What Happens Next When Stock Market Volatility (VIX) Returns

Stock-Markets / Stock Markets 2018 May 31, 2018 - 01:11 PM GMTBy: Troy_Bombardia

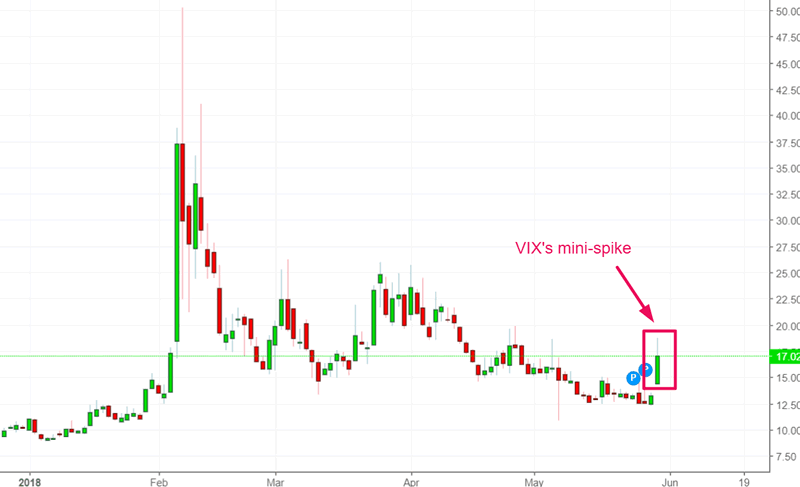

The stock market’s volatility index (VIX) spiked today from a very low level (from less than 14 to 17).

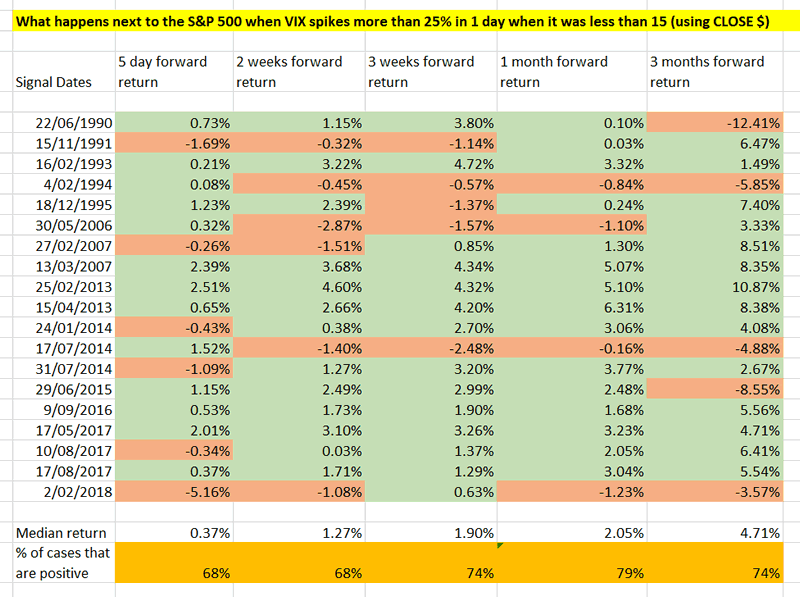

This study looks at what happens next to the S&P 500 when VIX spikes more than 25% from under 15.

Here are the S&P 500’s forward returns for the next 1 week, 2 week, 3 week, 1 month, and 3 months.

Click here to download the data in Excel.

But as always, we need to apply context to market studies. The recent spike in volatility (VIX) has occurred after a recent and bigger spike in January-February 2018. In other words, today is the “return” of volatility.

