Stock Market Short term Downside Limited, Medium-Long Term is Bullish

Stock-Markets / Stock Markets 2018 Jun 03, 2018 - 01:29 PM GMTBy: Troy_Bombardia

As always, the economy’s fundamentals determine the stock market’s medium-long term outlook. Technicals determine the stock market’s short-medium term outlook. Here’s why the stock market’s short term downside is limited while the medium-long term is bullish.

As always, the economy’s fundamentals determine the stock market’s medium-long term outlook. Technicals determine the stock market’s short-medium term outlook. Here’s why the stock market’s short term downside is limited while the medium-long term is bullish.

As always, we go from the long term, to the medium term, to the short term.

*A recap of this week’s thoughts and market studies.

Long term is bullish

The Medium-Long Term Model states that there is no “significant correction” or bear market for U.S. equities on the horizon.

Last week I wrote about Why the economy is still too strong to induce an equities bear market and recession. Not much has changed about the U.S. economy – it is still improving at a decent pace.

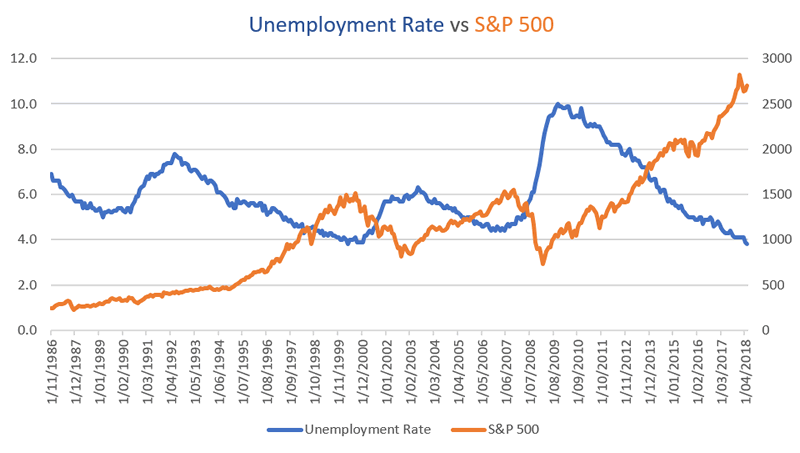

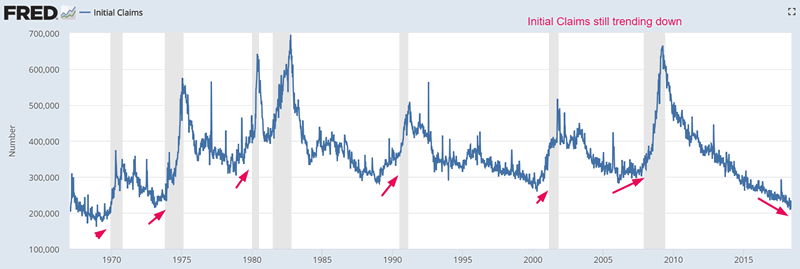

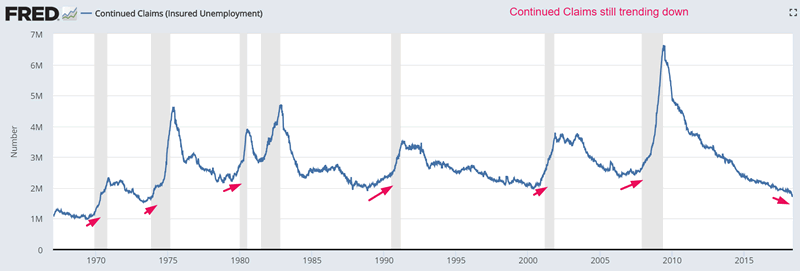

The Unemployment Rate, Initial Claims, and Continued Claims are still trending down. These leading indicators tend to trend upwards before an equities bear market and economic recession begins.

