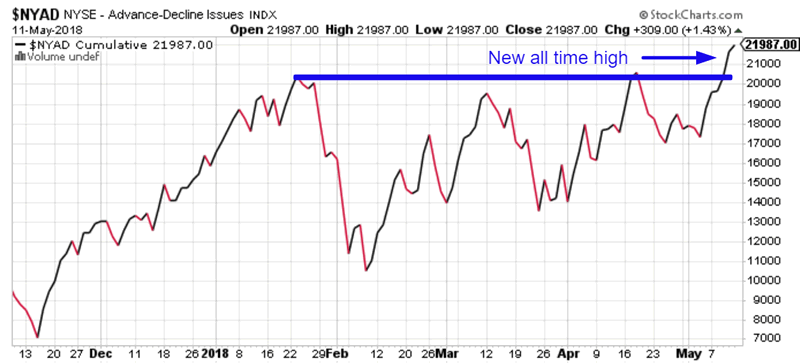

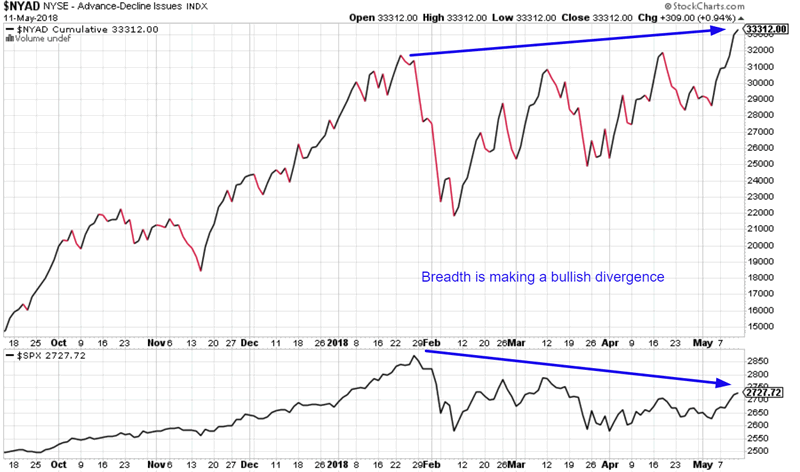

In today’s daily post we stated that the NYSE’s Advance-Decline cumulative line (breadth indicator) has made a new high even though the S&P 500 hasn’t.

This is a medium and long term bullish sign for the stock market.

From a long term perspective

This previous study demonstrated that bull market tops are marked by bearish breadth divergences. With the cumulative Advance-Decline line making a new all-time high, this clearly isn’t the case right now.

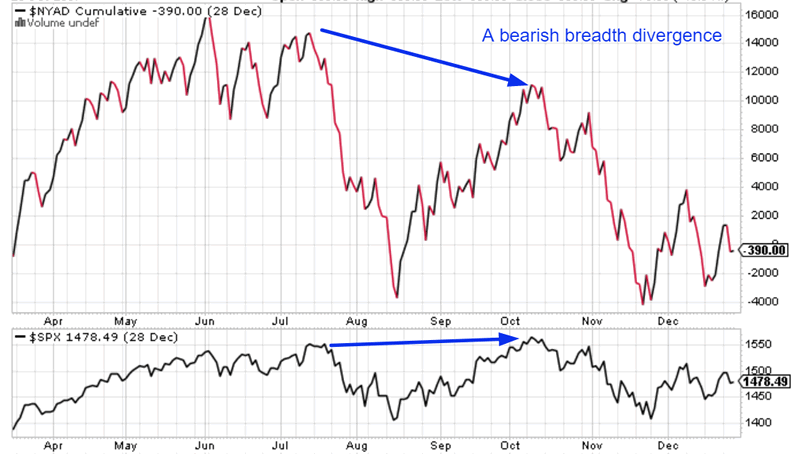

2007

Breadth made a bearish divergence before the stock market topped.