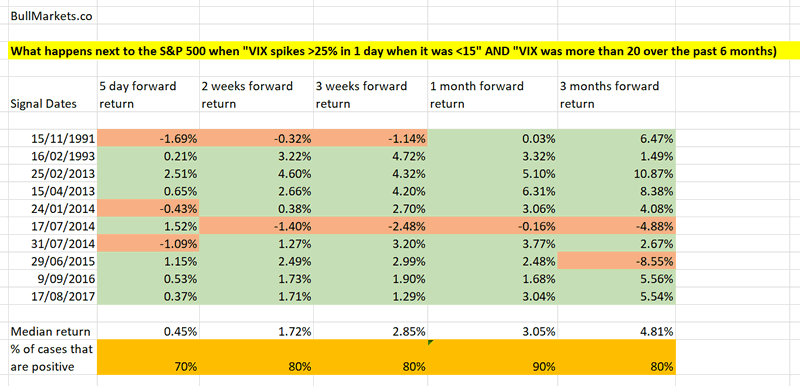

To further refine this study:

What happens next to the S&P 500 when VIX spikes more than 25% from under 15 AFTER VIX was above 20 less than 6 months ago.

Here are the S&P 500’s forward returns. Notice how the forward returns are more positive.

Click here to download the data in Excel.

Here are these 10 historical cases in detail

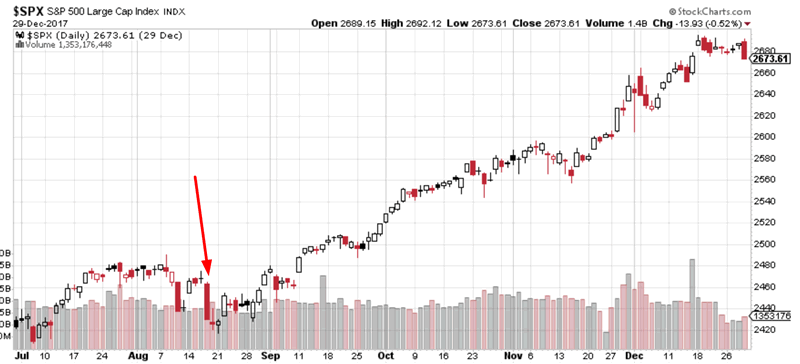

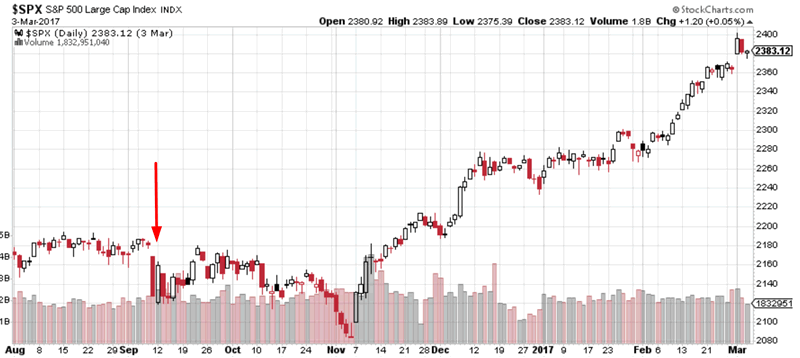

August 17, 2017

The stock market went up after this signal.

September 9, 2016

The stock market faced a little more downside over the next 2 months, and then soared.

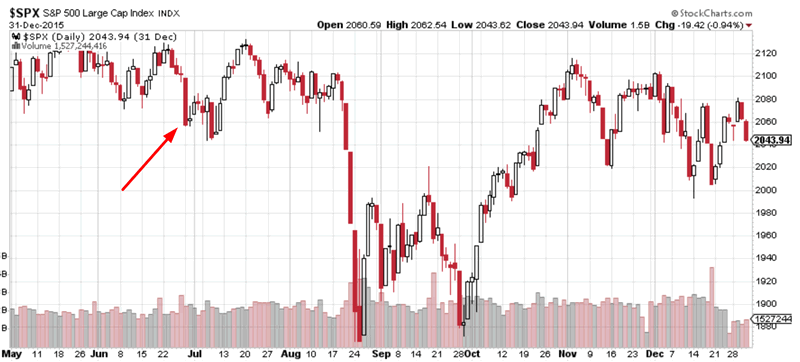

June 29, 2015

The stock market made a “significant correction” in the next few months after this signal came out. The Medium-Long Term Model predicted the significant correction.