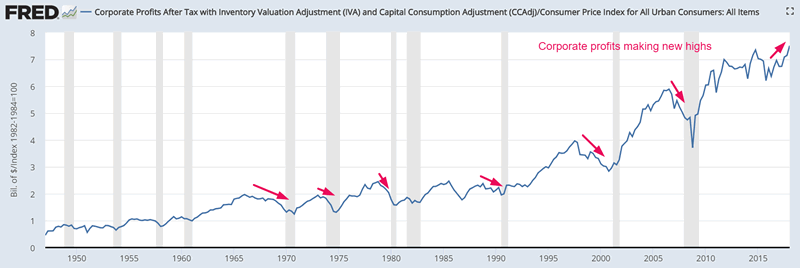

Meanwhile, corporate profits continue to trend higher, even when adjusting for inflation. Historically, corporate profits (inflation-adjusted) tend to go down for a few quarters before an equities bear market or “significant correction” begins.

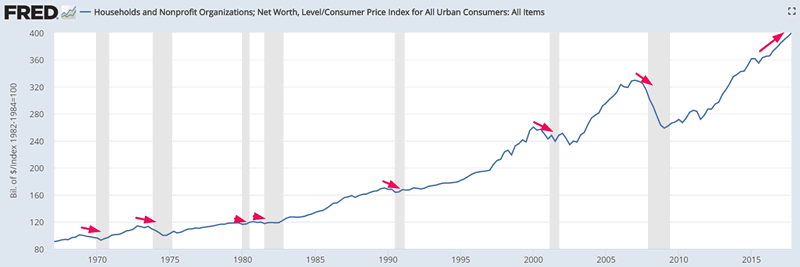

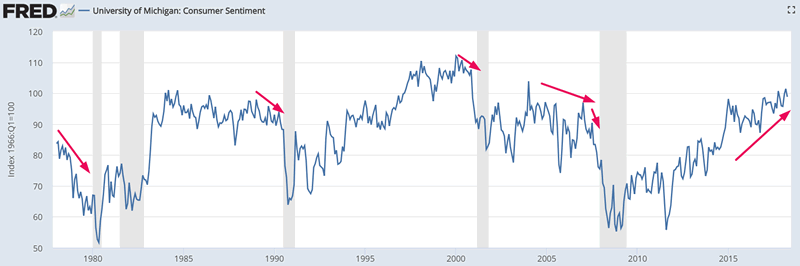

Households’ Networth and Consumer Confidence are still trending higher. These are also leading indicators for the stock market and economy. These 2 economic indicators tend to trend downwards before an equities bear market begins.

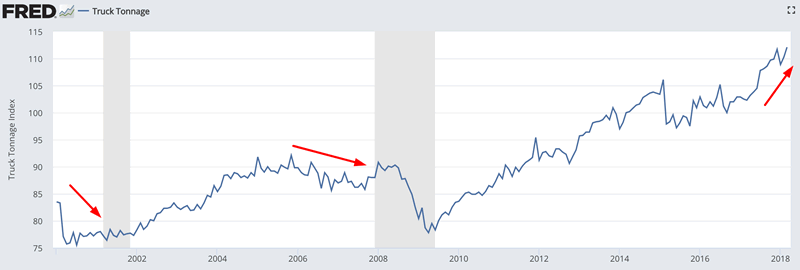

Truck Tonnage continues to increase. This leading indicators tends to trend downwards before an equities bear market begins.

Medium and short term

The stock market’s short term is notoriously difficult to predict. It is mostly random. Predicting the medium term is easier. Various market studies from the past week demonstrate that although short term downside risk is present, this risk is limited because the stock market’s medium term bias is bullish.