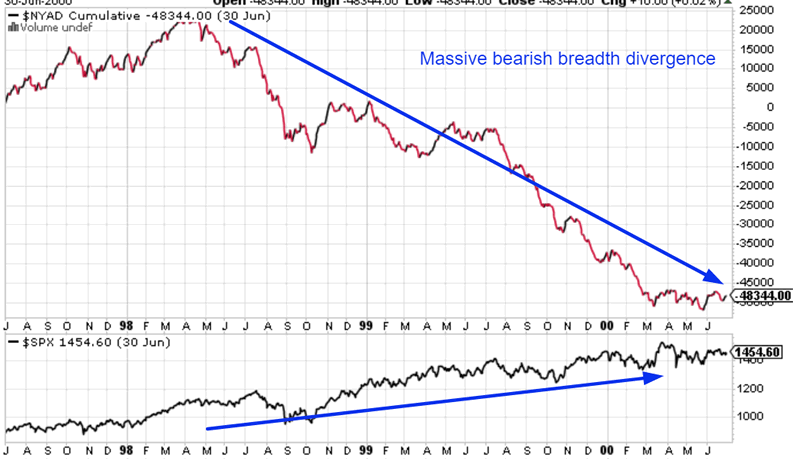

2000

Breadth made a bearish divergence before the stock market topped.

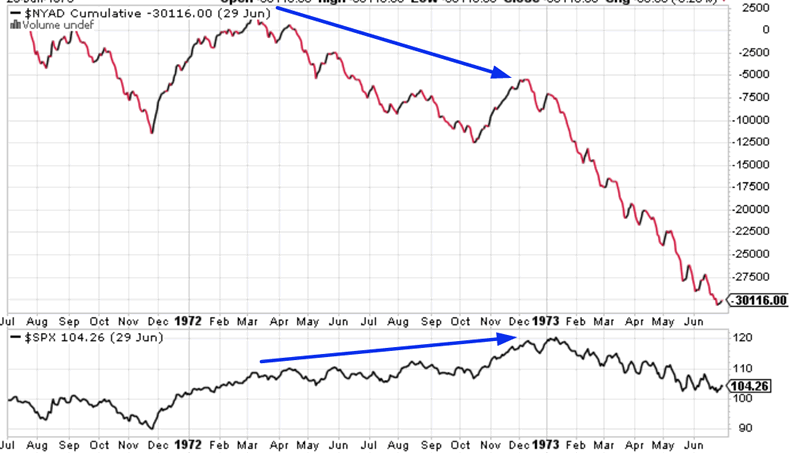

1973

Breadth made a bearish divergence before the stock market topped.

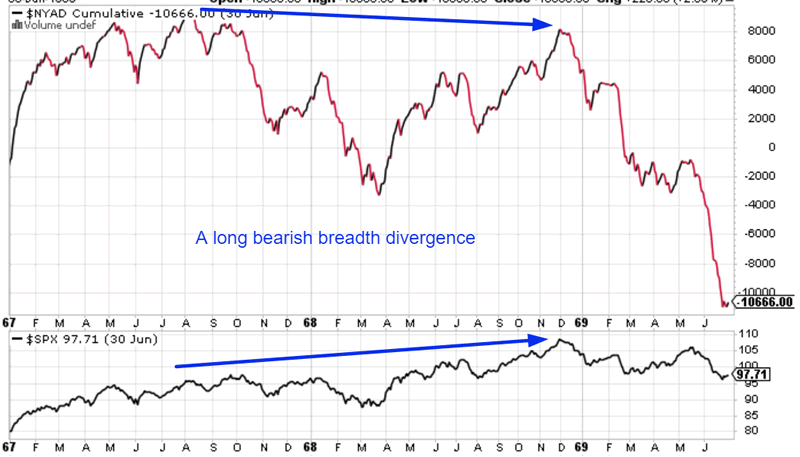

1968

Breadth made a bearish divergence before the stock market topped.

Today

Breadth is making a BULLISH divergence today.

Medium Term

Breadth making a new all-time high means that the stock market correction’s bottom is probably already in. The stock market might make a small pullback, but it will not break below its February 9, 2018 lows.

See this previous study if you haven’t already.

What’s not surprising

The stock market didn’t go up during April on a very strong earnings season. The stock market is going up now that earnings season is over.

This has bearish investors confused, who thought that “the stock market not going up on strong earnings” was a bearish sign. I said that it wasn’t. There were a lot of historical cases in which the stock market didn’t go up on strong earnings, but went up AFTER earnings season was over. This is normal. Ignore the stock market’s reaction to earnings reports. It doesn’t tell you much about what the stock market will do next.

By Troy Bombardia

I’m Troy Bombardia, the author behind BullMarkets.co. I used to run a hedge fund, but closed it due to a major health scare. I am now enjoying life and simply investing/trading my own account. I focus on long term performance and ignore short term performance.

Copyright 2018 © Troy Bombardia - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.