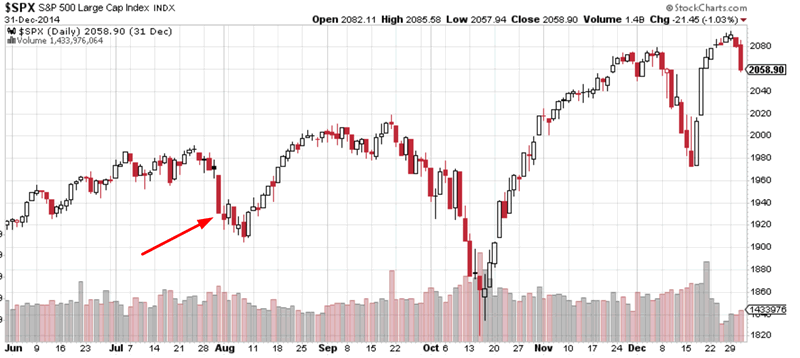

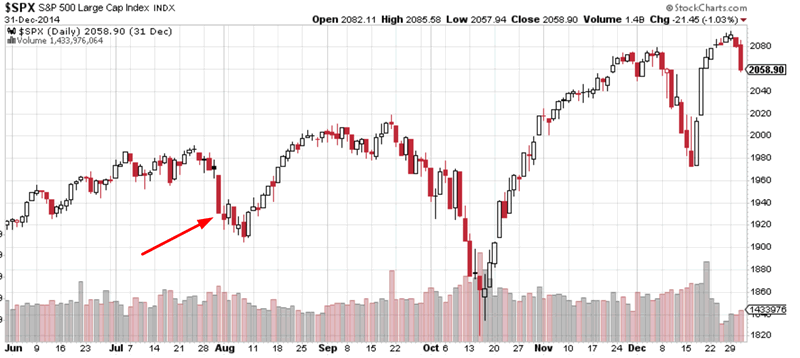

July 31, 2014

The S&P 500 swung sideways over the next 3 months, making a “small correction” from September-October 2014. It eventually trended higher.

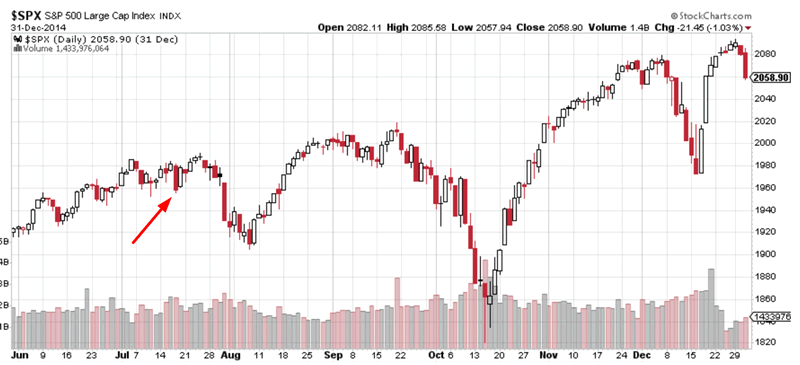

July 17, 2014

January 24, 2014

The stock market was in the middle of a 6%+ “small correction”. The downside was limited, and the stock market’s rally soon resumed.

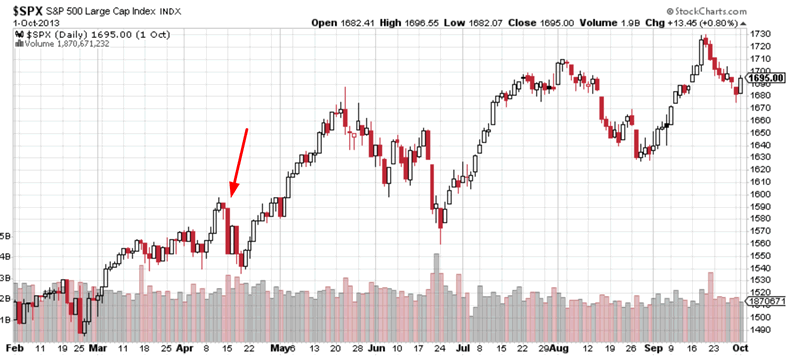

April 15, 2013

This signal occurred when the S&P 500 was in the middle of making a small pullback. The stock market trended higher over the next few months, even though there was a 6%+ “small correction” along the way.

