What Happens to Stocks, Forex, Commodities, and Bonds When the Fed Hikes Rates

Stock-Markets / Financial Markets 2018 Jun 13, 2018 - 03:38 PM GMTBy: Troy_Bombardia

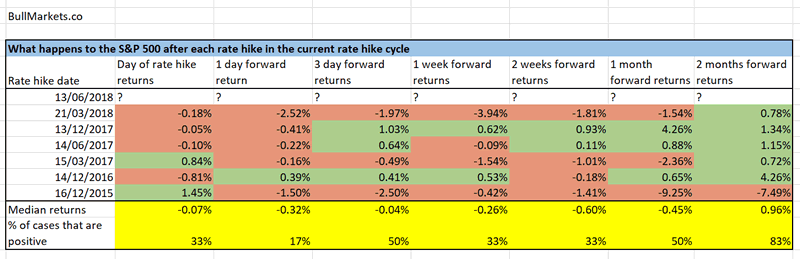

The Fed is expected to hike interest rates today. As I’ve demonstrated in a previous study, the U.S. stock market has a tendency to fall a little after rate hikes in the current rate hike cycle.

The Fed is expected to hike interest rates today. As I’ve demonstrated in a previous study, the U.S. stock market has a tendency to fall a little after rate hikes in the current rate hike cycle.

But what about other markets? How have other markets performed after the Fed hikes interest rates in the current rate hike cycle?

Click here to download the data in Excel

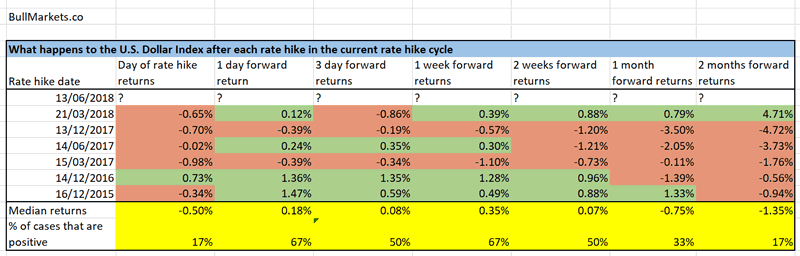

Here’s what happens next to the U.S. Dollar Index when the Fed hikes interest rates in the current rate hike cycle.

Notice how the U.S. Dollar tends to fall on the day that the Fed hikes interest rates. This certainly goes against traditional dogma which states that “the U.S. Dollar should rise when the Fed hikes rates”.

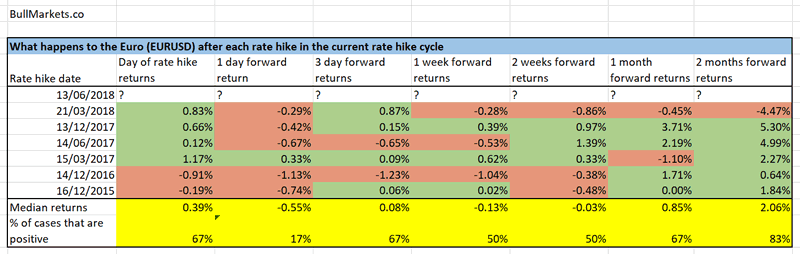

Here’s what happens next to the Euro (EURUSD) when the Fed hikes interest rates in the current rate hike cycle.

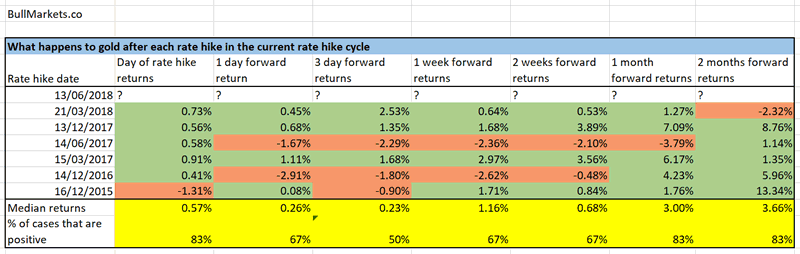

Here’s what happens next to gold when the Fed hikes interest rates in the current rate hike cycle.

Notice how gold tends to go up on the day that the Fed hikes interest rates. Once again, this goes against traditional dogma which states that gold should fall when the Fed hikes rates.

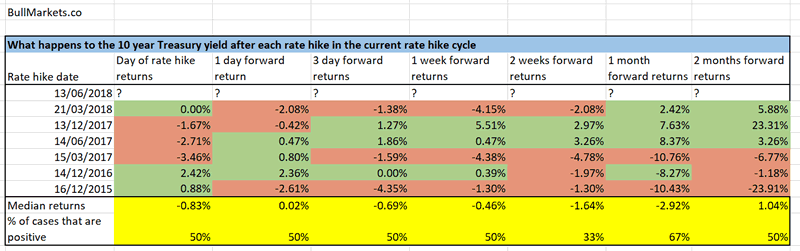

Here’s what happens next to the 10 year Treasury yield when the Fed hikes interest rates in the current rate hike cycle.

Notice how the 10 year Treasury yield doesn’t always go up when the Fed hikes interest rates. This also goes against traditional dogma. The 10 year yield sometimes falls because the yield curve flattens when the Fed hikes rates. This causes short term rates to rise while long term rates swing sideways.

Conclusion

This study is useful for short term traders but isn’t very useful for medium-long term traders. Focus on fundamentals and technicals. Don’t put too much emphasis on what the Fed does, because the Fed is data-dependent (i.e. they base their decisions on the fundamentals).

Click here for more market studies.

By Troy Bombardia

I’m Troy Bombardia, the author behind BullMarkets.co. I used to run a hedge fund, but closed it due to a major health scare. I am now enjoying life and simply investing/trading my own account. I focus on long term performance and ignore short term performance.

Copyright 2018 © Troy Bombardia - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.