Judgment Day for the ECB

Interest-Rates / ECB Interest Rates Jun 07, 2018 - 05:37 PM GMTBy: Arkadiusz_Sieron

Will the ECB Withstand Pressure?

Will the ECB Withstand Pressure?

Next week, the ECB will hold its monetary policy meeting. The bank was expected to start winding down its stimulus program at the end of 2018. However, Italian turmoil led some analysts to think that the ECB will remain cautious. Will the ECB withstand the pressure or funk? And what does it all mean for the gold market?

Judgment Day for the ECB Is Coming

Yesterday, we stated that the strong May employment report strengthens the Fed’s hand. The hike this month is, however, fully priced in gold. The important question is whether the U.S. central bank will raise interest rates once or twice more this year. We bet that we will see upward moves until the end of 2018, which could put downward pressure on the gold prices (although a lot depends on the messages accompanying the hikes).

However, as the markets have already factored in a U.S. rate hike; the ECB is now the most important player. As a reminder, in March, the ECB has already taken a small step in ending its quantitative easing and dropped a so-called easing bias, i.e., the pledge to increase bond buys if needed (we covered that change in the Gold News Monitor). And the ECB’s asset purchases, at the current monthly pace of €30 billion, are

intended to run until the end of September 2018, or beyond, if necessary, and in any case until the Governing Council sees a sustained adjustment in the path of inflation consistent with its inflation aim.

So the judgment day is coming. It may trigger heightened volatility. Be prepared.

To Unwind or Not to Unwind, That Is the Question

Indeed, as Peter Praet, ECB chief economist and a close Draghi’s ally, said yesterday during a speech in Berlin:

Next week, the Governing Council will have to assess whether progress so far has been sufficient to warrant a gradual unwinding of our net purchases.

And what is the likely outcome of that assessment? Well, Praet gave a hint:

Signals showing the convergence of inflation towards our aim have been improving, and both the underlying strength in the euro area economy and the fact that such strength is increasingly affecting wage formation supports our confidence that inflation will reach a level of below, but close to, 2% over the medium term.

It suggests that the uncertainty caused by a political crisis in Italy will not affect the ECB’s decision. Economics beat politics. The ‘political crisis’ may be actually an exaggeration, at least for Italians, who are used to frequent political changes and interruptions. The ECB is pleased with the rise in inflation, as its annual rate jumped from 1.2 to 1.9 in May (according to Eurostat flash estimate). Hence, investors should prepare for the gradual unwinding of monetary stimulus in the Eurozone. However, they should also remember that ECB’s major policy changes have been taken in two steps in recent years, so Draghi may just lay the groundwork this month for the real change in July.

Implications for Gold

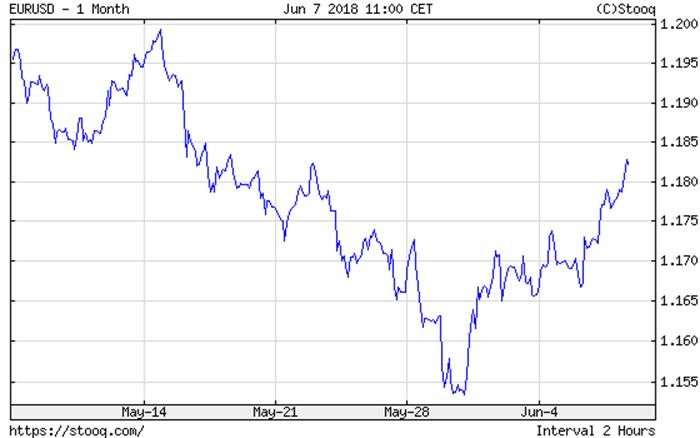

What does it mean for the gold market? Praet’s comments pushed the euro to a two-week high against the dollar, as one can see in the chart below.

Chart 1: EUR/USD exchange rate over the last month.

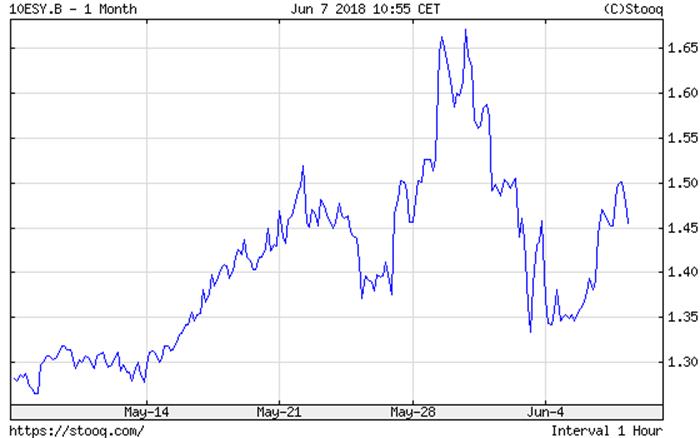

The rebound in euro’s strength should be positive for the gold prices. The yellow metal could catch its breath during dollar’s depreciation against the common currency. The biggest political turmoil in Italy is probably behind us. The situation in Spain – when a vote of no-confidence forced out Mariano Rajoy and made Pedro Sánchez a new prime minister – also stabilized, as the next chart – which paints the 10-year Spanish bond yields – shows.

Chart 2: 10-Year Spain’s Government Yields over the last month.

Therefore, the euro may be not doomed yet. One thing is certain: next week will be hot. Both the Fed and the ECB will hold their monetary policy meetings (actually, the BoJ will also hold a meeting). We will see if they can stand the pressure. Stay tuned!

Thank you.

If you enjoyed the above analysis and would you like to know more about the gold ETFs and their impact on gold price, we invite you to read the April Market Overview report. If you're interested in the detailed price analysis and price projections with targets, we invite you to sign up for our Gold & Silver Trading Alerts . If you're not ready to subscribe at this time, we invite you to sign up for our gold newsletter and stay up-to-date with our latest free articles. It's free and you can unsubscribe anytime.

Arkadiusz Sieron

Sunshine Profits‘ Market Overview Editor

Disclaimer

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Arkadiusz Sieron Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.