Trouble Spotting Market Trends? This Can Help

InvestorEducation / Elliott Wave Theory Jun 22, 2018 - 07:36 AM GMTBy: EWI

Learn How You can Spot a Market Trend – Before it Starts

Let it be stated upfront that there is no perfect way to analyze and forecast financial markets. No crystal balls.

Yet, let's be just as quick to add that in Elliott Wave International's review of market analysis methods, none approach the utility of the Elliott wave model.

The reason for the Elliott wave model's usefulness is easily explained: Elliott waves are reflections of the repetitive patterns of investor psychology, which is the real driver of prices, not news or events.

And, what could be more useful to an investor than a method which helps to identify a financial market's trend -- especially before it gets underway? Well, mastering the Elliott wave model helps you to do just that.

The Wall Street classic book, Elliott Wave Principle: Key to Market Behavior by Frost & Prechter, says:

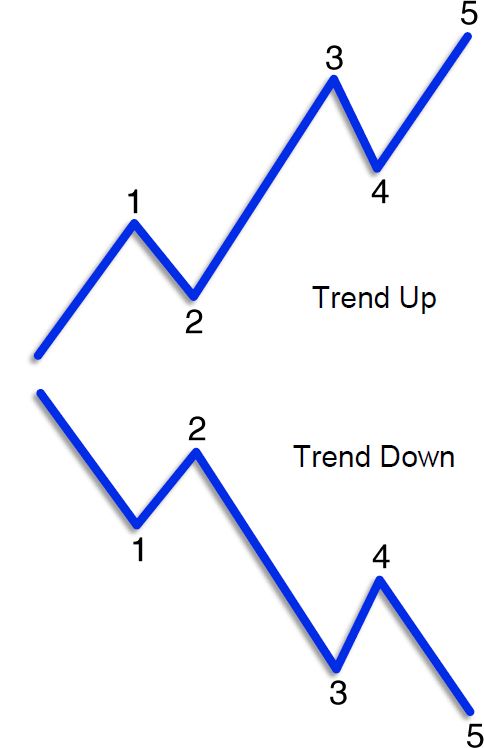

...action in the same direction as the one larger trend develops in five waves.

Here are illustrations:

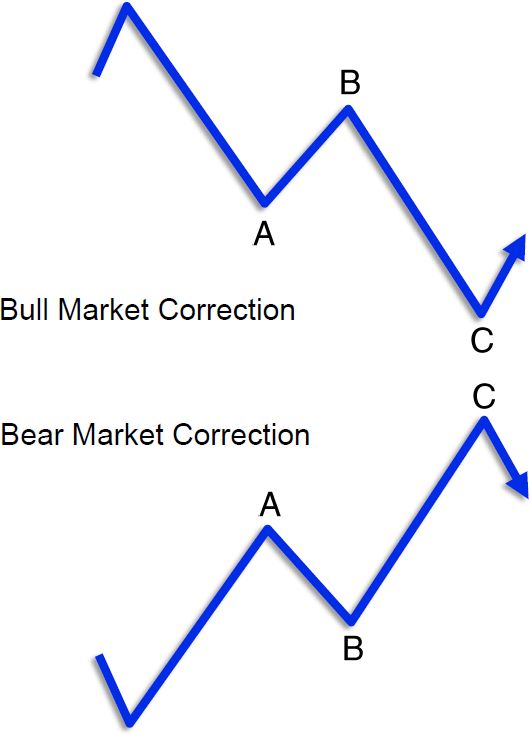

Let's now learn how the Elliott wave model identifies countertrend moves within the main trend by returning to Elliiott Wave Principle and additional illustrations:

... reaction against the one larger trend develops in three waves.

Lastly, let's learn how Elliott wave analysis signals the resumption of the main trend.

Elliott Wave International analyst Jeffrey Kennedy says:

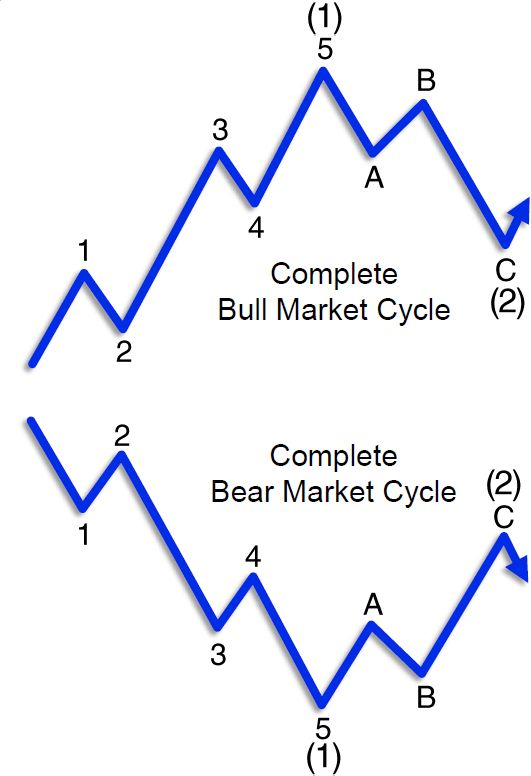

A complete Elliott wave cycle consists of eight waves. Upon its completion, a similar cycle ensues....

Again, here are illustrations of the point:

The reason that a market's basic form is five waves followed by three waves is that this is the most efficient method of achieving both fluctuation and progress in linear movement.

Think of it as a variation of nature's "two steps forward, one step back" model of achieving progress.

After all, humans are a part of the natural world, so it only follows that the financial markets, a product of human interaction, would carry the same imprint.

As you might imagine, there are many more details in applying the Elliott Wave Principle to financial markets, and it took an entire book to lay them all out.

The purpose of this article is to simply show you that the price patterns of financial markets unfold according to a repetitive, predictable structure. Familiarity with that structure can help you determine what's next.

Jump on once-in-a-lifetime opportunities and avoid dangerous pitfalls that no one else sees coming. We can help you prepare for opportunities and side step risks that will surprise most investors. You can get deeper insights in Elliott Wave International's new free report: 5 "Tells" that the Markets Are About to Reverse. The insights that you'll gain are especially applicable to the price patterns of key financial markets, including the stock market, now.

This article was syndicated by Elliott Wave International and was originally published under the headline Trouble Spotting Market Trends? This Can Help. EWI is the world's largest market forecasting firm. Its staff of full-time analysts led by Chartered Market Technician Robert Prechter provides 24-hour-a-day market analysis to institutional and private investors around the world.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.