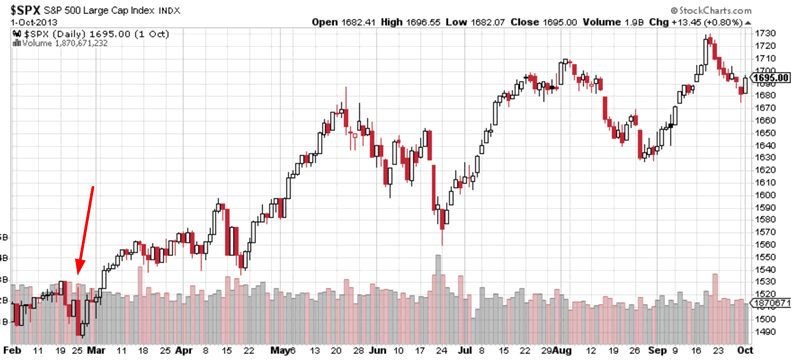

February 25, 2013

This signal occurred when the S&P 500 was in the middle of making a small pullback. The stock market trended higher over the next few months.

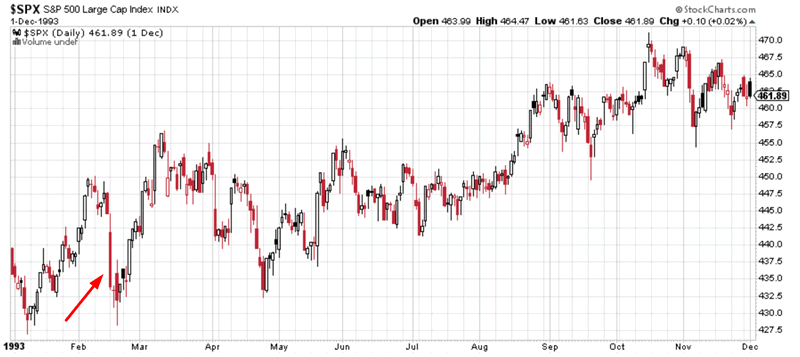

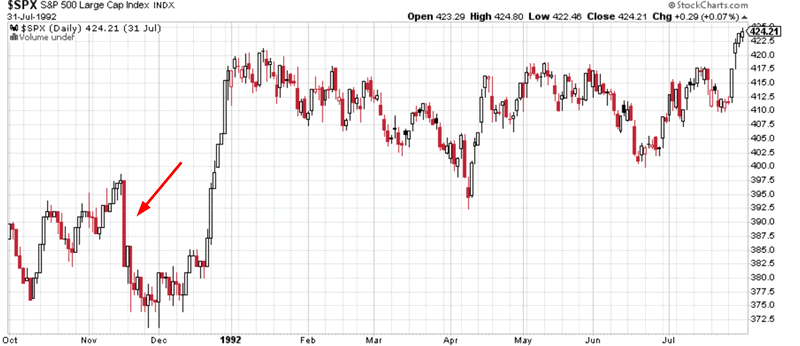

February 16, 1993

This signal occurred near the market’s bottom. The S&P trended higher over the next several months in a choppy manner.

November 15, 1991

The stock market’s downside was limited after this signal came out. The S&P 500 trended higher over the next year.

Conclusion

Most cases saw a little more downside for the S&P 500 over the next 1-3 weeks (i.e. only a few cases were positive throughout the entire next 1-3 weeks). HOWEVER, the stock market usually trended higher over the next 1-3 months after VIX spiked the way it did today.

This study suggests that the stock market’s short term downside is limited, and that the medium term outlook is bullish.

By Troy Bombardia

I’m Troy Bombardia, the author behind BullMarkets.co. I used to run a hedge fund, but closed it due to a major health scare. I am now enjoying life and simply investing/trading my own account. I focus on long term performance and ignore short term performance.

Copyright 2018 © Troy Bombardia - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Troy_Bombardia Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.