What Happens Next to Stocks when Russell Goes up 6 Weeks in a Row

Stock-Markets / Stock Markets 2018 Jun 12, 2018 - 02:53 PM GMTBy: Troy_Bombardia

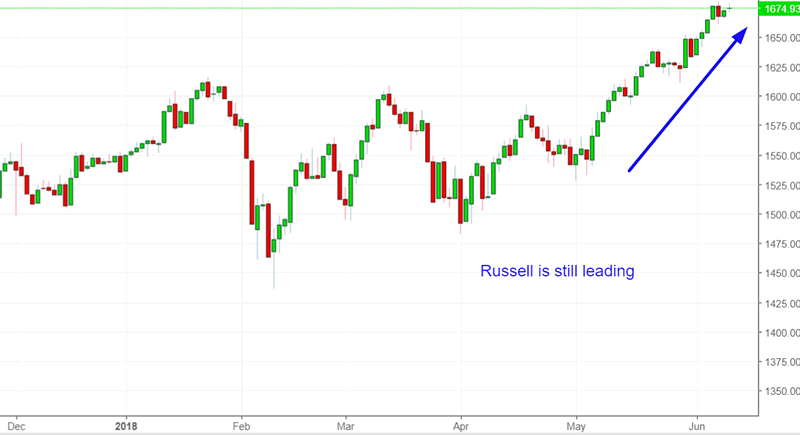

Small cap stocks (Russell 2000 Index) continues to lead the stock market higher.

Small cap stocks (Russell 2000 Index) continues to lead the stock market higher.

As I demonstrated in a study last week, the Russell leading the S&P 500 is a medium term bullish sign for the stock market.

We can look at this idea from another angle. The Russell 2000 has gone up 6 weeks in a row right now for the first time since mid-2017. This is the return of “strong momentum” for small cap stocks.

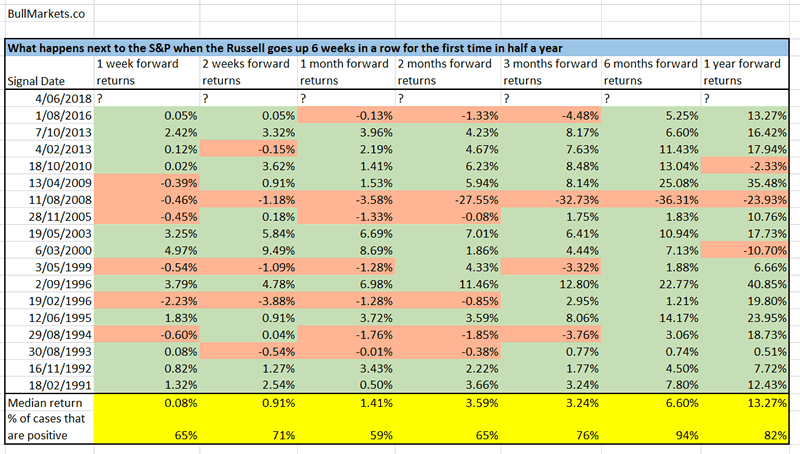

Here are the historical cases in which “momentum returned” to the Russell (i.e. Russell went up 6 weeks in a row for the first time in 6 months), and what happened next to the S&P 500.

Click here to download the data in Excel.

Conclusion

Notice how the S&P’s returns on a 6 month forward basis are extremely bullish. The S&P went up in 17 out of 18 historical cases.

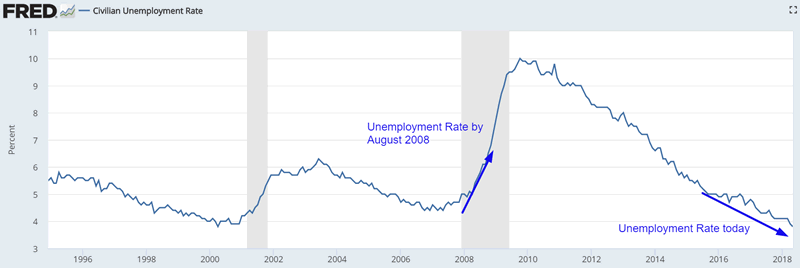

There is only 1 bearish case out of those 18 historical cases: August 2008. That historical case doesn’t really apply to today. Same symptoms, different context:

The August 2008 Russell rally occurred after the Russell had already fallen -25%. Today, the Russell has gone up 6 weeks in a row while making new all-time highs.

In addition, the economy was clearly going to hell by August 2008. The economy is doing well today.

So if we exclude that 1 bearish historical case which has a very different background from today, this is an extremely bullish sign for the stock market on a 6 month forward basis.

Click here for more market studies.

By Troy Bombardia

I’m Troy Bombardia, the author behind BullMarkets.co. I used to run a hedge fund, but closed it due to a major health scare. I am now enjoying life and simply investing/trading my own account. I focus on long term performance and ignore short term performance.

Copyright 2018 © Troy Bombardia - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.