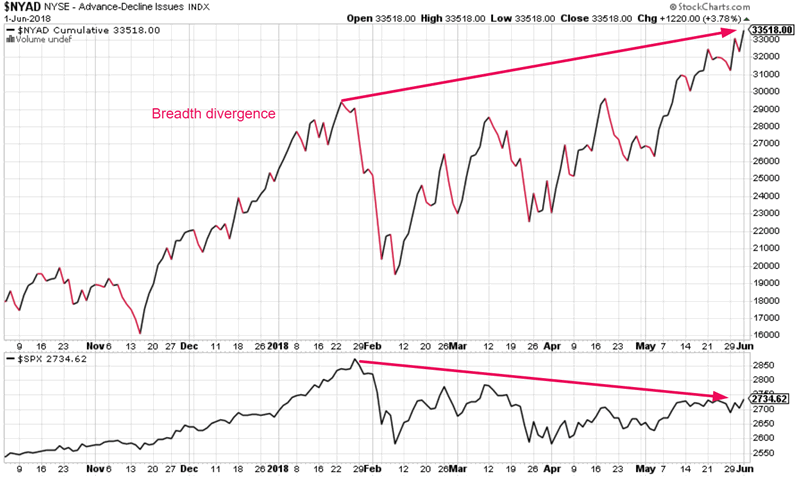

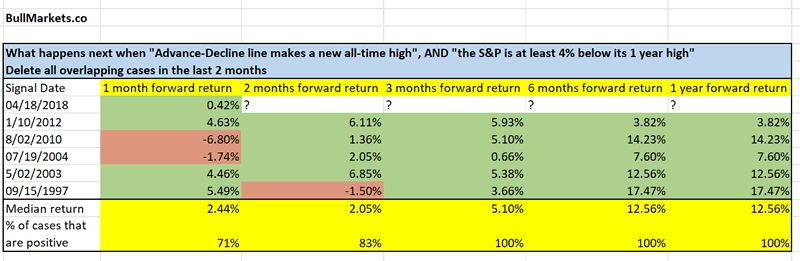

For starters, breadth continues to form a bullish divergence with the S&P 500. This is a medium term bullish sign. See the S&P’s forward returns (all the GREEN).

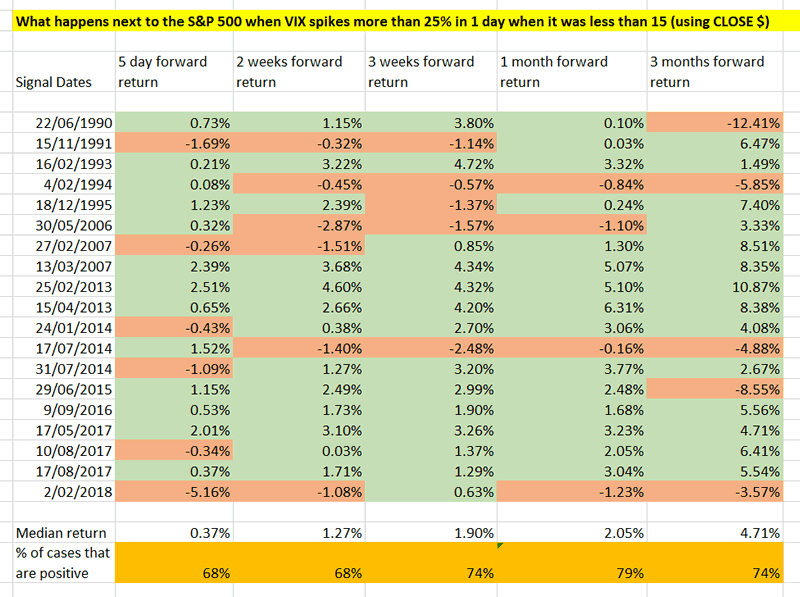

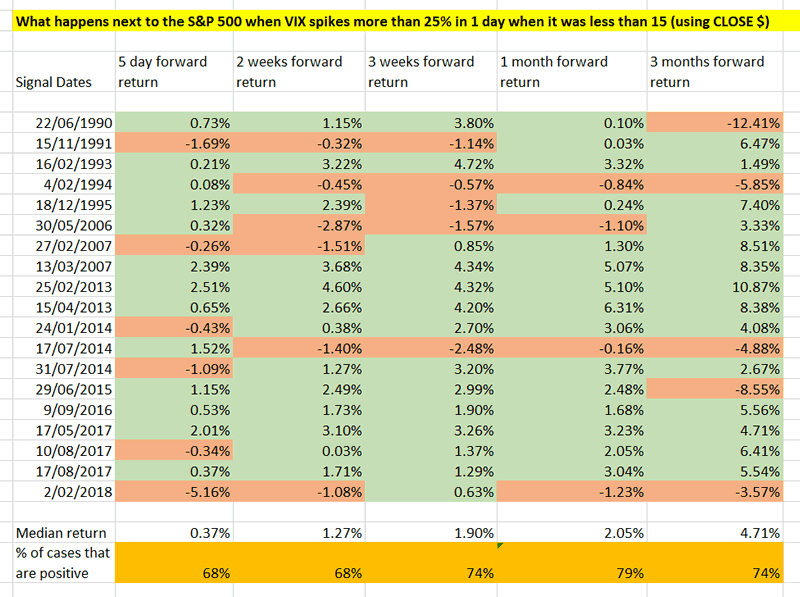

The stock market’s volatility (VIX) spiked and then cratered. The S&P’s 1-3 month forward returns are bullish.

