Gold Cannabis Stocks Wednessday

Commodities / Gold and Silver 2018 Jun 28, 2018 - 10:15 AM GMTBy: Denali_Guide

FLAT LINE AFTER A HEART ATTACK, but what awaits come the Holidays?

FLAT LINE AFTER A HEART ATTACK, but what awaits come the Holidays?

So the GREEN is a Cannabis Index, which shows once investors got over their reluctance, they embraced the reality that Cannabis was and still is a coming trend.

For this reason, I’d take a Scientific Wild Assinine Guess (S.W.A.G) that a minimum of 2-4 times the CANNIBIS related stocks, in the short run, are going to have speculative success, as compared to the Metal Miners and Developers. BUT be prepared for that to switch places. I am still long a lot of Cannibis related stocks, and also Miner related stocks.

Canadian Legalization looms July 1, and the cyclical rallies in the Precious Metals and Miners sectors, coming “about” six (6) months apart, generally Jan and Jul. Now, simply, the basic meme is “BUY The RUMOR”, and “SELL The NEWS” ( the obvious announcement concerning the Rumor). So with the Cannabis industry expanding like a bucket of water spilled on a tile floor, there is a time to beware of The DRAIN, where some of the companies disappear. Not all bad though, many will be absorbed by the bigger plays, that were investments for the “early adaptors”, and now provide buyouts for the smaller players.

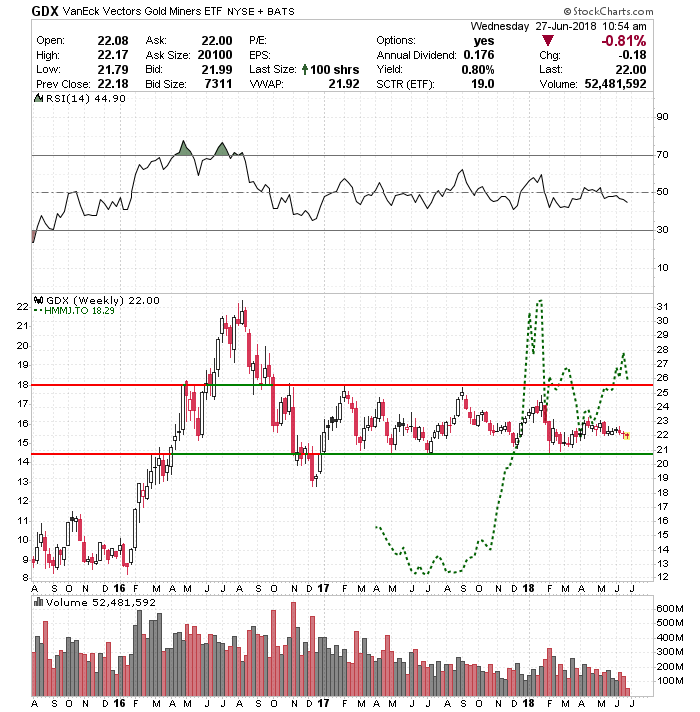

Lets go back to the really horrible or really great or just indifferent chart of the GDX.

GDX has been locked in a range of a high of 25.5 and a low of 20.67 for eighteen (18+) plus months. Highly unusual ? Yes I will go with that unusual label. For now.

Now for those who witnessed the 2011-2012 debacle where the US Govt got spooked because they lost their AAA rating, moved down to AA, and the Govt. then took steps advocated by Paul Volker, former Fed Chair, who said the mistake of the 80s, was not to control the price of Gold. So the Exchange Stabilization Fund, visible hand, probably using J.P.Morgan bank as their agent, began to degrade the price of gold on the paper markets. So in April, the degrading attempts got more and more intense, and in the week ending April 12th, 2013, a quantity of paper gold contracts approximately equivalent to TWO years of a major miner, were dumped more or less at one time, resulting in a horrendous break in the paper contract gold price. It was good for the ESF in the short run, but maybe not in the long run. Such hasty action resulted in a GAP which still exists today, creating a potential Island Bottom, from April 12 to now, betwn GDX 31.44 and GDX 32.54, not an inconsequential or fractional gap. While 25.50, the current top end of the GDX trading range for the last eighteen months, is far from 31.44 GDX, that is where the 2017 rally ran up to, but did not cross.

This gap, to me, along with others in there, I know as the “STRAITS of HELL”. If arriving there, the GDX jumps the gap, it will have completed an Island Bottom of FIVE (5) years. Try to comprehend what that would say. For example, a structural analysis (blueprint) style, projects an upside potential to 33 GDX as the target of the next move. Longer term, it is double that. Possible ? Sure. Probable? I don’t know, but with a gap, an eighteen (18) month flat line, a rally from 12 GDX to 31 GDX in eight (8) months, it is difficult to come up with any probability except the price of Gold is manipulated with paper contracts until is its no longer done. Think of the turkeys at Thanksgiving. Everything is OK until that morning. So this will keep up until it can’t. Then I think the probability of the GDX jumping the “STRAITS of HELL” like a crown fire in the tall pines, is very real, at which time, GDX will be “on-fire”, or en fuego as Krazy Cramer likes to say. So much for that, now you know.

Let talk about CANNABIS Stocks now:

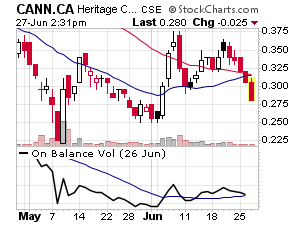

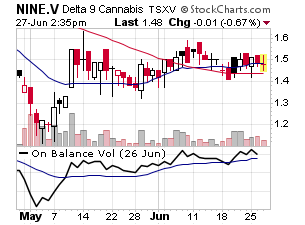

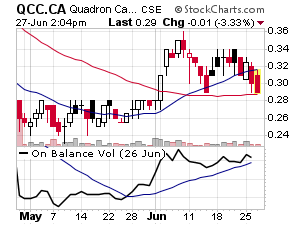

Pretty much illustrates the point that not all Cannabis stocks go straight up, but the trend is good for now. Subscribe and get our latest picks.

By Denali Guide

http://denaliguidesummit.blogspot.ca

To the the charts involved, go here, to my Public Stock Charts Portfolio, and go to the last section. All charts update automatically. http://stockcharts.com/public/1398475/tenpp/1

© 2017 Copyright Denali Guide - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.