Study: A Rising and Strong U.S. Dollar Isn’t Consistently Bearish for the Stock Market

Stock-Markets / Stock Markets 2018 May 22, 2018 - 08:31 PM GMTBy: Troy_Bombardia

Investors and traders are susceptible to recency bias, which means that they emphasis recent observations over those that occurred in the past.

Investors and traders are susceptible to recency bias, which means that they emphasis recent observations over those that occurred in the past.

The U.S. Dollar has been rising recently, which reminds some investors of the 2014-2015 USD spike that led to a “significant correction” for the U.S. stock market in 2015-2016.

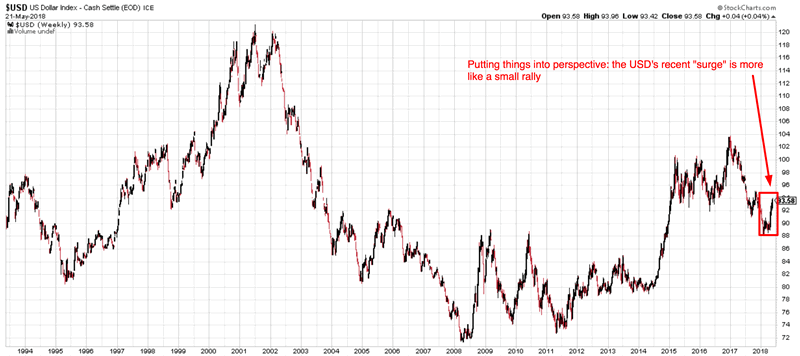

For starters, it’s important to put things into perspective. The U.S. Dollar’s recent “surge” is more like a small rally.

Here’s the more important point.

A more detailed look at history demonstrates that a rising and strong U.S. Dollar is not consistently bearish for the U.S. stock market. In fact, the stock market tends to go up more often than it goes down when the U.S. Dollar is rising!

Let’s look at the USD’s 3 major historical bull markets and the U.S. stock market’s (S&P 500’s) reaction.

*The S&P 500 is on a log scale.

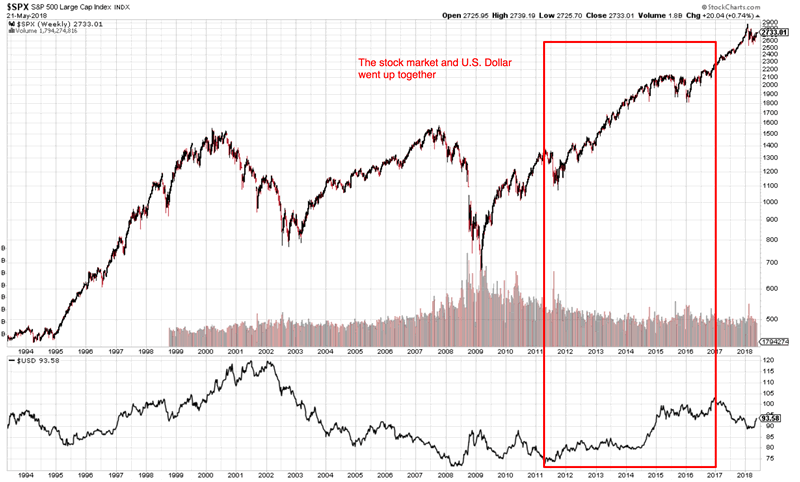

Mid-2011 to late-2016

The U.S. dollar rallied from mid-2011 to late-2016. The U.S. stock market trended higher during this period, although there were “small corrections” and “significant corrections” along the way.

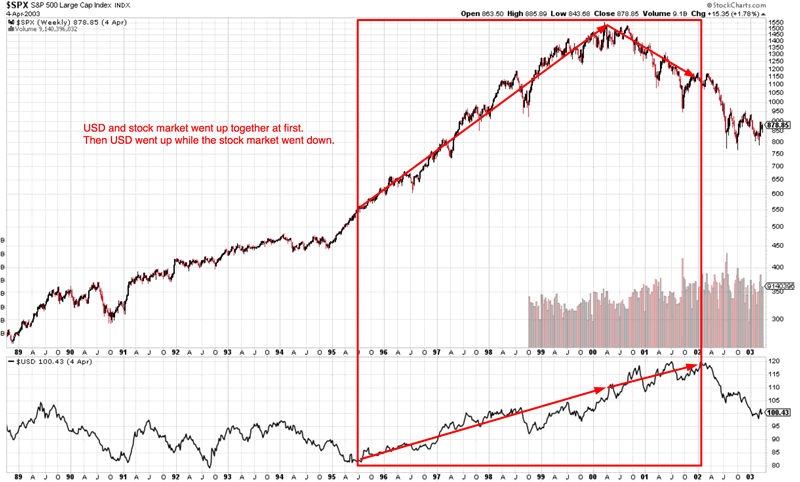

Mid-1995 to the end of 2001

The U.S. Dollar rallied from mid-1995 to the end of 2001. The USD and stock market went up together at first. Then the USD and stock market moved in opposite directions.

