SPX Extends But in a Limited Range

Stock-Markets / Stock Markets 2018 Jun 06, 2018 - 03:19 PM GMT SPX futures are higher this morning as they progress toward their ultimate target at/near 2762.00. The Cycles Model has tomorrow tagged as the turn date, but we should see waning strength and possibly a turn in the indicators as early as today. The hourly Trading Bands are very tight, suggesting a reversal is coming in the SPX.

SPX futures are higher this morning as they progress toward their ultimate target at/near 2762.00. The Cycles Model has tomorrow tagged as the turn date, but we should see waning strength and possibly a turn in the indicators as early as today. The hourly Trading Bands are very tight, suggesting a reversal is coming in the SPX.

ZeroHedge reports, “Global stocks, US equity futures and Treasury yields extended gains while the dollar slumped as "risk-on" sentiment returned after the U.S. and China exchanged trade proposals meant to avoid an escalation of economic tensions, while European bonds declined and the euro strengthened following a Bloomberg report and hawkish comments from ECB speakers suggesting that the ECB's next, June 14 meeting will be "live" to debate the end of QE.”

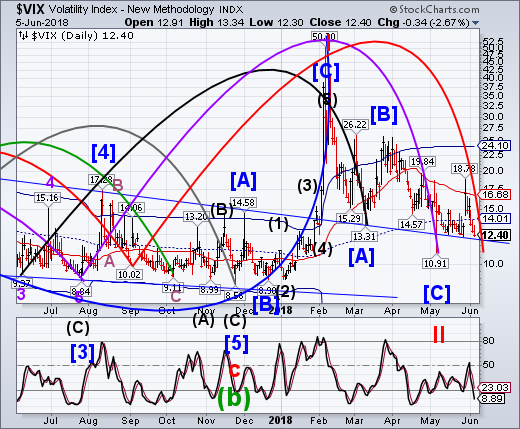

VIX futures have made a new low at 11.63 this morning. Today is day 278 of an extended Maser Cycle and the second time that VIX has gone beneath the 2-year trendline. Of course, the Algos have crisscrossed the 2-year trendline on the SPX multiple times already. Today is also a Pi date (314 days from the July 26 low), which punctuates the potential turn date with even more emphasis.

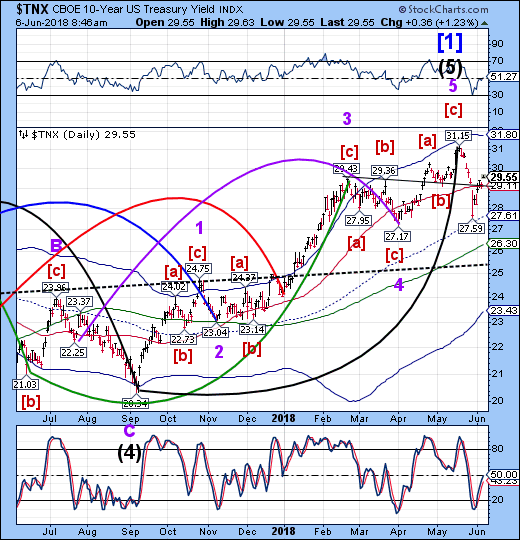

TNX is higher this morning, having surpassed the 50% retracement level at 29.37. This opens the possibility of a 61.8% retracement at 29.79. Today is a minor turn date for treasuries, but there are indications of growing strength in the bond complex starting next week, with yields declining.

Bloomberg comments, “The rebound in the U.S. bond market in recent weeks that pushed yields on 10-year Treasuries back below the psychologically important 3 percent level has made the bond bears very happy. Yes, the bears. Rather than capitulating, some new data suggests that the bears see the rally as an opportunity to set up new positions betting against bonds at more attractive levels.

A widely followed JPMorgan Chase & Co. survey showed that investors went from being neutral on bonds to bearish in the biggest weekly decline in sentiment since the start of October. Its so-called All Client Net Long index slid to negative 19 from 0 in the week ended June 4, as 10-year yields dropped to as low as 2.76 percent from as high as 3.13 percent on May 18. If anything, the survey underscores the multitude of headwinds facing the bond market. Signs of faster inflation have traders betting on two to three more interest-rate increases from the Federal Reserve this year, starting with one next week. On top of that, the government is poised to double bond sales this year to about $1 trillion to pay for a growing federal budget deficit.”

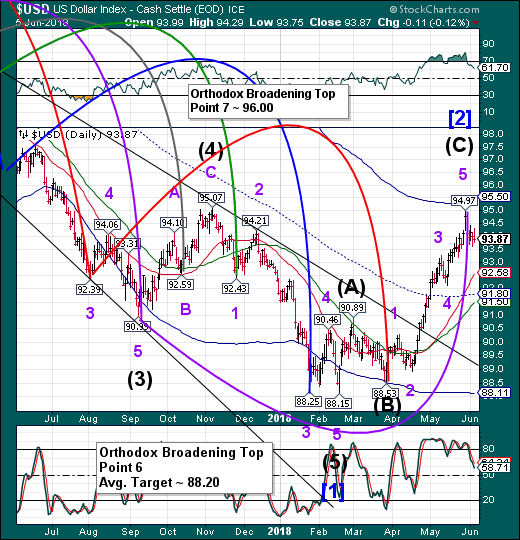

USD futures have resumed their decline this morning with a low of 93.53. The Cycles Model suggests there may be weakness in the USD through the month of June.

Today may be an interesting day in the markets.

Regards,

Tony

Our Investment Advisor Registration is on the Web.

We are in the process of updating our website at http://mrpracticalinvestor.com/ to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinve4stor.com .

Anthony M. Cherniawski, President and CIOhttp://mrpracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals.

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.