VIX study:

VIX study:

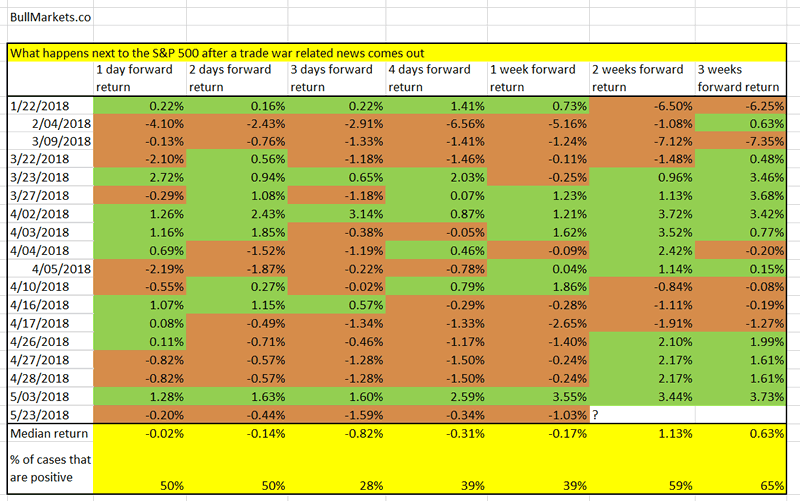

And with all the talk of a trade war, here is the stock market’s forward return after a trade war related news is released. There is a bearish bias for 1 week (i.e. short term downside risk). The bearish bias disappears after that. See study:

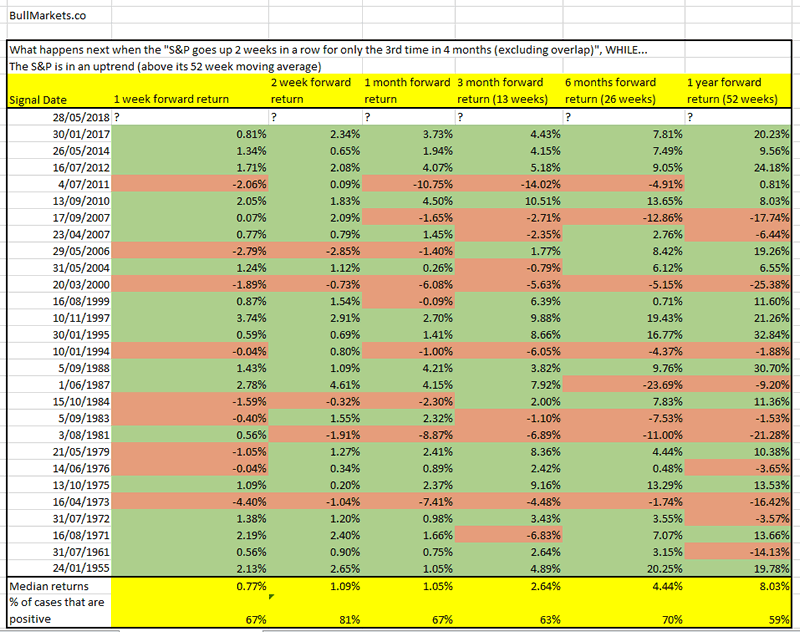

But considering that the stock market just went up 2 weeks in a row, even the short term risk is limited. The forward returns after 2 weeks are positive 81% of the time.

Conclusion

- The long term is bullish. January 2018 was not this bull market’s top.

- The medium term is bullish. The stock market will probably trend higher over the next few months. This study suggested that the stock market will make a new high before summer 2018 is over.

- The stock market’s short term is 50-50.

Focus on the medium-long term. Have a great weekend, and please share this on social media!

By Troy Bombardia

I’m Troy Bombardia, the author behind BullMarkets.co. I used to run a hedge fund, but closed it due to a major health scare. I am now enjoying life and simply investing/trading my own account. I focus on long term performance and ignore short term performance.

Copyright 2018 © Troy Bombardia - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.