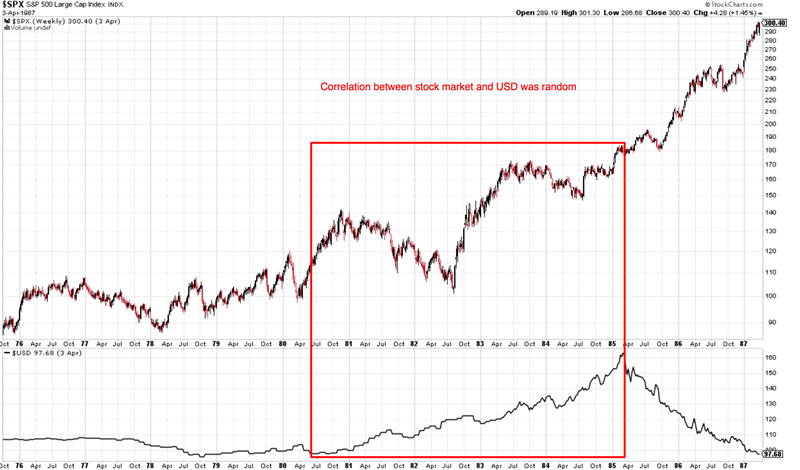

Mid-1980 to early-1985

The U.S. Dollar went up from mid-1980 to early-1985. The correlation between the USD and S&P 500 was extremely random. Sometimes the stock market went up when the USD went up. Sometimes the stock market went down when the USD went down.

The stock market’s performance during other USD rallies

The stock market’s performance was mostly random during smaller USD rallies as well.

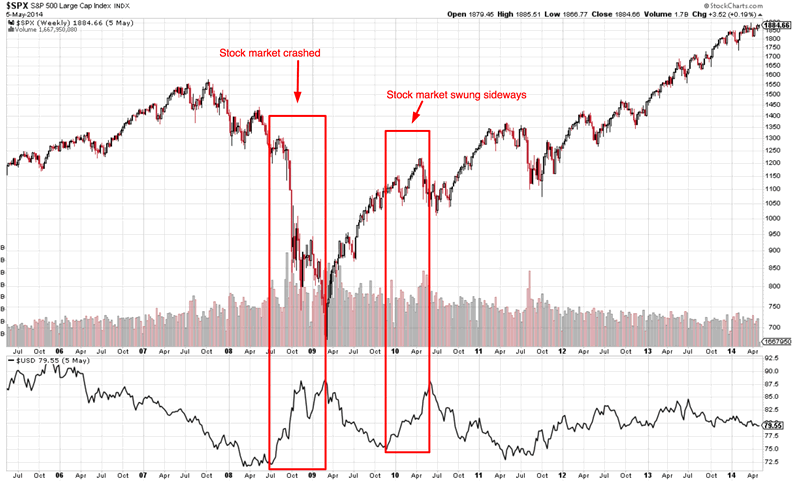

The USD rallied from mid-2008 to early-2009 and from late-2009 to mid-2010. The stock market crashed and swung sideways, respectively.

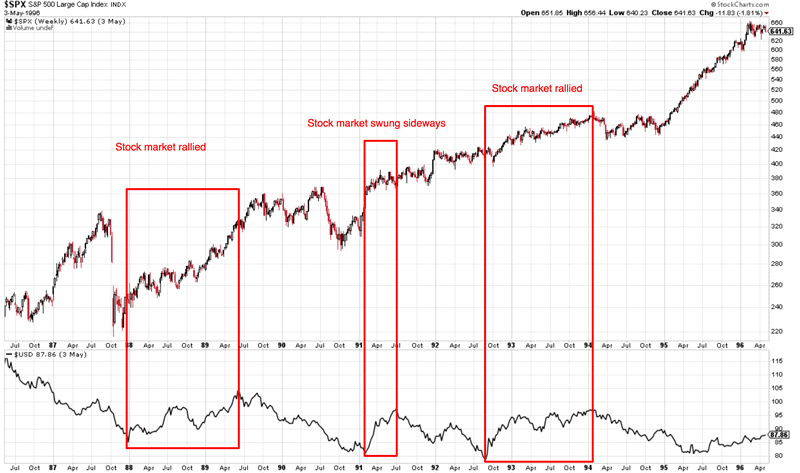

The USD rallied from 1988 to early-1989, early 1991, and late 1991 to early 1994. The stock market either rallied or swung sideways during these USD rallies.

Conclusion

A rising or strong U.S. Dollar is neither consistently bearish nor consistently bullish for the U.S. stock market. The correlation is mostly random. This suggests that U.S. stock market investors and traders shouldn’t focus too much on the U.S. dollar and currency markets when predicting the stock market’s medium-long term outlook. Correlations are of secondary importance when predicting the stock market’s future direction.

Read Stocks on May 22, 2018: outlook

By Troy Bombardia

I’m Troy Bombardia, the author behind BullMarkets.co. I used to run a hedge fund, but closed it due to a major health scare. I am now enjoying life and simply investing/trading my own account. I focus on long term performance and ignore short term performance.

Copyright 2018 © Troy Bombardia - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.