Is the ECB Ending QE a Good Thing? Markets Think So

Stock-Markets / Financial Markets 2018 Jun 14, 2018 - 02:15 PM GMT SPX finally made its Master Cycle high at 11:30 am at 2791.47, just 10 points shy of its March 13 high. Nevertheless, this counts best as the “top” of Wave [2]. SPX futures put in an overnight high of 2789.00 but have eased down. The decline from the top so far is miniscule, so any (short) positions taken here would be considered to be aggressive.

SPX finally made its Master Cycle high at 11:30 am at 2791.47, just 10 points shy of its March 13 high. Nevertheless, this counts best as the “top” of Wave [2]. SPX futures put in an overnight high of 2789.00 but have eased down. The decline from the top so far is miniscule, so any (short) positions taken here would be considered to be aggressive.

Should the Orthodox Broadening Top be accurate, the next target would be “point 6” near 2570.00. The Ending Diagonal agrees, since a break of the lower trendline near 2740.00 may send the SPX to its target at 2553.80. This would give the SPX a clear break of its 200-day Moving Average at 2652.40.

ZeroHedge comments, “US futures are flat after a torrid 24 hours, which saw European and Asian stocks decline led by China, HK and South Korea, as weak economic data, a Fed rate hike and U.S. tariff threats spooked emerging markets and sucked the life out of a rally spurred by the Chinese central bank unexpectedly deciding not to follow the Fed in raising interest rates amid what Rabobank said was "shockingly weak" Chinese data as the global economy is now on its last legs. Of course, the looming ECB rate decision, in which Draghi may announce the beginning of the end of QE, is adding another layer of uncertainty (full ECB preview here).

This is the amusing preview of today's main ECB event from UBS economist Paul Donovan

Now it is the turn of the ECB. ECB President Draghi's extensive rehabilitation to overcome an addiction to easing seems to have paid off. There are hopes of either 1) an announcement of the timetable to end bond buying, or 2) an announcement of an announcement of the timetable to end bond buying.”

NDX futures are modestly higher. The reaction to the ECB announcement is coming in with stocks rising, but yields falling. This is a direct disconnect that needs resolution. Why would stocks celebrate the end European QE?

VIX futures are taking a hit by revisiting yesterday’s low. This could be a false flag used to increase long positions by the Commercials. VIX should not go beneath its trendline at 11.95.

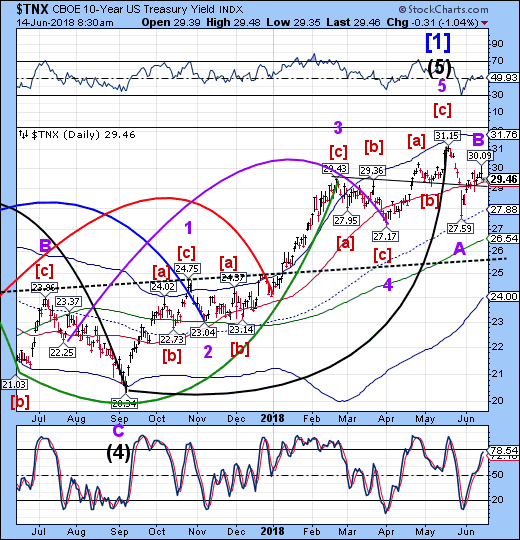

After a brief skirmish with the 3-handle yesterday, TNX is moving back down after the ECB announcement. Could it be that European investors find US Treasuries to be a “safe haven” or possibly even a bargain?

ZeroHedge comments, “In his monthly must-see live webcast this week, DoubleLine CEO Jeffrey Gundlach made one very specific call (among others) that stood out to many listening in on the call.

Having explained that the combination of rising U.S. interest rates and fiscal deficits is like a "suicide mission" - which notably escalated the intensity from last month when he referred to the trend as a "pretty dangerous cocktail" - Gundlach concluded that the debt burden will rise to such a level that borrowing costs will surge.”

Tony – Ultimately Jeff will be right, but yields don’t go in a straight line. In addition, a Wave [2] can go an awfully long distance (all the way back to the start of Wave [1] at 13.36) before a Wave [3] takes it to 6%. The Commercials may be right in going long bonds.

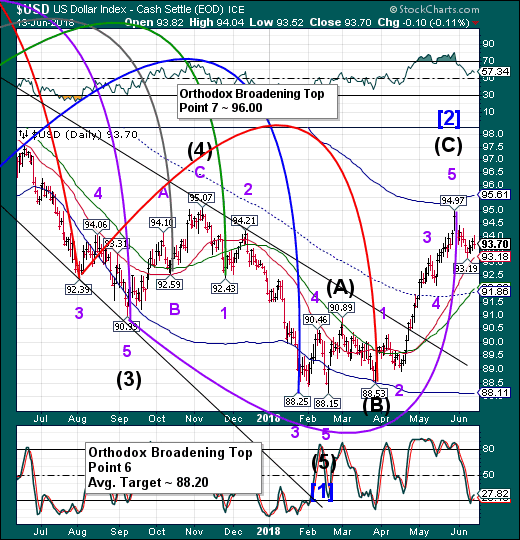

USD futures swung higher this morning, but did not exceed yesterday’s high as I write. The consolidation should end shortly, followed by a probable decline to the next Master Cycle low at the end of the month.

Regards,

Tony

Our Investment Advisor Registration is on the Web.

We are in the process of updating our website at http://mrpracticalinvestor.com/ to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinve4stor.com .

Anthony M. Cherniawski, President and CIOhttp://mrpracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals.

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.