Russell Has Gone up 8 Weeks in a Row. Bullish for Stocks

Stock-Markets / Stock Markets 2018 Jun 24, 2018 - 04:43 PM GMTBy: Troy_Bombardia

Last week we published a study which demonstrated that when the Russell 2000 (small caps index) goes up 7 weeks in a row, the stock market’s future returns are very bullish.

Last week we published a study which demonstrated that when the Russell 2000 (small caps index) goes up 7 weeks in a row, the stock market’s future returns are very bullish.

The Russell 2000 has now extended that rally streak to 8 weeks up in a row.

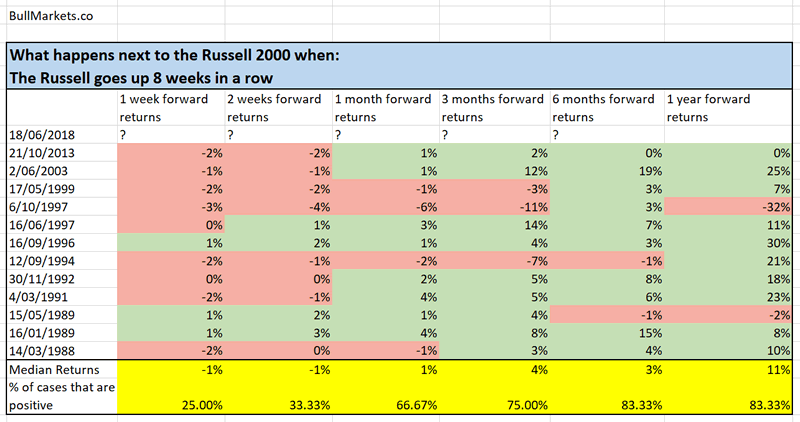

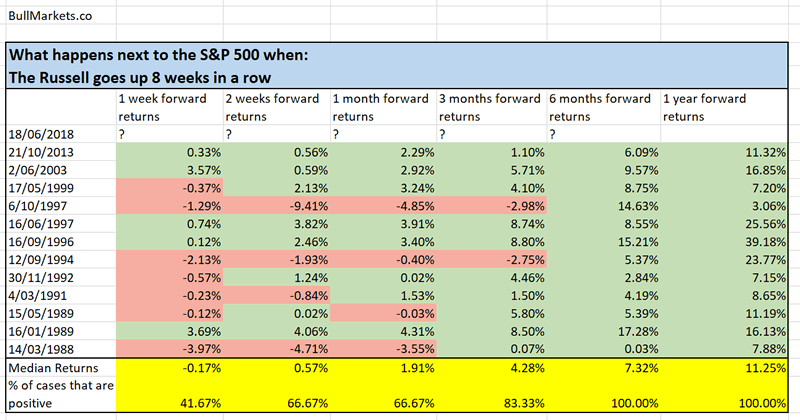

When the Russell 2000 goes up 8 weeks in a row, the stock market’s forward returns on a 3-12 month basis are very bullish.

This is because the Russell 2000 only goes up 8 weeks in a row during bull markets – it doesn’t go up 8 weeks in a row during bear market rallies.

This is telling us that even though the stock market hasn’t made new highs since January 2018, it is still in a bull market.

Here’s what happens next to the Russell 2000 when it goes up 8 weeks in a row.

Here’s what happens next to the S&P 500 when the Russell goes up 8 weeks in a row.

Click here to download the data in Excel.

Conclusion

This suggests that:

- The stock market could face some more short term downside, but more importantly….

- The stock market’s medium term and long term direction are bullish.

The stock market is demonstrating all kinds of internal bullish price action that is characteristic of bull markets. Remember: extreme strength usually begets more bullish strength.

Click here for more market studies.

By Troy Bombardia

I’m Troy Bombardia, the author behind BullMarkets.co. I used to run a hedge fund, but closed it due to a major health scare. I am now enjoying life and simply investing/trading my own account. I focus on long term performance and ignore short term performance.

Copyright 2018 © Troy Bombardia - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.